-

A majority of sell tickets were driven by passive funds off program desks, traders say.

October 10 -

Caution is key across global markets as investors try to gauge whether the selloff is a harbinger or a blip.

October 10 -

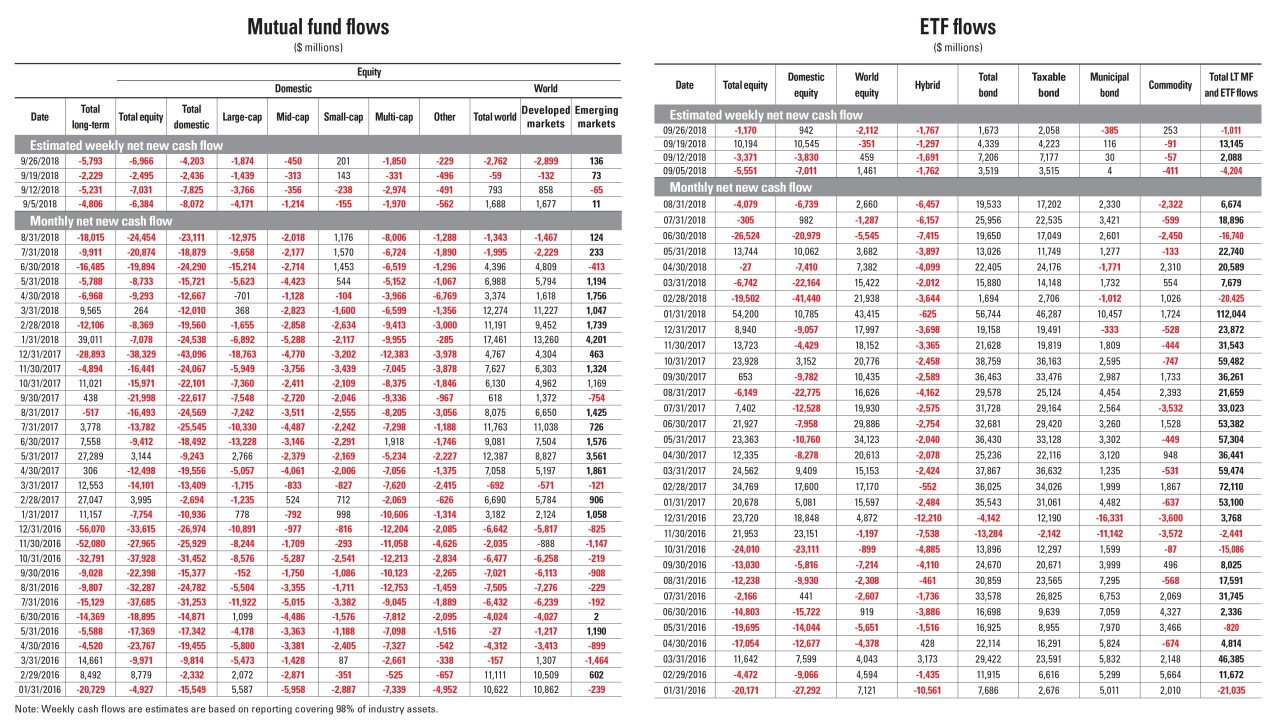

Data reported by the Investment Company Institute.

October 5 -

Investors flocked to ultra-short bond funds as few are willing to bet against persistent rising rates.

October 5 -

Stellar U.S. economic data, hawkish monetary expectations and strong commodity prices have pushed 10-year and 30-year Treasurys to breakout range.

October 4 -

The "Rule of 100" follows the rule-of-thumb of growing more conservative as investors grow older, but it also may be obsolete since it was developed when interest rates were higher.

October 3 -

The crash of 2008 was intense but, in hindsight, short-lived. Market gains began a few months afterward and have continued with few exceptions.

October 3 -

Dick Lampen says the SEC charges against Dr. Phillip Frost, the firm’s primary shareholder, won’t affect its “significant” other resources.

October 1 -

The iShares 20+ Year Treasury Bond ETF took in close to $2 billion in September, putting it on track for its second most monthly inflows ever.

September 27 -

No one’s talking about the latest Treasury market selloff because it’s tough to find the negative ramifications across other asset classes.

September 20