-

Three funds tracking the debt products attracted a combined $2.3 billion in one week.

January 8 -

Despite returns of about 8% last year, the products lagged behind the S&P 500’s 22% climb.

January 5 -

The funds with the biggest AUM declines didn’t badly underperform, but investors often found cheaper alternatives.

January 3 -

It paid in 2017 to be a penny-pinching retiree because target-date funds dominate the cross-section of profitable and cheap.

December 27 -

Advisors should not overlook client savings accounts as idle funds.

December 20 MaxMyInterest

MaxMyInterest -

Data reported by the Investment Company Institute.

December 15 -

Passive funds are the decisive victor in attracting cash.

December 13 -

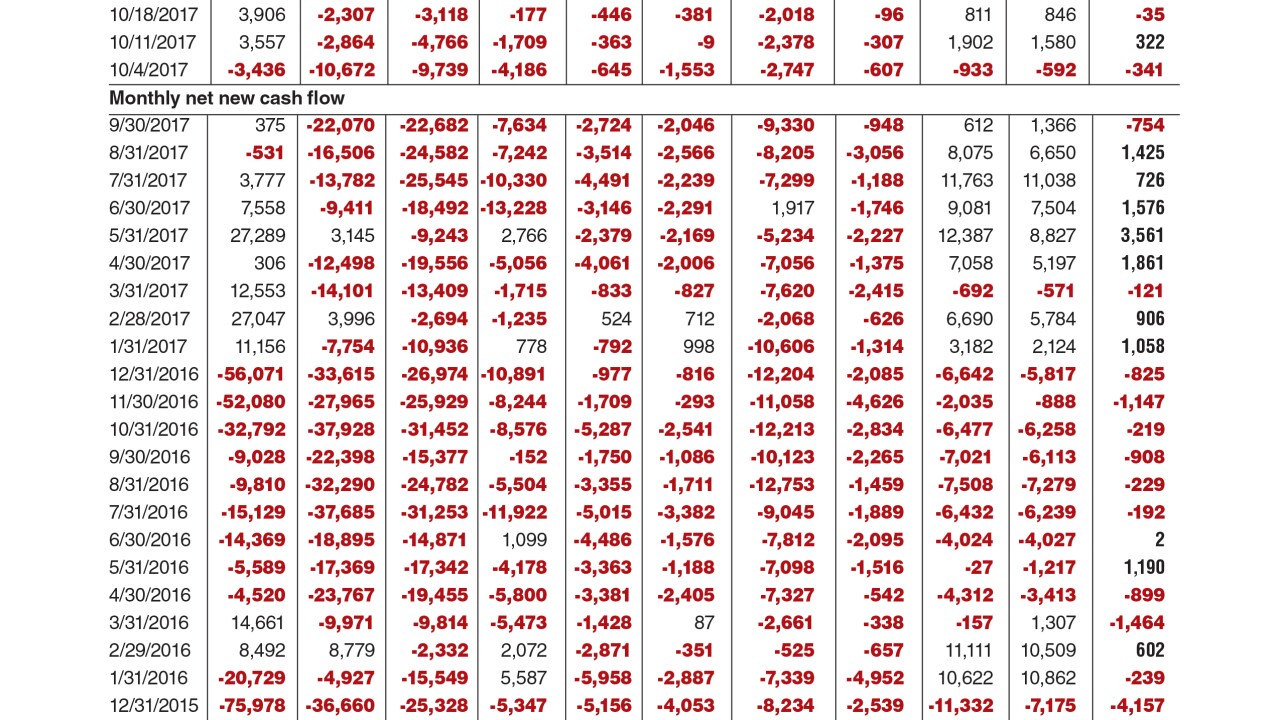

Data reported by the Investment Company Institute.

December 8 -

To add insult to injury, these returns didn’t even come cheap. The average expense ratio was more than 1%.

December 6 -

Data reported by the Investment Company Institute.

December 1 -

These eye-popping returns didn’t come cheap. Expense ratios averaged more than 1% and went as high as 158 basis points.

November 29 -

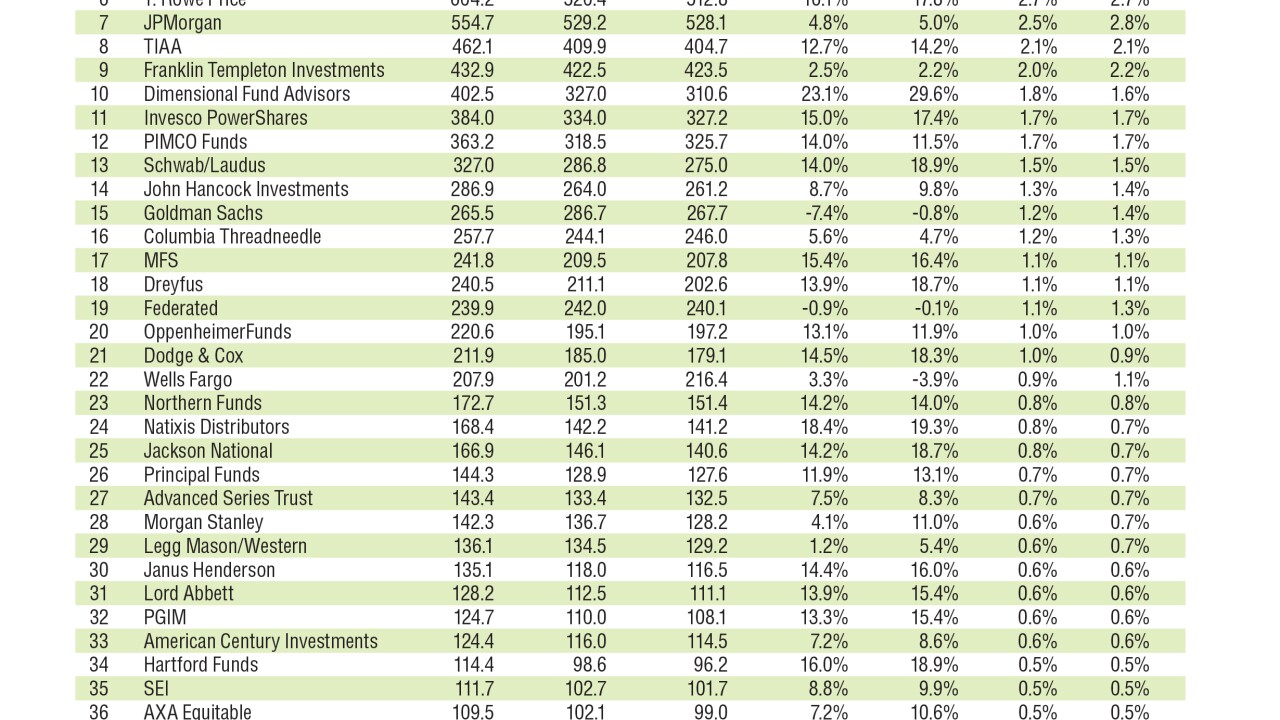

Data reported by FUSE Research.

November 22 -

Data reported by the Investment Company Institute.

November 17 -

Data reported by the Investment Company Institute.

November 10 -

Investors may be growing impatient with implementation of the administration’s agenda, an analyst says.

November 9 -

Emerging markets, value and small-cap funds dominate the list, but other factors need to be considered, as well.

November 8 -

Research into the point system for ranking funds questions whether the metric is valid in gauging future performance.

November 7 -

Data reported by the Investment Company Institute.

November 3 -

The firm recently dismissed two portfolio managers due to inappropriate behavior.

October 27 -

Data reported by the Investment Company Institute.

October 27