A unit of insurance giant American International Group has agreed to pay $40 million over allegations its disclosures — and lack thereof — cost public school teachers and mutual fund clients millions of dollars, according to the SEC.

Valic Financial Advisors, a company in AIG’s retirement business unit, did not report to clients that it had a referral arrangement with Creative Benefits for Educators, the SEC says. The entity, which is owned by a statewide teachers’ union, says it helps educators find “the best insurance and financial services at affordable prices.” Valic Financial Advisors “deceptively identified” three of its own employees as staff of Creative Benefits for Educators to the teachers, the SEC says.

Valic Financial Advisors earned more than $30 million on products it sold to teachers over a 13-year period, according to the SEC’s order. Separately, it made millions of dollars from revenue sharing and 12b-1 fees while also avoiding certain costs via its mutual fund recommendations.

“We are pleased to have resolved these matters involving Valic Financial Advisors, which is taking all necessary steps to ensure a robust program of disclosure improvements and governance enhancements,” an AIG spokeswoman said in a statement.

A spokeswoman at the Florida Education Association, which owns Creative Benefits for Educators, provided a statement:

“Our statewide union has never endorsed a particular 403(b) financial product … While we are disappointed that Valic Financial Advisors failed to comply with federal disclosure requirements, we are thankful that Creative Benefits for Educators had already terminated its relationship,” she said.

A Creative Benefits for Educators spokesman said the firm “was not aware that Valic had not disclosed details of its working relationship with CBE to appropriate regulatory agencies,” and said the relationship had been terminated.

The SEC’s charges against Valic Financial Advisors comes after the regulator said it would do more to protect teachers’ retirement savings. Last year, the regulator

Valic Financial Advisors formed an agreement with the union entity in 2006. The entity had garnered the financial trust of its members, and its stated purpose was to protect union family finances, according to the SEC.

Valic Financial Advisors’ parent company, Variable Annuity Life Insurance Company, paid the teacher union entity $10,000 a month “for its exclusive endorsement of [Valic Financial Advisors] as its preferred financial services partner,” according to the SEC. The firm also paid the salaries of three full-time representatives who promoted Valic Financial Advisors to teachers, as well as the entity’s other non-financial services business partners.

Teachers were not told that Creative Benefits for Educators had a financial incentive to recommend Valic to them, the SEC says.

While it’s not unusual for employers to receive incentives from financial services firms, a union doing so is “the ultimate betrayal of trust,” says Jeff Kaplan, an investors’ attorney who is not representing any parties involved in this matter. “Isn’t that how unions originated? Employers were taking advantage of their employees.”

A spokeswoman for the Florida Education Association says the union does not have a “direct financial relationship” with the Creative Benefits for Educators.

Valic terminated its 13-year relationship with the union entity in October 2019 following press inquiries and requests from the SEC, according to the regulator. The Wall Street Journal

In a separate order, Valic Financial Advisors settled with the SEC for making false and misleading statements about conflicts stemming from its use of its clearing broker’s no-transaction fee program. The firm did not self-report in the SEC’s mutual fund share class initiative in 2018.

In addition to its monetary penalties, Valic Financial Advisors has agreed to cap management fees for Florida K-12 403(b) and 457(b) plan participants.

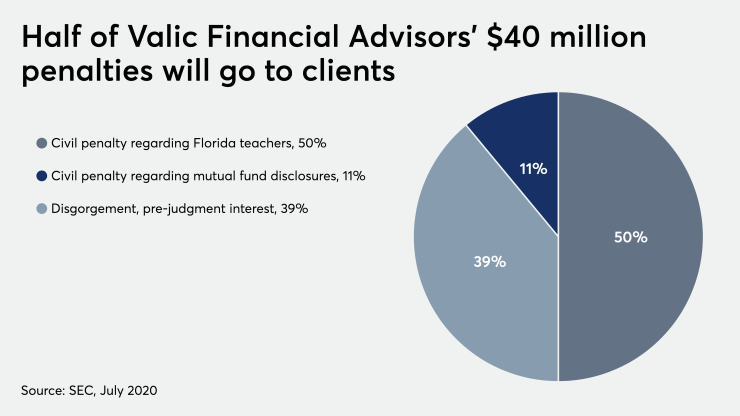

Over $19.9 million in monetary relief will be given to clients who were impacted by the alleged misconduct, according to the SEC.