-

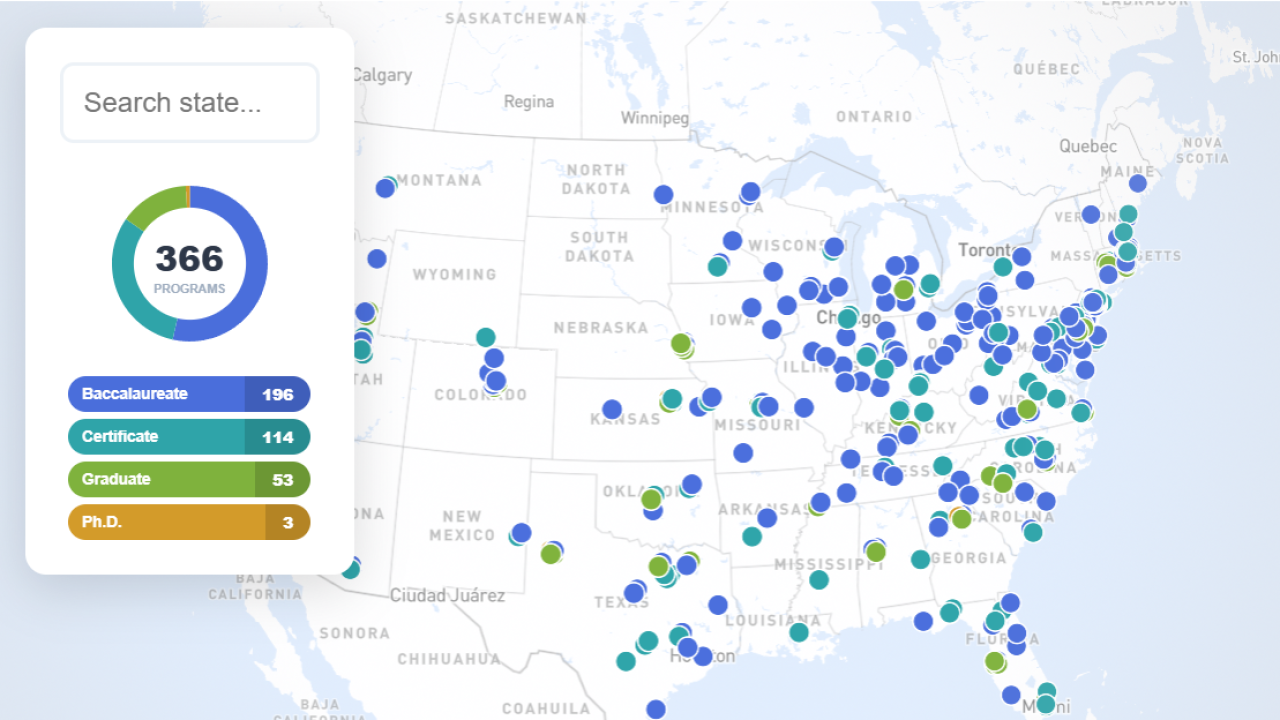

The growth of CFP Board-registered programs, from certificates to doctoral programs, reflects the industry's shift away from commission-based models.

February 25 -

In the coming weeks, the CFP Board will launch a working group to reconsider whether a bachelor's degree should remain a requirement for CFP certification.

January 29 -

K. Dane Snowden initially joined the CFP Board as chief operating officer in 2023 and replaces outgoing CEO Kevin Keller.

January 21 -

The share of test takers who pass the CFP Board's exam has risen significantly in recent years, but experts are divided on what's behind the change.

November 5 -

The American College of Financial Services and RISR are collaborating as a BNY Wealth report showcased the planning complexities of owner succession deals.

July 31 -

The CFP Board promised to enhance its review processes after an investigation found major shortcomings. A new analysis of CFP data found that the problem has only gotten worse.

July 17 -

Terri Kallsen will precede him next year as chair of the Board of Directors; Seay will take over that role in 2027.

July 16 -

Earning and maintaining certifications requires a significant time investment. So why do advisors go through the trouble?

July 3 -

A former marketing executive at the CFA Institute faces charges of embezzling nearly $5 million to fund extravagant expenses, including luxury travel and a $150,000 engagement ring, according to prosecutors.

June 24 -

The new rules, set to take effect May 23, will allow CFP applicants to forgo a more intensive review process in certain circumstances.

May 19 -

Certified financial planners will pay an additional $120 a year for the CFP designation, starting in October. The CFP board said the fee hike will help fund expanded advertising efforts.

April 30 -

Kevin Keller prides himself on the growing public awareness of the CFP mark while warning that his successor is likely to face increased competition from other groups.

February 23 -

Atop the standard-setting organization since 2007, Kevin Keller has seen its ranks of certification holders nearly double and has overseen work to bring more diversity to the profession.

February 6 -

The many technical skills and professional requirements get most of the attention. But experts say a transition also requires a great deal of time and other capabilities.

January 17 -

The "model rule" for state regulators is meant to help clients distinguish between advisors who earn management fees and brokers who collect transaction-based commissions.

January 2 -

The standard-setting group is mulling increasing continuing education requirements and requiring that CFP aspirants have certain types of financial planning-related experiences, among other changes.

December 17 -

The regulators' organization is also seeking to let state regulators enforce the same Reg BI conduct standard that federal watchdogs now apply to broker-dealers.

November 5 -

While the process of preparing for the 170 multiple-choice-question test can be expensive, time-consuming and nerve-racking, there are ways to make it less unpleasant and more successful.

October 29 -

The giant universities that have their own investment arms are likely out of reach, but they represent only a small portion of the rapidly growing channel.

October 10 -

The program allows candidates to complete the certification program online, asynchronously and in half the time it takes to complete the standard program.

July 25