-

A deep dive into all the critical questions, strategies and tax planning moves for clients and their university-bound children.

December 29 -

The majority of advisors don’t understand how much of a positive difference they can make for their clients, says advisor Deborah Fox.

July 28 -

Age-based portfolios were susceptible to market volatility — and some clients have pulled out college savings.

June 2 -

With astute maneuvering, advisors can add money to a clients’ college-fund kitty without jeopardizing financial aid.

January 2 -

Don't neglect the FAFSA and other ideas to help families with annual incomes of more than $300,000.

December 30 -

With careful planning, they can be among the 72% of U.S. students to get need-based assistance.

November 11 -

There are attractive hedges against rising college tuition costs. But, not every student will benefit.

November 8 -

Students can always borrow money for school, but there are no "retirement loans" available for clients to use to fund life after work, a CFP writes.

October 7 -

Of the six finalists at the fourth annual XY Planning Network fintech competition, half focused on addressing concerns of younger investors.

September 20 -

FINRA Rule 3210 typically requires permission for brokerage accounts.

May 29 -

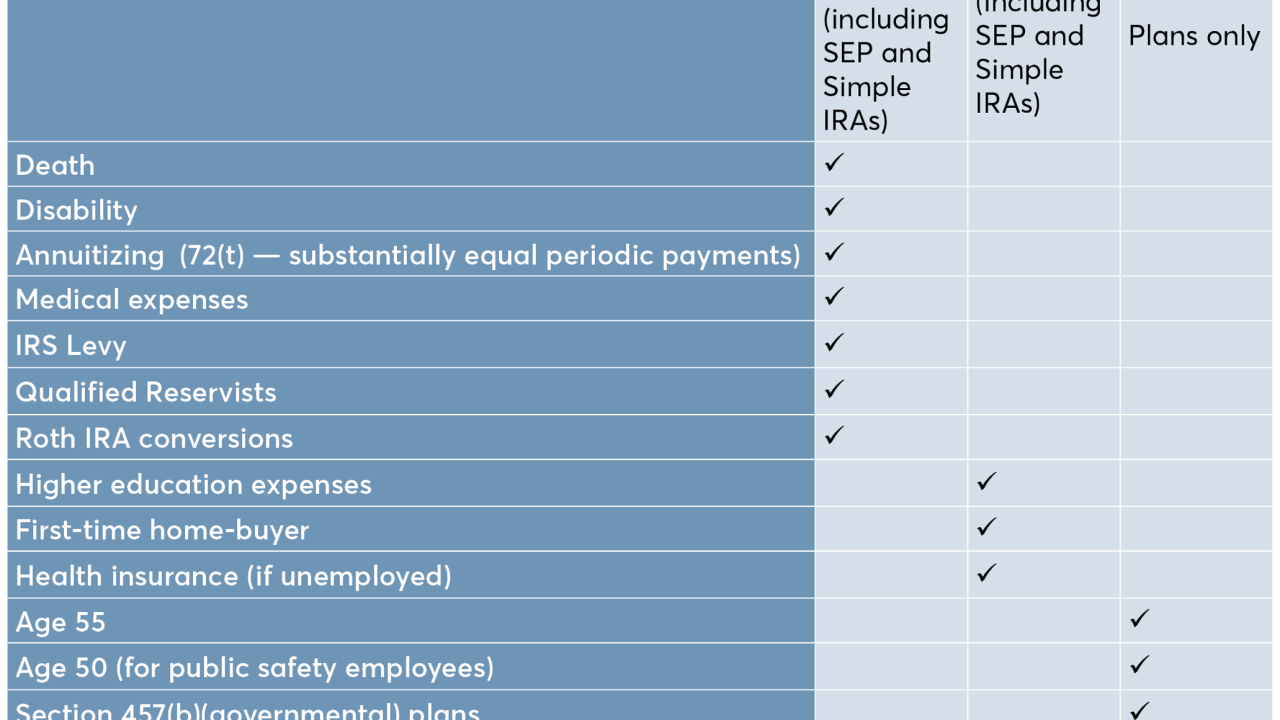

When financial emergencies compel early withdrawals from clients' retirement accounts, they face income tax and often an additional 10% penalty.

April 29 -

Grandchildren won't be able to have their own accounts until they are earning their own income, but they can be named beneficiaries.

April 8 -

A new FINRA initiative to root out breaches of supervisory rules on 529 plans provoked criticism from the IBD advocacy group.

January 31 -

Workers should urge their employers to offer this savings option in their 401(k) plans to save for emergency and unforeseen expenses.

December 6 -

Startup entrepreneur sees an opportunity to simplify savings plans and financial giving for children, and hook their parents into wealth management in the process.

October 24 -

Why these are more inviting under the new tax law.

September 11 -

Why these are more inviting under the new tax law.

September 6 -

Despite questions about the hastily cobbled legislation, there's some consensus as to what advisors and their clients can do now to avoid unpleasant surprises.

January 29 -

Advisors say it’s never too early to start saving for college.

December 11 -

While there’s no fail-safe method for modeling the costs, a popular calculation may significantly under- or overstate the burden of tuition, room and board, Kitces.com research associate Derek Tharp writes.

December 6