Fraud

Fraud

-

The advisor fooled her victims into thinking she would invest their funds when in fact she used the money to buy luxury items and real estate, prosecutors claim.

April 23 -

The defrauded clients included the advisor’s own in-laws, who had suffered from Alzheimer’s and a debilitating stroke.

April 19 -

The payout brings the distribution to more than $1.2 billion, a fraction of the more than $50 billion scam.

April 12 -

One couple in their eighties invested more than $700,000 with the alleged schemers, representing almost the entirety of their cashed-out pension, regulators say.

April 10 -

A recent report about bad incentives for brokers "did not accurately reflect how we do business and serve our clients," said Jon Weiss, head of wealth and investment management.

April 6 -

The Justice Department disclosed a felony probe the day before the broker’s termination.

April 6 -

Many of the trades should have triggered market manipulation concerns because they involved companies that were barely operating but engaging heavily in promotional activity, the SEC says.

April 5 -

The broker misappropriated his clients’ investment money for rent, credit card bills and other personal uses, investigators say.

April 2 -

The regional BD failed to properly document its own investigations in the matter, and couldn't answer some SEC questions about who knew what and when, the regulator says.

March 27 -

The two IBDs have agreed to pay restitution in one of the largest securities fraud cases in the advisor’s home state.

March 21 -

The organization awarded millions to firm insiders that provided information in a 2016 case against BofA.

March 19 -

Seniors should consider designating joint agents, reviewing the security features on their financial accounts, and having their names removed from credit card solicitations.

March 16 -

The FBI has reportedly interviewed employees at the bank’s wealth management unit.

March 16 -

Investors were bilked out of approximately $611,000, say federal prosecutors.

March 15 -

Pinnacle Investments tapped Ami Forte despite her ongoing legal struggles with her former firm and Home Shopping Network founder Roy Speer’s estate.

March 15 -

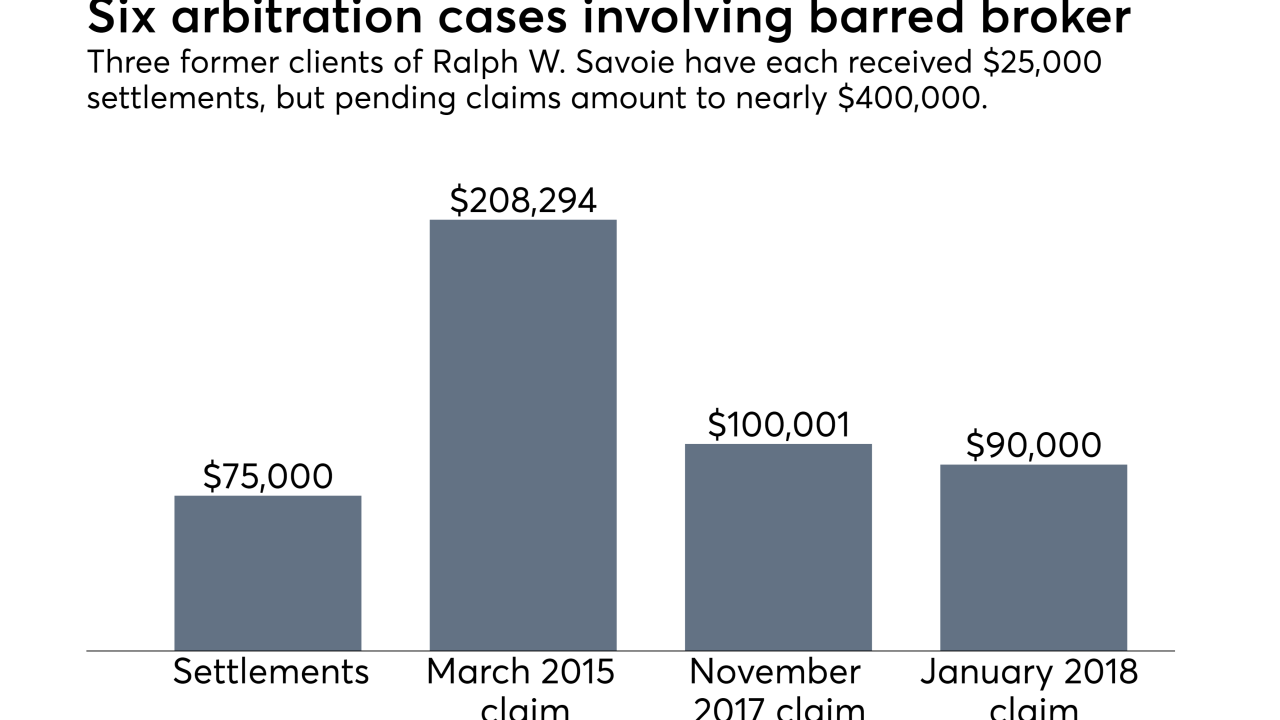

Citing mounting investor losses from unpaid arbitration awards, investor advocates see a role for Congress to force FINRA's hand.

March 7 -

Religious groups threaten to withdraw shareholder proposal on the bank’s decision.

March 7 -

One recruiter says, "If I'm an advisor at Wells Fargo right now, I have to ask myself is this the firm I want to tie my future to?"

March 2 -

The beleaguered bank is reported to have been ordered by the Justice Department in late 2017 to conduct an independent investigation of the business.

March 1 -

The advisor lured the client into investing $100,000 in what he claimed was a private placement bond but instead deposited the money into his personal bank account, say federal prosecutors.

February 27