Armed with an ample new source of capital, Mariner Wealth Advisors is getting back into the M&A game. Big time.

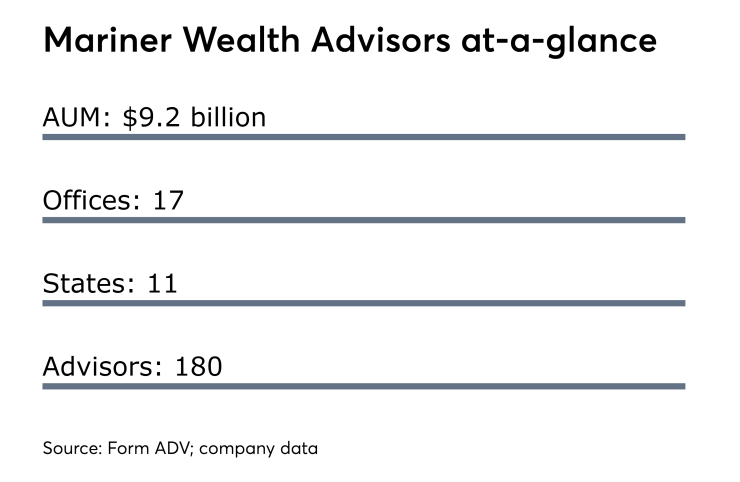

After sitting on the sidelines for nearly three years, Mariner, which has over $9 billion in AUM, plans to make seven to 10 acquisitions next year, targeting firms across the country with between $250 million and $1 billion in AUM, says Mariner CEO Marty Bicknell.

Mariner's M&A war chest, estimated at more than $1 billion, is coming from its holding company's pending sale of Tortoise Investments, an asset management firm with approximately $20 billion in assets, to the private equity firm Lovell Minnick Partners.

After focusing on integrating its previous acquisitions and organic growth for the past three years, Mariner will deploy capital from the Tortoise sale towards an "aggressive" M&A strategy, says Bicknell, who is also CEO of Mariner Holdings, which has an estimated $46 billion in total assets.

Terms of the Tortoise sale, set to close in February, were not disclosed.

M&A BATTLEFIELD

Mariner faces intense completion as it re-enters the M&A market for RIA firms.

Even RIAs with less than $400 million are highly coveted in the current seller's market.

BRING IT ON

"All that competition is great," says Bicknell. "It creates interest in the minds of the sellers. The more people are talking about selling firms, the more transactions get done."

Mariner typically buys 70% of a firm "looking for a partner to grow," Bicknell says. "We will re-invest capital in the business to buy sales and advice talent." Valuations are set at a multiple of EBITDA, he says.

Today's seller's market will be upended in the event of a bear market, according to Bicknell.

"It will absolutely change the dynamic," he says. "A lot of buyers will hit the pause button, and sellers will see fewer people on the buyer's side."