-

Advisors need to be willing to take a financial hit for clients

April 2 Retirement Matters

Retirement Matters -

As an alternative to placing restrictions on lump sum withdrawals, clients could provide retirees more distribution flexibility.

March 28 October Three Consulting

October Three Consulting -

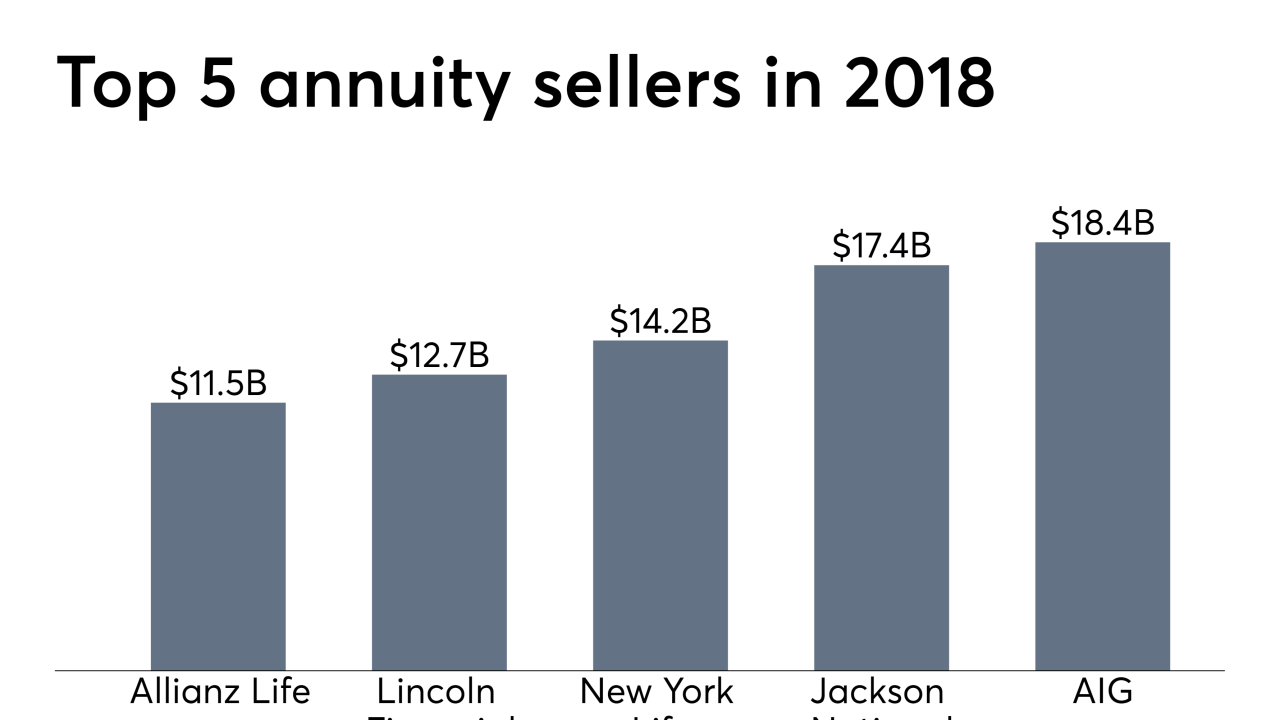

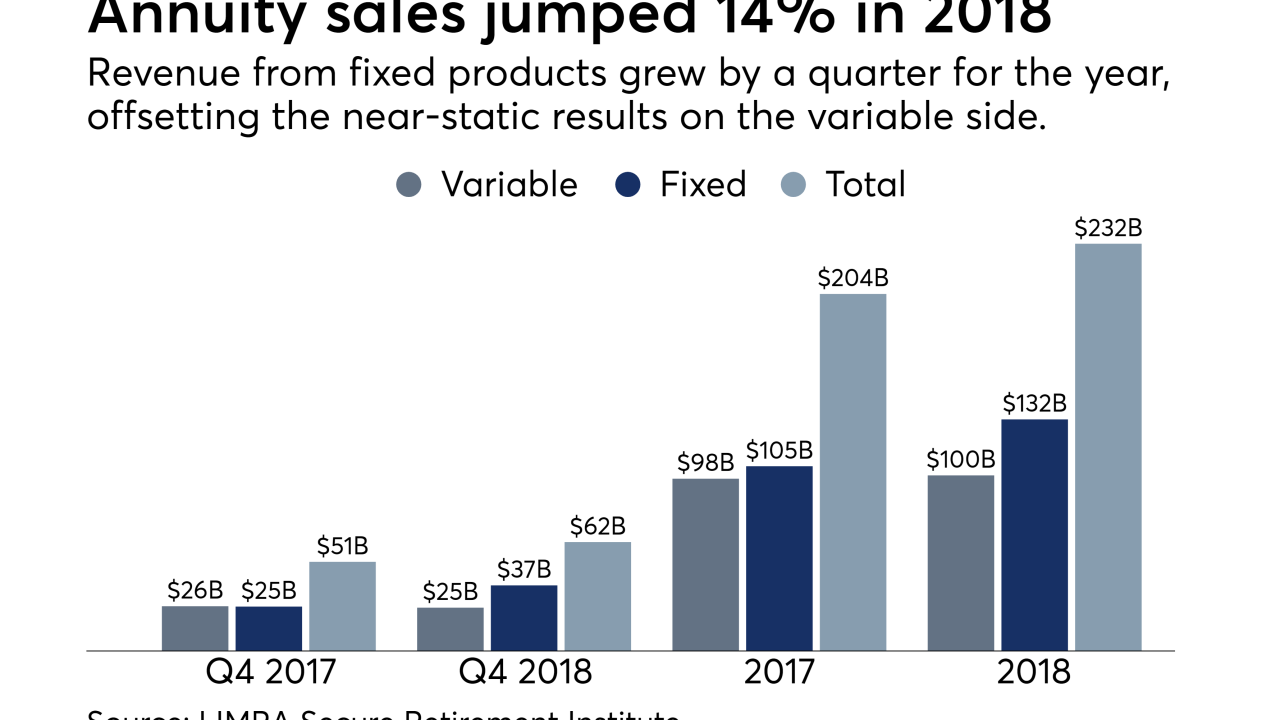

Growing fixed products, along with new fee-only offerings, are changing the shelf and the carrier rankings.

March 28 -

Seniors will face a 20% penalty on top of income taxes if they withdraw funds from a health savings account for non-medical expenses before the age of 65.

March 11 -

Fixed and variable contracts ended 2018 at nearly reverse levels of revenue from their totals three years earlier.

February 25 -

Although earnings in a deferred annuity will not be included in an investor's adjusted gross income, future withdrawals from the annuity could trigger a bigger tax bill.

February 14 -

Getting clients to think realistically about their post-work years is tough, but this one question quickly gets to the heart of the matter, says Trilogy Financial CEO Jeff Motske.

February 1 -

The No. 1 IBD requested that other variable writers “contractually reaffirm their commitments to protecting trails,” an executive says.

January 24 -

A widely held view is that a lot of spending is wasted on “heroic” measures at the end of life, but it’s difficult to know which patients are in their final year.

December 24 -

One of the major provisions of proposed legislation would require 401(k) plans to offer annuities so participants could create new income streams.

December 19