Welcome to Retirement Scan, our daily roundup of retirement news your clients may be talking about.

Blue Owl's decision to halt withdrawals from one of its private credit funds raises further questions about the already obscure world of private credit.

Small oversights when drafting a trust can snowball into major headaches for clients and their heirs. Here's how advisors can help.

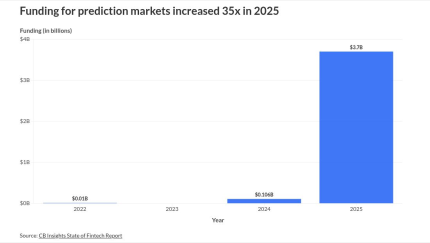

The platforms, where bets are placed on everything from U.K. soccer teams to the price of bitcoin, are getting traction from investors and attention from regulators.

Although planning for retirement can be complicated, seniors are advised to keep their investment portfolios as simple as possible, writes Morningstar’s Christine Benz. For example, clients should combine multiple tax-deferred retirement accounts such as traditional IRAs and 401(k)s into a single account, she writes. “Employing a single provider for all of these accounts can also greatly simplify your oversight and record-keeping responsibilities,” according to Benz.

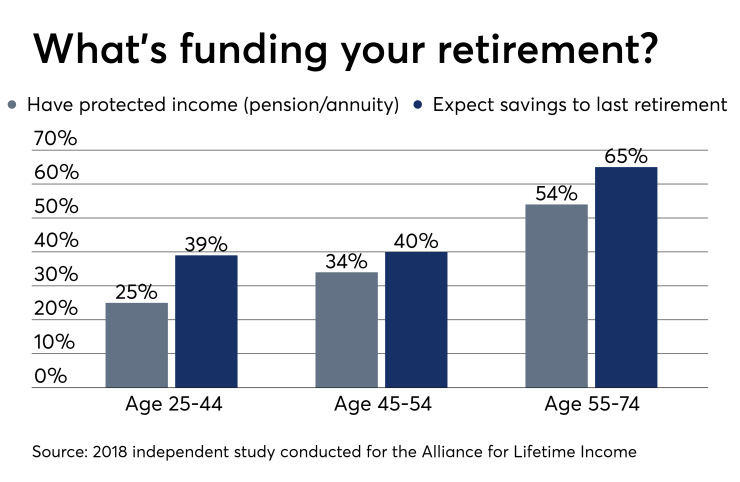

While saving for retirement is necessary to secure retirement, creating a sustainable distribution strategy is just as important, a Forbes contributor writes. “The decisions you make as you enter retirement are key and can make or break your retirement success,” the expert writes, adding that one reason is clients “no longer will have earned income and the safety of getting a paycheck every couple of weeks” deposited into their accounts.

Seniors can expect a portion of their Social Security benefits to be subject to federal income taxes if their combined income exceeds a certain threshold, according to an article from Motley Fool. The combined income is their annual earnings plus 50% of their retirement benefits. For example, half of the benefits will be taxed if the combined income is between $25,000 and $34,000 for individuals, or between $32,000 and $44,000 for joint filers.

Virginia and Colorado are among the most-appealing locations for retirees to spend their golden years, due in part to top scores in affordability, health-related factors and overall quality of life.

Holding annuities as part of the retirement income strategy can be a smart strategy for clients to secure their stability in retirement, writes an expert in MarketWatch. These products “often get a bad rap for high fees, surrender charges, and complexity, but certain kinds of annuities can give you steady, pension-like income or insure against your running out of money if you wind up living longer than you expect,” according to the expert.