Fraud

Fraud

-

Dean Mustaphalli "deceived the clients that trusted him," New York Attorney General Barbara Underwood said.

May 30 -

The advisor told victims that he would invest their money in Royal Alliance brokerage accounts but instead used the funds to make BMW car payments and pay for personal expenses, prosecutors claimed.

May 29 -

The advisor defrauded some 100 clients by persuading them to invest more than $71 million in 16 private funds offered by his two investment advisory companies, the SEC claims.

May 18 -

Former advisor Paul Marshall's prison term "will be little solace to the dozen victims who lost their life savings due to his greed and callous concern for their well-being,” the FBI says.

May 11 -

Clients thought they were investing in real estate developments that would be flipped for profit.

May 10 -

Overall, the advisor defrauded at least nine clients out of $1 million, which he used to pay for tuition and mortgage payments, federal prosecutors say.

May 8 -

The Ponzi-like scheme used investor funds to pay other investors’ debts and cover personal expenses.

May 7 -

The advisor convinced the couple to transfer their retirement savings, but they claim the money never made it to their accounts. Their attorneys say there are other victims.

May 7 -

The dirty little secret about elder exploitation is that almost 60% of cases involve a perpetrator who is a family member, according to a 2014 study.

May 4 -

State regulators and the No. 1 IBD struck a settlement after investigators found the firm guilty of negligence and a failure to supervise.

May 2 -

The advisor fooled her victims into thinking she would invest their funds when in fact she used the money to buy luxury items and real estate, prosecutors claim.

April 23 -

The defrauded clients included the advisor’s own in-laws, who had suffered from Alzheimer’s and a debilitating stroke.

April 19 -

The payout brings the distribution to more than $1.2 billion, a fraction of the more than $50 billion scam.

April 12 -

One couple in their eighties invested more than $700,000 with the alleged schemers, representing almost the entirety of their cashed-out pension, regulators say.

April 10 -

A recent report about bad incentives for brokers "did not accurately reflect how we do business and serve our clients," said Jon Weiss, head of wealth and investment management.

April 6 -

The Justice Department disclosed a felony probe the day before the broker’s termination.

April 6 -

Many of the trades should have triggered market manipulation concerns because they involved companies that were barely operating but engaging heavily in promotional activity, the SEC says.

April 5 -

The broker misappropriated his clients’ investment money for rent, credit card bills and other personal uses, investigators say.

April 2 -

The regional BD failed to properly document its own investigations in the matter, and couldn't answer some SEC questions about who knew what and when, the regulator says.

March 27 -

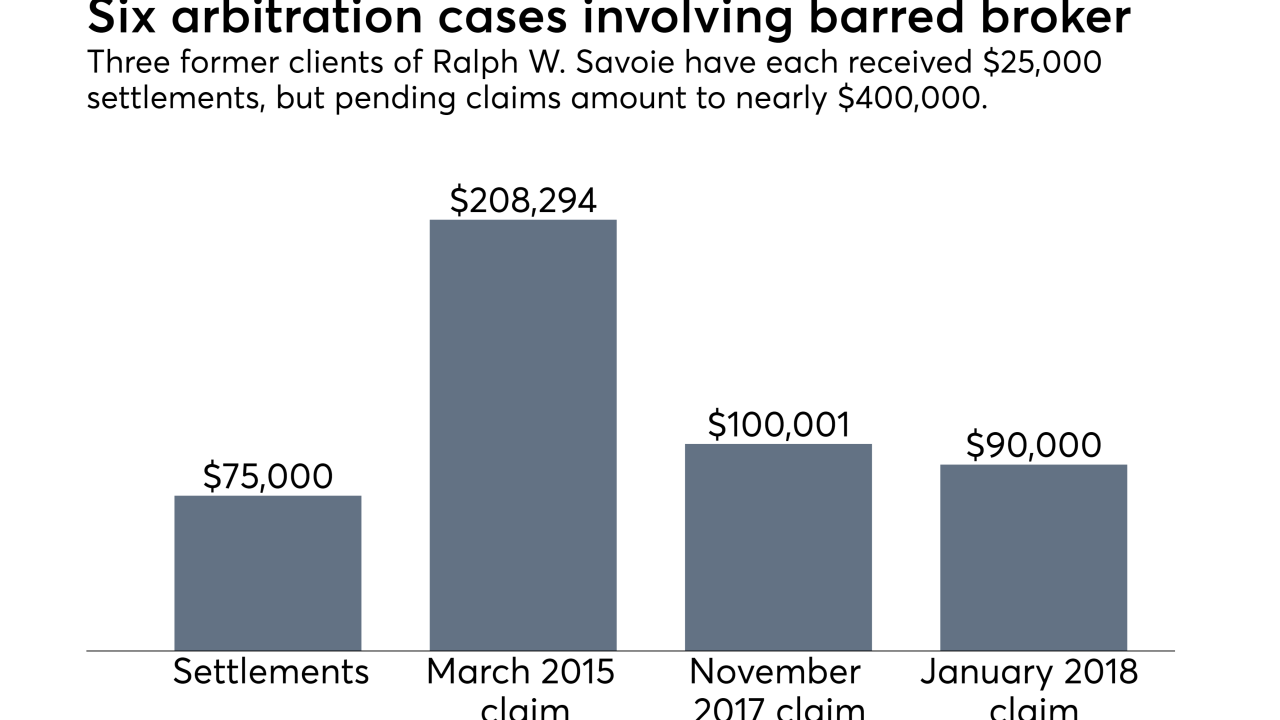

The two IBDs have agreed to pay restitution in one of the largest securities fraud cases in the advisor’s home state.

March 21