We collected the 20 funds with the worst year-to-date performances as of Dec. 4 with an AUM minimum of $500 million. All but three are in natural resources, namely energy, gold and real estate. The others focus on value investments.

In a testament to just how frothy the market is overall, the average return of these 20 is a relatively muted -2.3%. To add insult to injury, though, these returns (read: losses) didn’t come cheap. The average expense ratio was 1.11% — about even with the 1.08% that last week’s top performing funds charged.

With sector investments, especially those that are often global in nature like natural resources, higher expenses can be expected. But it still makes for an unpleasant surprise when viewed side by side with negative returns.

To check out this year’s losers — plus how they’ve fared over three years — scroll through the list. All data from Morningstar.

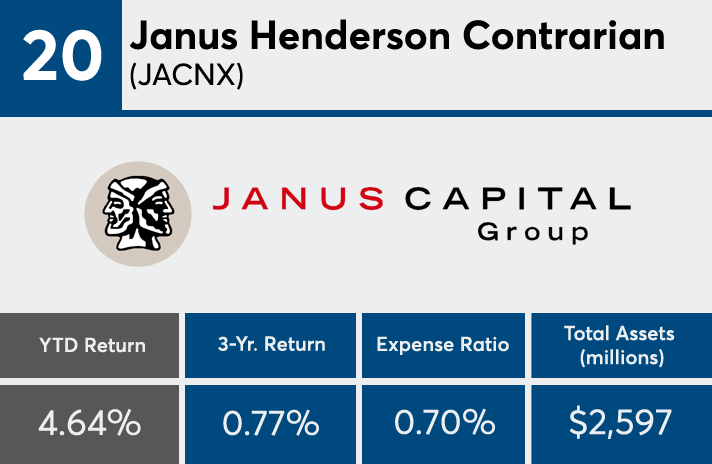

20. Janus Henderson Contrarian (JACNX)

3-Yr. Return: 0.77%

Expense Ratio: 0.70%

Net Assets (millions): $2,597

19. T. Rowe Price Real Estate (TRREX)

3-Yr. Return: 5.97%

Expense Ratio: 0.74%

Net Assets (millions): $6,126

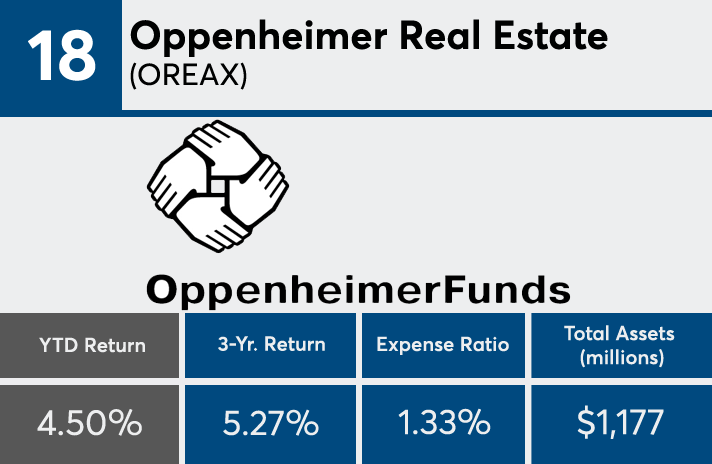

18. Oppenheimer Real Estate (OREAX)

3-Yr. Return: 5.27%

Expense Ratio: 1.33%

Net Assets (millions): $1,177

17. JPMorgan Small Cap Value (PSOPX)

3-Yr. Return: 9.68%

Expense Ratio: 0.99%

Net Assets (millions): $2,065

16. USAA Precious Metals and Minerals (USAGX)

3-Yr. Return: 1.79%

Expense Ratio: 1.22%

Net Assets (millions): $569

15. Fidelity Select Gold (FSAGX)

3-Yr. Return: 5.84%

Expense Ratio: 0.84%

Net Assets (millions): $1,337

14. Poplar Forest Partners Institutional (IPFPX)

3-Yr. Return: 7.19%

Expense Ratio: 1.00%

Net Assets (millions): $778

13. Vanguard Energy Inv (VGENX)

3-Yr. Return: 0.42%

Expense Ratio: 0.41%

Net Assets (millions): $9,447

12. JHancock Natural Resources NAV (JHNRX)

3-Yr. Return: -2.82%

Expense Ratio: 0.97%

Net Assets (millions): $514

11. Victory Global Natural Resources (RSNRX)

3-Yr. Return: -3.87%

Expense Ratio: 1.48%

Net Assets (millions): $1,443

10. Ivy Natural Resources (IGNAX)

3-Yr. Return: -2.63%

Expense Ratio: 1.72%

Net Assets (millions): $597

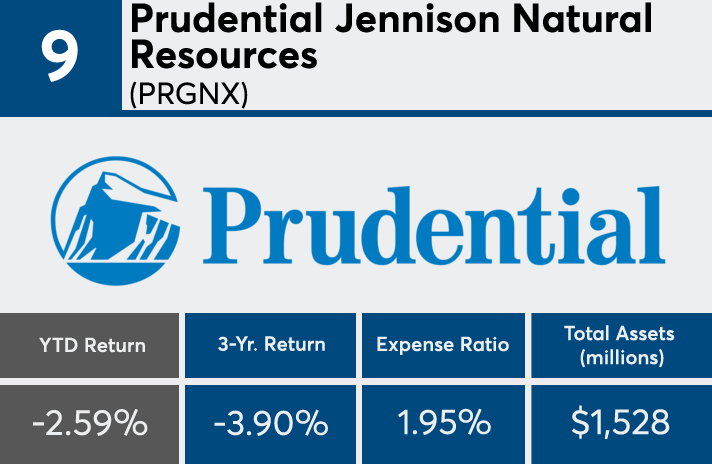

9. Prudential Jennison Natural Resources (PRGNX)

3-Yr. Return: -3.90%

Expense Ratio: 1.95%

Net Assets (millions): $1,528

8. Franklin Gold and Precious Metals (FKRCX)

3-Yr. Return: 2.86%

Expense Ratio: 1.11%

Net Assets (millions): $981

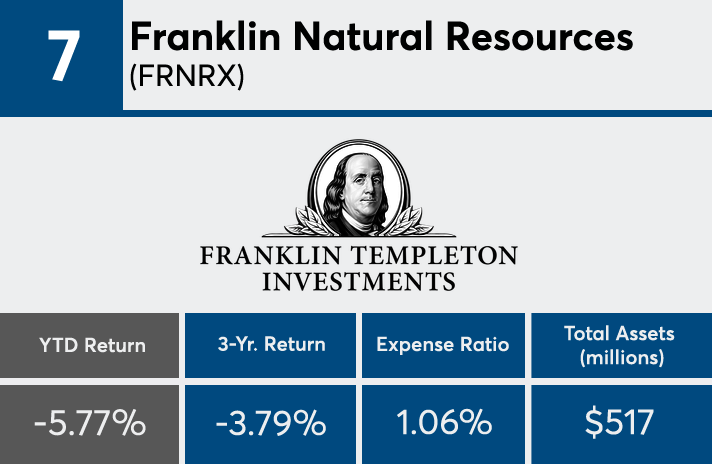

7. Franklin Natural Resources (FRNRX)

3-Yr. Return: -3.79%

Expense Ratio: 1.06%

Net Assets (millions): $517

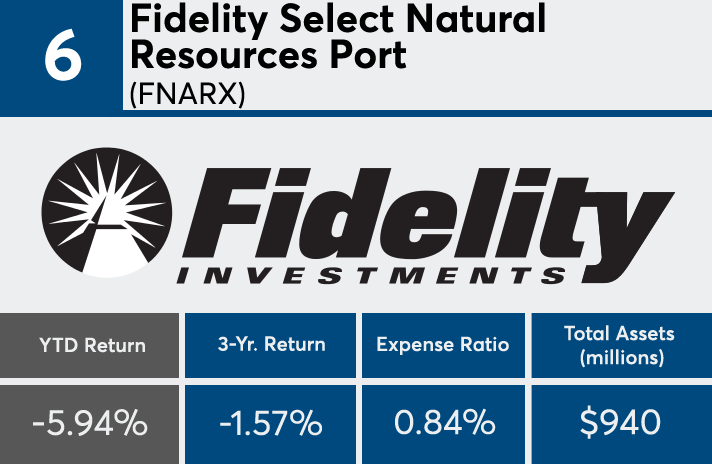

6. Fidelity Select Natural Resources Port (FNARX)

3-Yr. Return: -1.57%

Expense Ratio: 0.84%

Net Assets (millions): $940

5. Spirit of America Energy (SOAEX)

3-Yr. Return: -9.78%

Expense Ratio: 1.44%

Net Assets (millions): $662

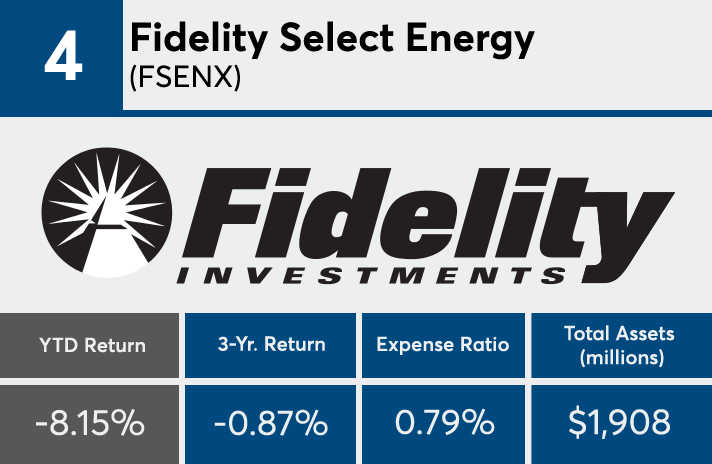

4. Fidelity Select Energy (FSENX)

3-Yr. Return: -0.87%

Expense Ratio: 0.79%

Net Assets (millions): $1,908

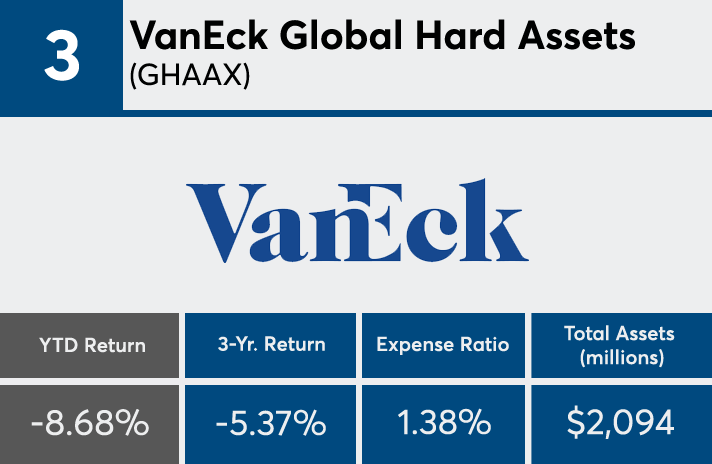

3. VanEck Global Hard Assets (GHAAX)

3-Yr. Return: -5.37%

Expense Ratio: 1.38%

Net Assets (millions): $2,094

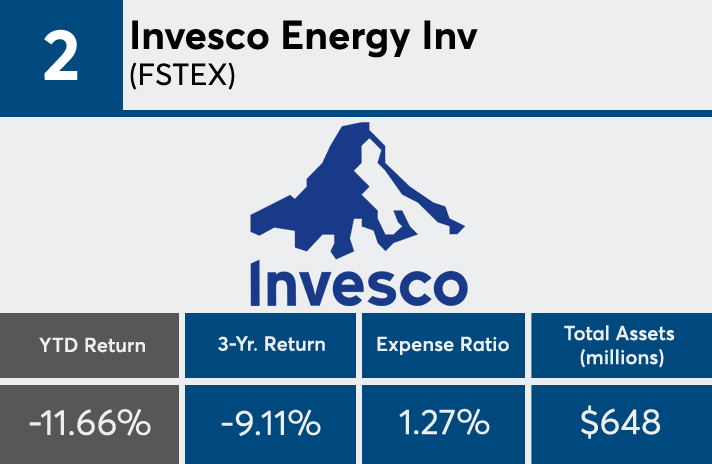

2. Invesco Energy Inv (FSTEX)

3-Yr. Return: -9.11%

Expense Ratio: 1.27%

Net Assets (millions): $648

1. Fairholme (FAIRX)

3-Yr. Return: -0.73%

Expense Ratio: 1.03%

Net Assets (millions): $1,844