-

The onetime king of the bond market doesn’t blame his personal ordeals for poor investment decisions; in fact, he says, they probably made him better.

March 1 -

Beacon Capital is shifting to the manager’s sector products after volatility late last year prompted it to sell stock funds and hole-up in debt.

February 22 -

The firm’s acting head has cut jobs and merged teams to reign in withdrawals that began after manager Tim Haywood’s suspension, who was dismissed Thursday.

February 21 -

The average fee was nearly 20 basis points higher than the top-performer.

February 13 -

Although the issuer has amassed $127 billion in less than a decade, only four of the firm’s 22 ETFs focuses on debt.

February 12 -

Fresh doubts about whether star managers can deliver consistently superior returns have been raised following Bill Gross’ retirement.

February 6 -

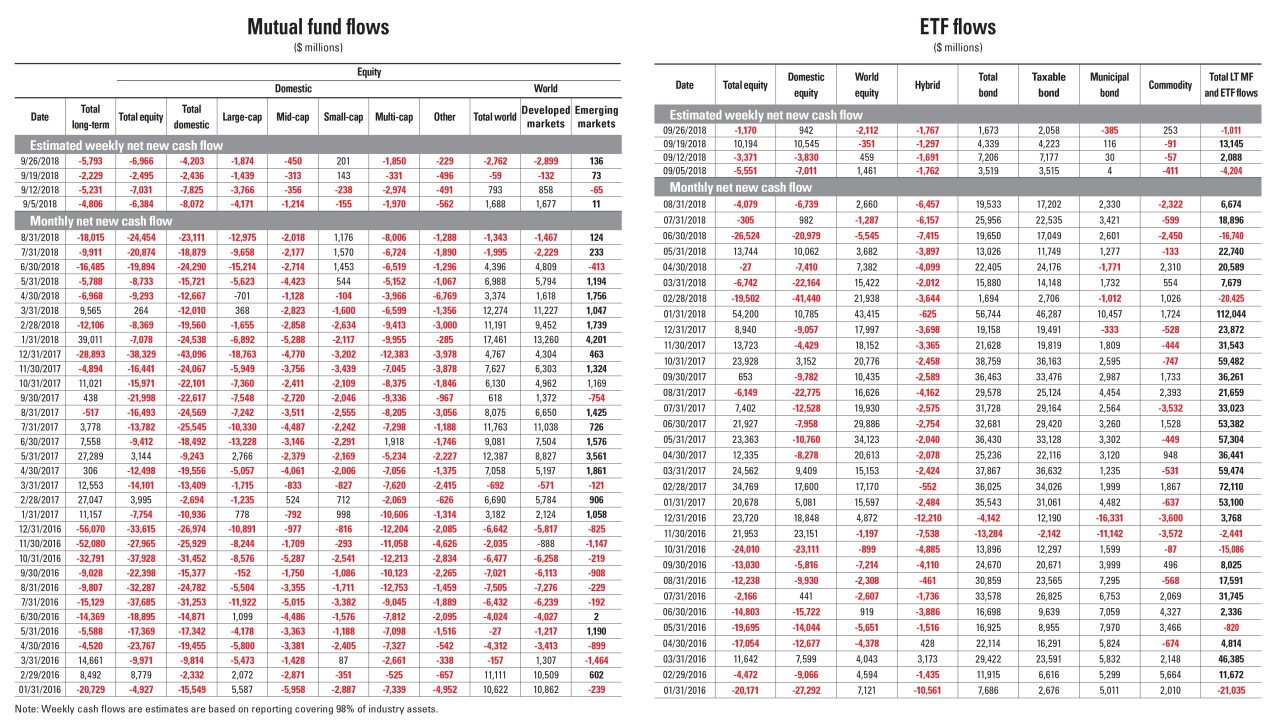

Data reported by the Investment Company Institute.

February 6 -

At Pimco, the fixed-income giant he co-founded, Bill Gross racked up one of the longest winning streaks of any money manager.

February 4 -

The funds include a wide range of offerings from emerging markets to precious metals, multi-strategy and REITs.

January 14 -

High-yield and leveraged loan funds “rebounded incredibly strongly (too strongly, possibly),” a strategist writes.

January 14 -

The Janus Henderson Global Unconstrained Bond Fund has experienced 10 consecutive months of redemptions, underperforming 80% of peers.

January 14 -

Data reported by the Investment Company Institute.

January 10 -

The firm anticipates the change will save its 1.5 million Admiral Shares clients roughly $71 million.

December 12 -

The firm has parted ways with its CEO Alex Friedman and launched a restructuring plan.

November 26 -

Investors have grown cautious following October’s rout in global markets.

November 21 -

Data reported by the Investment Company Institute.

November 20 -

Although its fees are higher than other thematic offerings, similar products from Ark Investment Management have outpaced their peers. Plus; other launches.

November 16 -

ESG ETFs currently hold a combined $6 billion in assets. The firm expects that will grow to $500 billion in the next decade.

October 24 -

Clients nearing retirement should consider standard and itemized deductions and choose the option that will generate the bigger savings.

October 23 -

Data reported by the Investment Company Institute.

October 5