-

The focus of retirement planning is shifting, according to Morningstar experts, moving away from simple saving toward bespoke decumulation strategies and guaranteed lifetime income solutions.

February 12 -

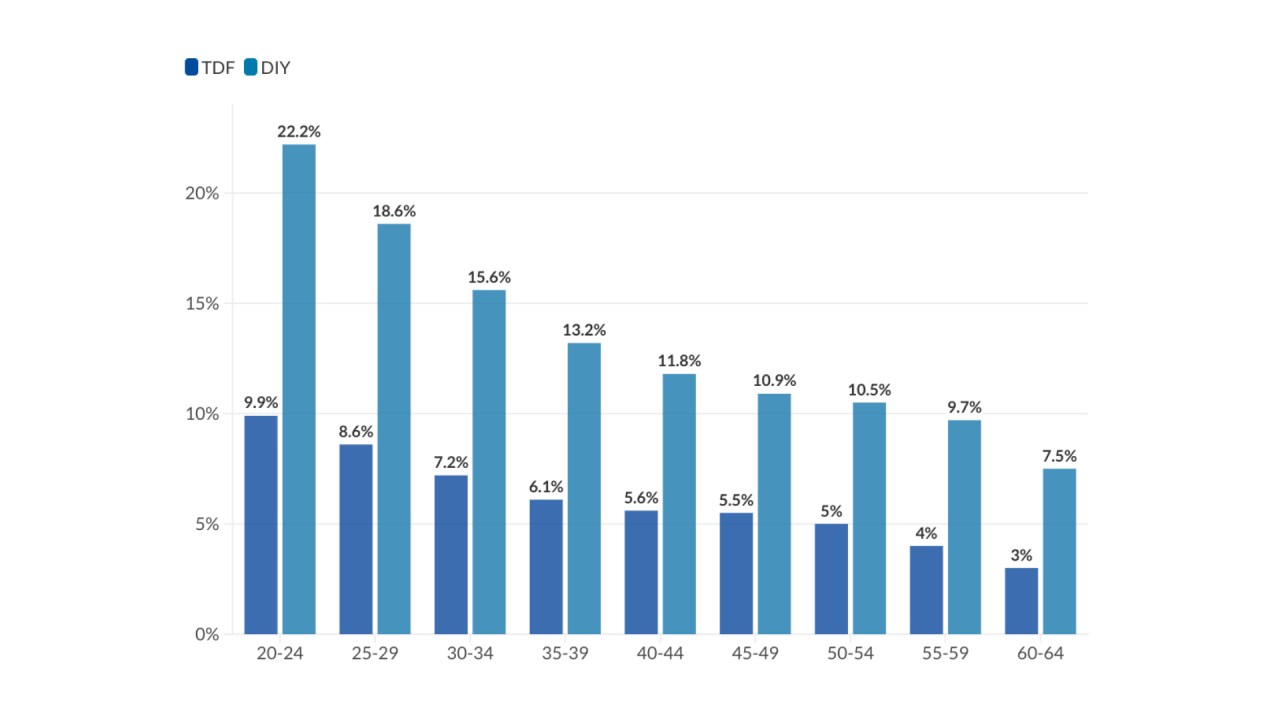

A new Morningstar study suggests managed accounts can significantly boost retirement wealth, particularly for younger workers and those currently managing their own portfolios.

January 20 -

Investors have been gravitating toward actively managed strategies, which have absorbed about 40% of industry inflows amid this year's market turbulence — the highest share ever.

June 16 -

With promises of potentially beating the market, actively managed ETFs can appear attractive to investors. But with higher fees and more potential volatility, are they worth it?

February 11 -

"This pace is unlike anything we have seen," said Matthew Bartolini, head of SPDR Americas research at State Street Global Advisors.

June 7 -

Cash is flooding into actively managed developing nation funds, which many investors suspect are undervalued.

April 1 -

Actively managed exchange-traded funds have accounted for nearly one-third of ETF flows so far this year, a record share.

February 22 -

Some funds lost more than 90% this year.

December 29 -

With $2.6 trillion in total assets, the firm is by far the biggest name yet that’s seeking to make such a move.

August 13 -

The long-term leaders carry fees more than twice the broader industry.

May 27 -

Home to more than $3 trillion, outperformance among the leaders comes with some caveats.

May 6 -

If Biden’s proposal is enacted, Nir Kaissar writes many investors will dump their funds to avoid paying a higher tax down the road.

April 26 -

The lineup of exclusively short-duration fixed-income products, taxable and municipal, still managed an overall gain.

April 21 -

The top 20 performers nearly doubled the gains of their peers over the period.

April 15 -

The 20 mutual funds in this ranking outpaced broader markets over the past year with an average gain of more than 68%.

April 8 -

Selective bets on undervalued stocks are paying off as unloved value and cyclical strategies fall into favor.

April 6 -

Over the past year, the 20 mutual funds in this ranking have an average gain of more than 100%. Their fees are also more than twice the broader industry.

April 1 -

ARKK, along with other funds in her lineup, is in the green after logging its longest stretch of losses since the COVID 19-spurred meltdown last year.

March 9 -

This group carried fees nearly three times the industry average.

March 4 -

Spooked by rising bond yields, traders punished the pricier parts of the equity market last week, including many of the fund's top holdings.

March 2