-

The company received $15 million to build out a platform connecting clients to financial planning, investment management and tax professionals.

July 6 -

The two announcements hours apart came after at least 33 firms with $1 billion or more in client assets changed hands in the first quarter.

July 1 -

The multigenerational practice decided it was time to make the move.

June 21 -

The wacky performers can teach us how to grow our businesses, writes Chip Munn.

June 14 Signature Wealth Group

Signature Wealth Group -

The four largest U.S. banks face investor pressure to deliver the returns of smaller rivals, but they complain that the federal deposit cap and capital rules make that difficult. So they're pouring money into wealth management, payments and digital banking to seize more market share in existing businesses and fend off nonbank challengers.

June 9 -

The efforts to bolster risk controls and simplify global operations will ultimately lead to better shareholder returns, Jane Fraser said, while urging investors to show patience.

June 4 -

Last year, many banks made big, splashy pledges to advance racial equity. Now some of those banks are seeking to hold executives accountable for those efforts through their paychecks.

May 24 -

Cypress Trust in Palm Beach is poised to pull off a rarity: the conversion of a wealth management firm into a community bank. It’s simply another way to take advantage of the ongoing melding of the two financial services sectors, CEO Dana Kilborne says.

May 22 -

Peter Mallouk’s firm made its second multi billion-dollar deal in three months after its first private equity infusion last year.

May 5 -

Questions remain about how advanced standards, frameworks and systems are.

May 3 -

This generation of SRI managers will vanquish greenwashing and help slow-footed government achieve crucial environmental objectives, James Katz writes.

May 3 Humankind Investments

Humankind Investments -

Profits slumped last year and many investors are now voicing their displeasure with the compensation awarded to senior leaders. A nonbinding “say on pay” vote taken Tuesday passed narrowly, but Chairman Charles Noski indicated that the board will take the results into account when designing future pay packages.

April 27 -

While it’s good that firms are addressing mental-health concerns, Marcus Ashworth writes that temporary fixes don't get to the nub of the culture problem.

April 9 -

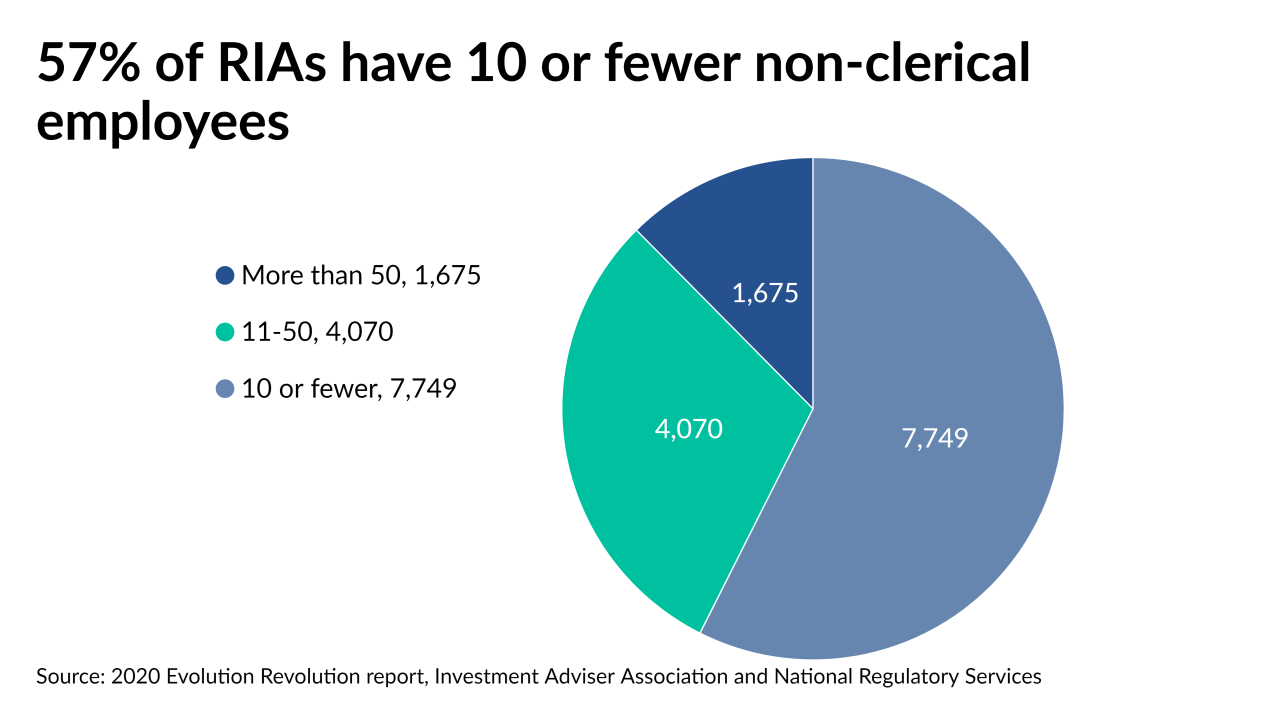

The changes mark a new phase in the tug-of-war between the structures.

March 30 -

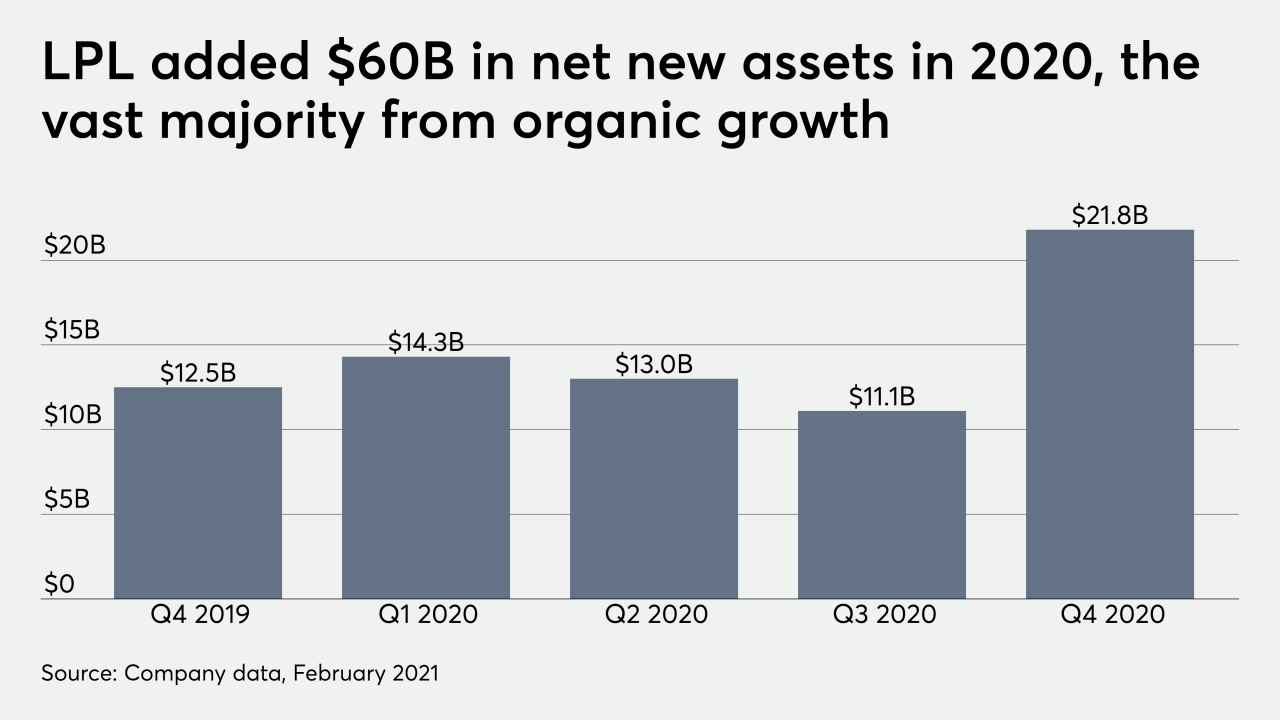

The brokers are offering their practice management lessons and resources as scale becomes increasingly crucial to wealth managers.

March 24 -

The bank joined dozens of other companies in announcing that they would suspend and review their political donations following the Capitol riot.

March 22 -

The asset manager said it's particularly interested in how firms are behaving in the communities in which they operate, be it locally or via their supply chains.

March 18 -

The largest banks have cut compensation or held it steady for their top executives. Many regionals, though not all, are expected to make similar decisions as boards balance the desire to reward strong leadership during the pandemic with lackluster financial performance and public relations concerns.

March 5 -

Career mobility and heightened client dependence are two unexpected by-products of extreme uncertainty, writes Jodi Perry.

March 1Raymond James Financial Services -

The agreement will expand the companies’ recruiting efforts in the bank and wirehouse channels.

February 17