-

Claiming the earned income tax and child tax credit may get tougher under Trump’s 2018 budget plan.

June 2 -

Harvesting losses to write off taxable gains is one strategy to address the Trump administration's plan to scrap the 3.8% net investment income surtax.

May 26 -

Each plan has pros and cons: Clients who own a Roth IRA for at least 5 years are entitled to penalty-free withdrawals for education expenses, but they'll owe income taxes on those earnings.

March 23 -

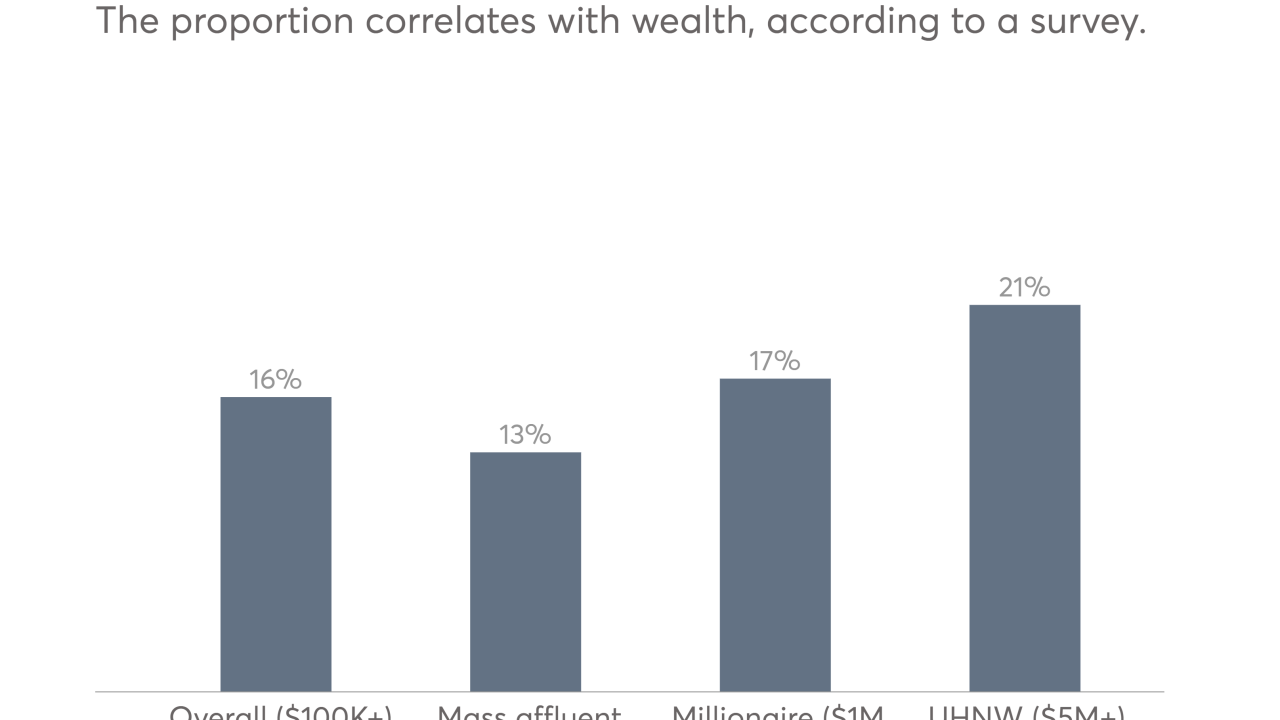

HNW investors and their planners shun the tax-advantaged savings accounts, according to a study.

March 21 -

How advisers focus too much on investments.

November 23 -

How advisers focus too much on investments.

November 23 -

Because federal rules now require parents to plan earlier for funding education, advisers can offer substantial value to clients through their financial aid expertise.

November 7 -

Understanding pro-rata rules can ensure that a client only pays their fair share to the government. Plus, these retirement preparations can boost returns and a look at when spending means better planning.

October 17 -

Assets in college savings plans named for an obscure section of the tax code hit a record this summer, totaling $266.2 billion, up 5.1% year-over-year.

September 30 -

This investing move is applicable whenever market conditions call for it. Plus, a deduction that may take some of the bite out of student loans.

September 9