-

With millennial and Gen Z clients expected to have longer lives than their parents, securing an effective retirement horizon can have its challenges.

October 1 -

Plans can quickly deteriorate as a result of poor planning and inaccurate assumptions about the future.

September 26 -

Establishing an S corporation would protect their profits from federal income taxes of more than 23.8%, an expert says.

September 24 -

Many pin the blame on stagnant or dwindling income, according to a new survey.

August 22 -

Seniors are advised to combine multiple tax-deferred accounts, such as traditional IRAs and 401(k)s.

August 13 -

Clients often underutilize deductions for work-related technology purchases and travel expenses.

July 30 -

Contribution limits in a Roth IRA could shrink for couples after marriage.

July 23 -

Despite changes in the new law aimed at scrapping a penalty for most new couples, those from high-income households may owe more this year.

July 2 -

Under new rules, small business owners can offer their workers tax-free dollars to buy health coverage.

June 25 -

The rule can create significant tax savings, but in unskilled hands it can just shift the burden elsewhere.

June 7 -

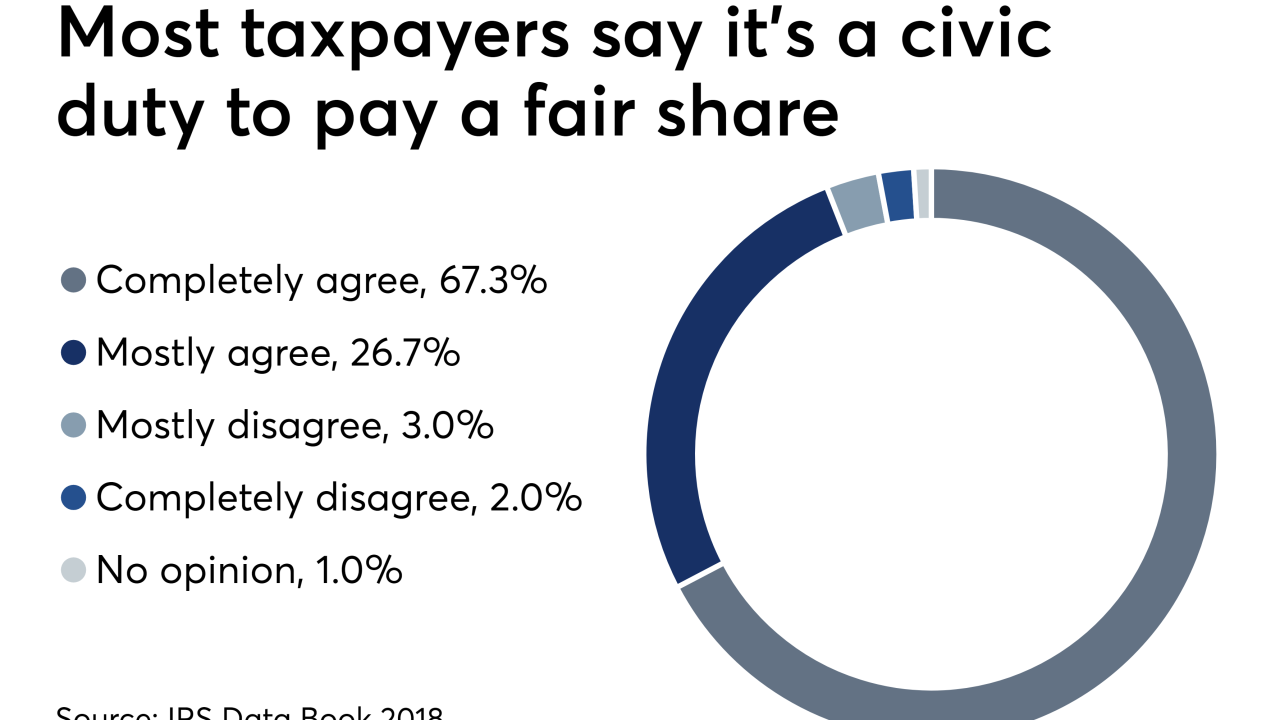

The agency processed more of every major type of form during FY 2018 than during the prior year, with the exception of estate tax returns.

May 22 -

“Health care prices are increasing at levels that significantly exceed overall inflation,” an expert warns.

April 23 -

Capital gains tax rates are not just taxed at a single, more favorable, rate anymore.

April 17 -

Outperformance has been driven in part by a push among investors to cut their tax bills after new limits were set on state and local deductions.

March 19 -

The tax law has made deducting philanthropic contributions more difficult, but there are ways to help clients reap benefits from their generosity.

March 19 -

It’s not just clients in high-tax states buying up muni bonds.

March 14 -

Changing filing statuses and maxing out deductible contributions to IRAs and HSAs are some ways clients received bigger reimbursements.

March 12 -

The Pension Benefit Guaranty Corp. is facing a $54 billion deficit for insuring multiemployer plans in unionized industries, says the GAO report.

March 7 -

“The more ties you cut, the better — auditors like to see a moving van and an itemized list of what was moved,” one lawyer says.

March 5 -

Some clients may experience a taxable event that pushes them into a higher tax bracket.

February 26