-

These eye-popping returns didn’t come cheap. Expense ratios averaged more than 1% and went as high as 158 basis points.

November 29 -

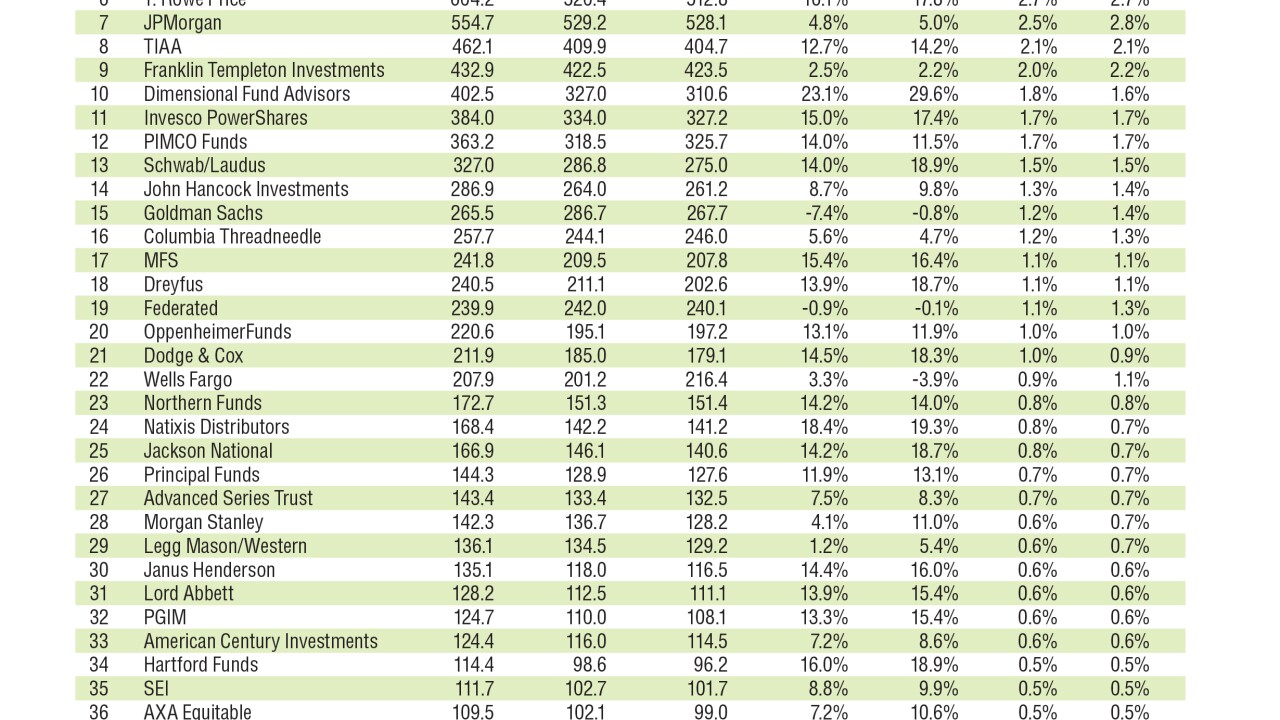

Data reported by FUSE Research.

November 22 -

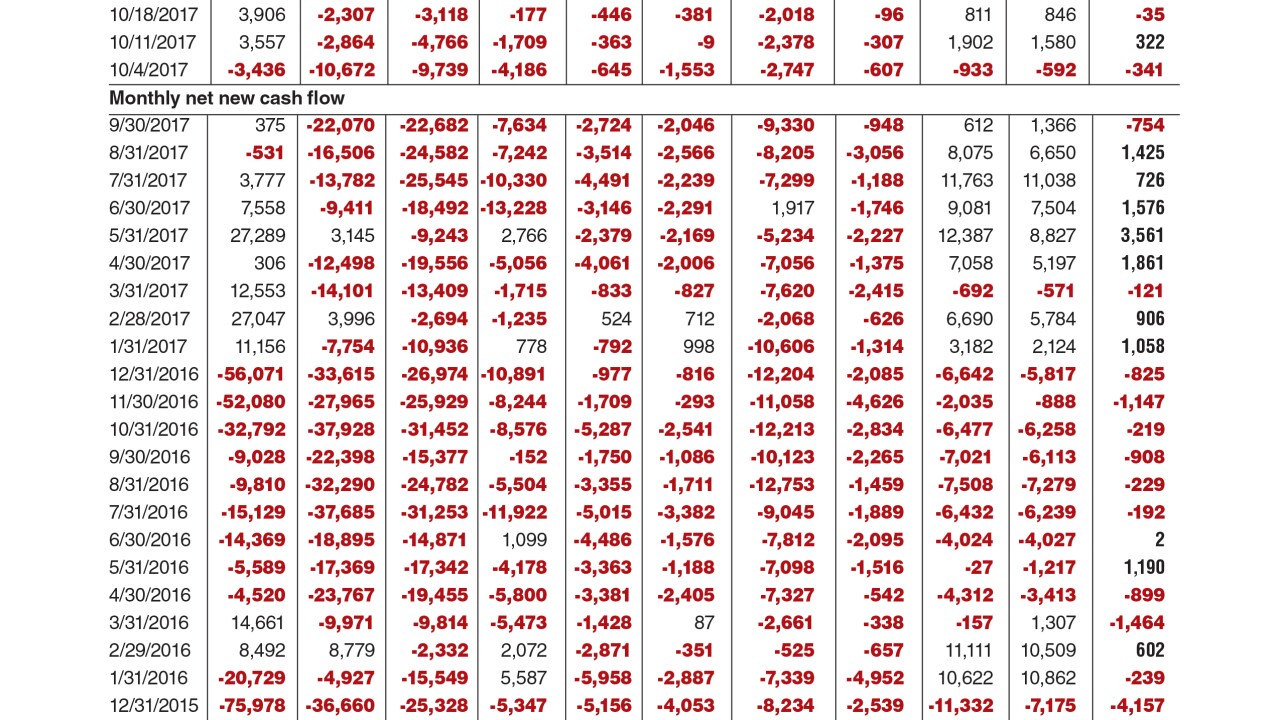

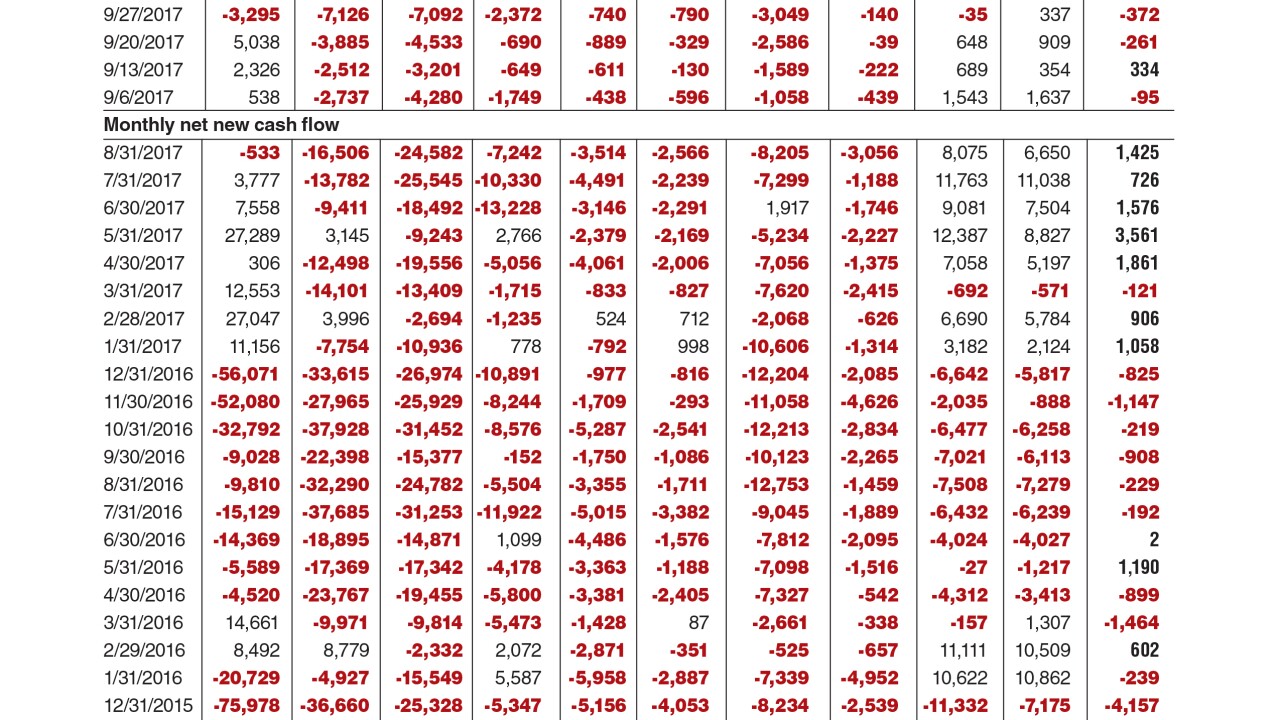

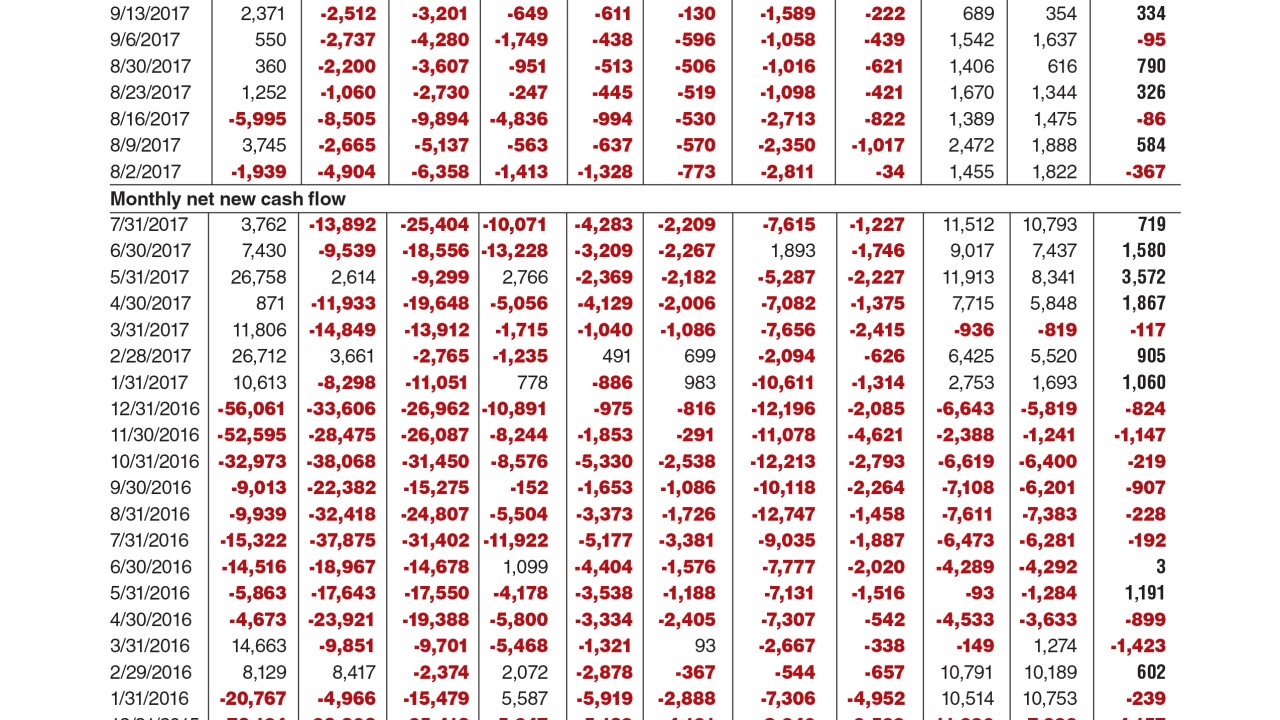

Data reported by the Investment Company Institute.

November 17 -

Data reported by the Investment Company Institute.

November 10 -

Investors may be growing impatient with implementation of the administration’s agenda, an analyst says.

November 9 -

Emerging markets, value and small-cap funds dominate the list, but other factors need to be considered, as well.

November 8 -

Research into the point system for ranking funds questions whether the metric is valid in gauging future performance.

November 7 -

Data reported by the Investment Company Institute.

November 3 -

The firm recently dismissed two portfolio managers due to inappropriate behavior.

October 27 -

Data reported by the Investment Company Institute.

October 27 -

The funds gained an average of 13.3% a year over the past decade, which began before the financial crisis.

October 25 -

Oct. 23: The custodian plans to offer advisors and retail investors access to 296 commission-free ETFs.

October 20 -

Data reported by FUSE Research.

October 20 -

With strong returns and affinity among younger clients, one advisor has gone as far as to mandate the strategy.

October 18 -

Data reported by the Investment Company Institute.

October 16 -

Data reported by the Investment Company Institute.

September 29 -

All posted positive returns over five years, but active saw the largest outflows.

September 20 -

Data reported by the Investment Company Institute.

September 15 -

Outperformance helps the sin industries be profitable, the Journal of Portfolio Management authors found.

September 11 -

Sept. 11: Managers have been told to prepare for spending more on research and trading services they get from banks.

September 8