As a business model, wealth management has come back from the depths of the financial crisis with flying colors, if not quite soaring returns. Ditto the overall financial sector.

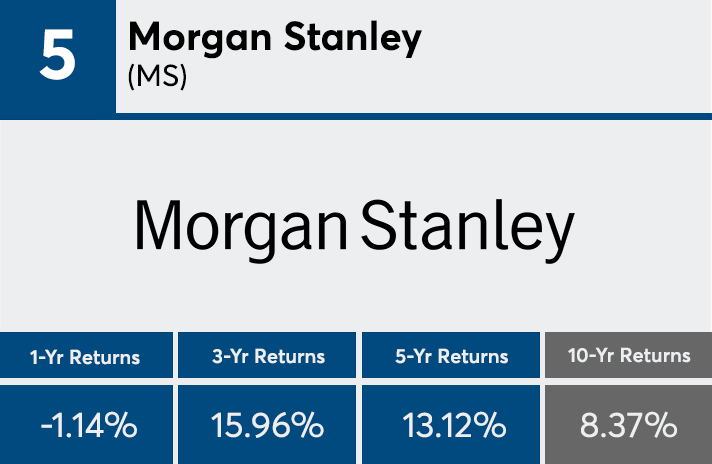

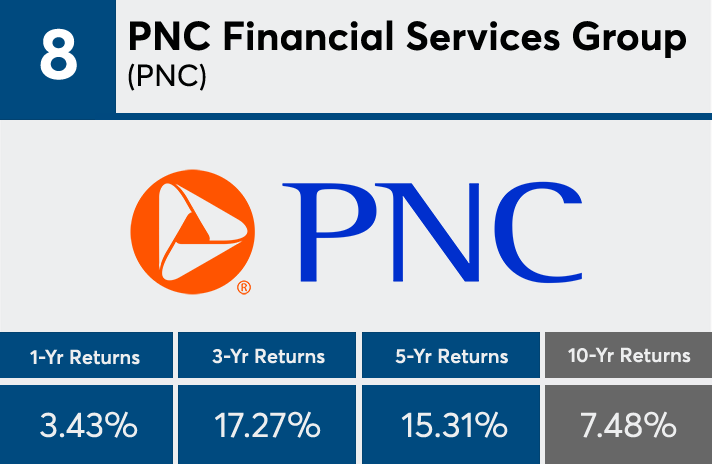

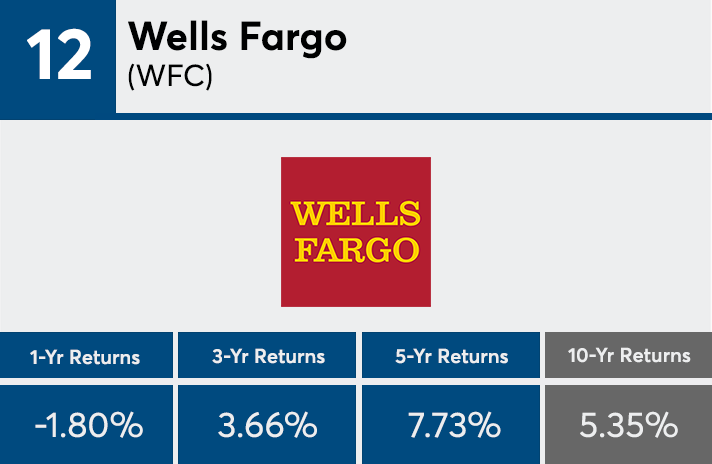

Starting with the stocks of the parent companies of the biggest publicly traded independent broker-dealers in the FP50 ranking of the biggest independent broker-dealers, we then added wirehouses and the biggest retail banks with wealth management operations to the mix. In most cases, of course, wealth management is just a portion of these companies’ overall businesses. While these names are not pure-plays on wealth management, they still provide the best proxy for the overall health of investing in the business, not to mention the currency used to award bonuses to executives. We ranked them on 10-year returns.

The results in a nutshell: A decade after watching some long-time investments banks disappear, get acquired overnight or technically convert to banks to avail themselves of much-needed help from the Fed, stocks in the industry have seen major advances. In fact, judging just from the past decade’s data, there is no obvious indication that the biggest market calamity that most people alive ever saw even happened.

The average 10-year annualized return for this group of stocks trading in the U.S. was 5.38%, with even better gains coming more recently. The past five years have seen annualized gains of 10.3%; the past three years, 13.4%.

The majority of the list comes in between 4% and 9% for annualized gains, although four companies are in the double digits. Three others posted losses, two of which are among the biggest retail banks.

We intentionally omitted LPL and Voya because they haven’t been publicly traded for 10 years. Over its eight years as a public company, LPL shares posted an annualized return of 12.1% since inception, 12.62% over five years, 19.29% over three years and 27.03% over one year. Shares of Voya, a public company since 2013, posted an annualized return of 17.52% since inception, 11.29% over five years, 8.7% over three years and 24.62% over one year.

The broader financial industry was hard hit by the crisis, as can be seen by the Vanguard Financial ETF. It lost 49% in 2008. But with the perspective of time, it’s easy to see that while the sky may have fallen, it only lasted about six months. Like the rest of the stock market, it bounced back with a gain in 2009, notching a 14% increase. In fact, except for a loss in 2011 (-14%) and 2015 (less than -1%), it posted gains each year since the crisis, with a 10-year annualized gain of 7.8%.

As well as the financial industry has performed, the overall markets have been better still. After losing 37% in 2008, the S&P 500 has bounced back with an impressive 12.3% annualized 10-year gain.

Scroll through to see the stocks of wealth management firms ranked by 10-year stock performance. We also show one-year, three-year and five-year returns for all the stocks listed. All data from Morningstar Direct.