-

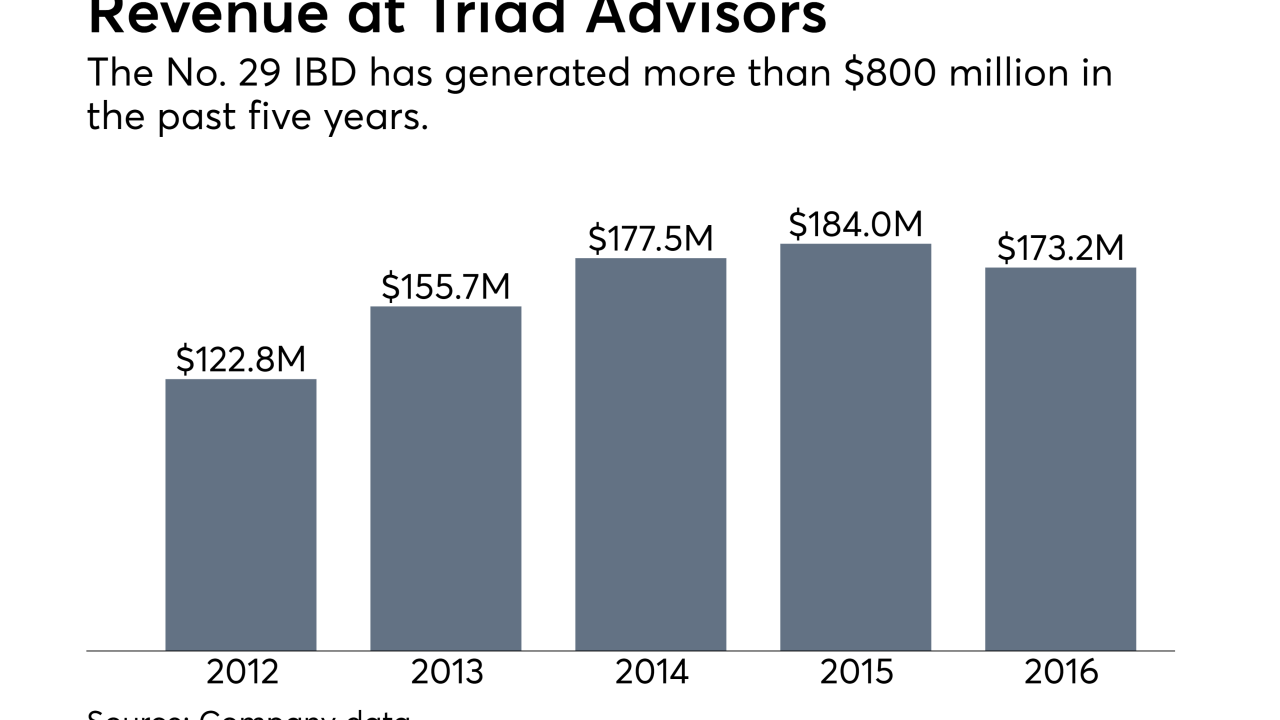

The No. 29 IBD has unveiled two significant recruiting moves in the past two months.

December 7 -

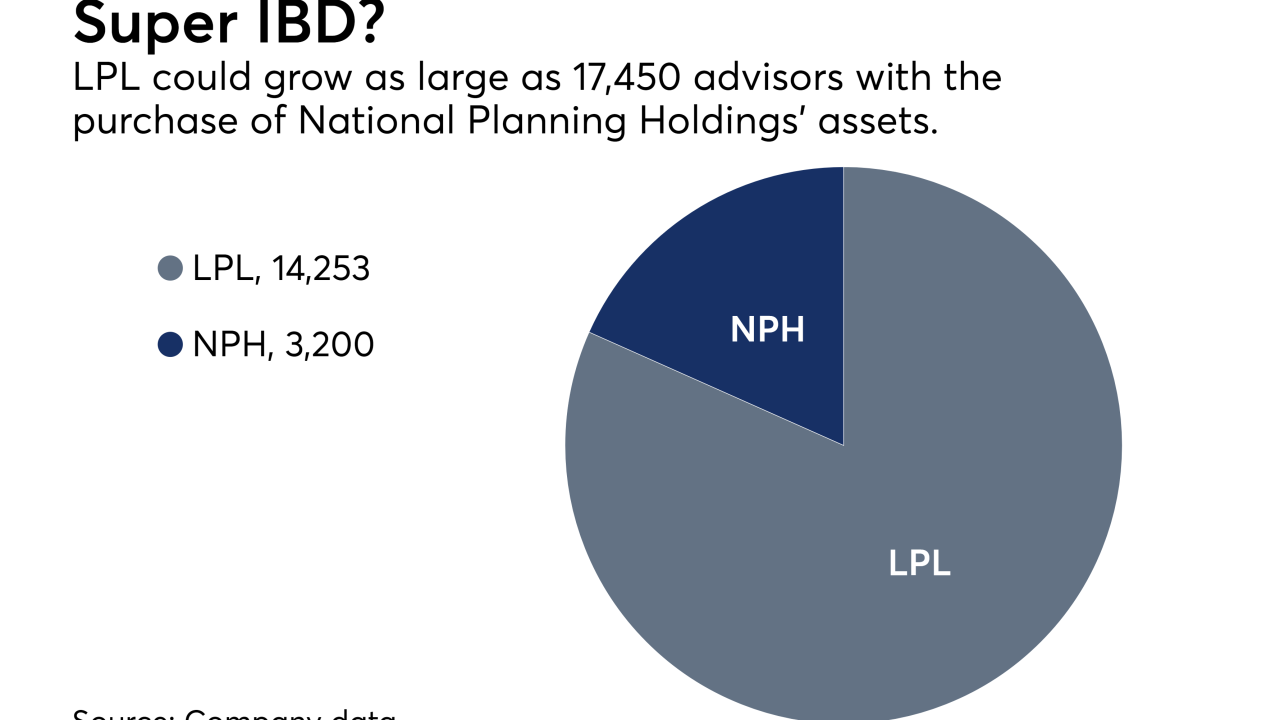

The No. 1 IBD unveiled a $1.1 billion firm that is part of the first incoming wave of NPH’s assets.

December 4 -

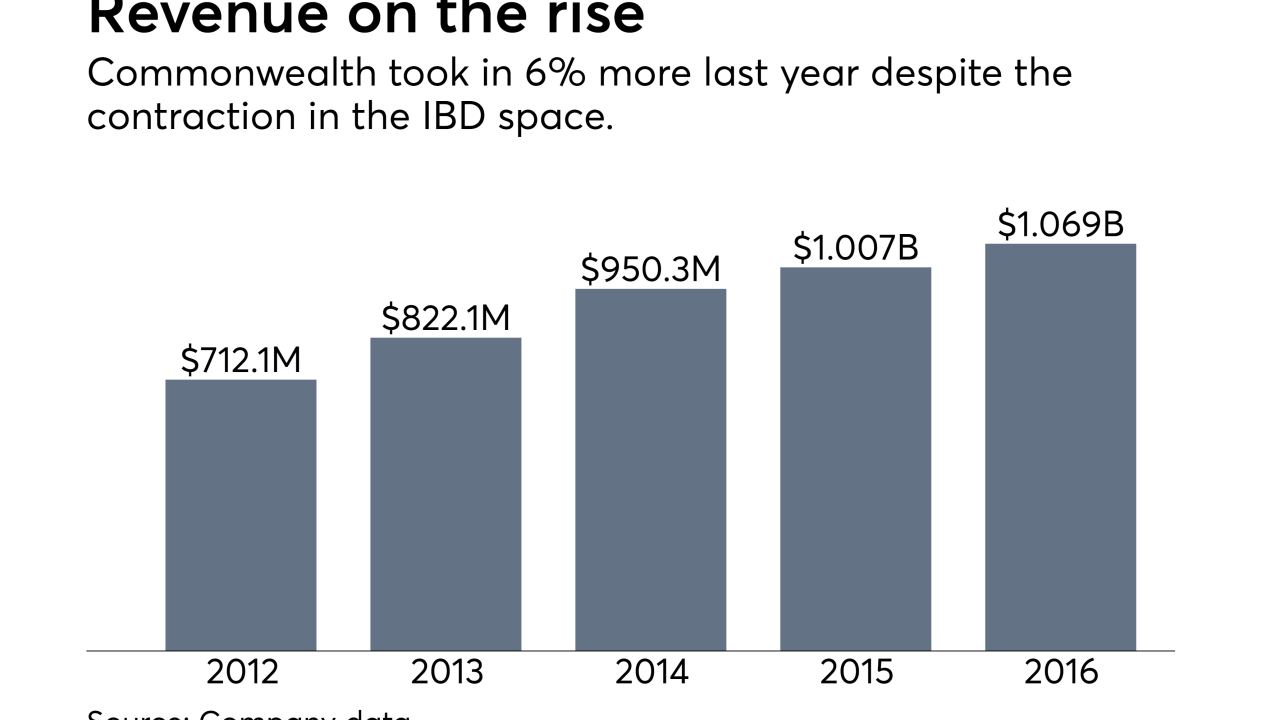

The No. 4 IBD has added 12 advisors with $2.1 billion in client assets since the acquisition.

November 30 -

The IBD's longtime head stepped down as part of a plan to remake the firm.

November 28 -

Too many advisors self-sabotage their referral process.

November 17 -

At least 274 advisors with $11.5 billion in client assets have left the fold since the acquisition.

November 16 -

Advisor Group BDs have poached at least four NPH practices after LPL acquired the network’s assets.

November 9 -

CEO Dan Arnold listed three reasons why the firm thinks its rivals peeled off some advisors.

November 8 -

The fourth largest IBD added a super OSJ with $650 million in AUM.

November 7 -

Independent Financial’s haul includes a new affiliated RIA launched by five of the practices.

November 7 -

Woodbury Financial has peeled off more than 80 advisors in the wake of LPL’s giant acquisition.

November 3 -

The Chicago-based RIA focuses on Midwest to expand its footprint.

October 27 -

The practice opted for USA Financial after Jackson National sold National Planning's assets.

October 26 -

Speculation about the RIA's future is quelled with a $100 million investment from Thomas H. Lee Partners.

October 25 -

What planners can learn from top performers like Chuck Yeager about becoming the best in their field.

October 23 Savant Capital Management

Savant Capital Management -

The sale of an asset management firm gives Mariner a capital source to buy RIAs. Lots of them.

October 20 -

The team marks at least the second to opt for a smaller IBD over the nation’s largest.

October 19 -

IHT Wealth Management now has $2.4 billion in client assets.

October 19 -

The move marks the latest in a frenzied period one recruiter describes as “a feast.”

October 19 -

The number of transactions is expected to increase over 20% from 2016.

October 17