-

The federal funds rate is currently at 5.25% to 5.50%, the highest in over two decades, but many financial advisors and analysts see that falling as soon as next month.

August 16 -

Art loans function as lines of credit, so clients draw on them and pay them back as they can.

August 16 -

The first half of 2024 marked a record stretch for ETFs, but not all funds were lifted by the rising tide.

August 15 -

A belief in the exceptional nature of U.S. markets can blind advisors to clients' true risk tolerance.

August 15 Toews Asset Management

Toews Asset Management -

July has historically been a strong month for ETF inflows, and this year was no exception.

August 13 -

Recent years have taken the shine off of fixed income, both as a portfolio diversifier and a way to boost total returns. The prospect of falling rates next month promises to reverse that.

August 12 -

Mutual funds are losing assets, while ETFs are gaining them. Here's a look at how a pioneering firm has adjusted to a difficult environment in recent years.

August 6 -

While big firms keep getting hit with lawsuits alleging unfair cash sweep policies, MaxMyInterest is generating returns from cash through the competitive marketplace.

August 6 -

These recoveries don't guarantee a bottom has been reached.

August 6 -

Financial planners have had to field plenty of questions about why they weren't more aggressively chasing returns. With the market correction, they now have a chance to show the benefits of a diversified strategy.

August 5 -

The planning strategies for large individual equity holdings pose tax, investment and behavioral questions for financial advisors and their customers.

August 5 -

The soliciations can be made only to clients who have a net worth of at least $1.5 million, high risk tolerance and the intention to invest in speculative assets.

August 5 -

Firms like BlackRock and Invesco are among those signaling they want to offer access to private markets via ETFs.

July 31 -

Despite the notion that an ESG backlash is pushing clients away, private equity products aiming to solve challenging problems through investments are still on the rise.

July 30 -

New alternative investment platform JKBX has attracted thousands of retail investors purchasing the streaming rights to hit songs from Beyoncé, Taylor Swift and more — here's what it might mean for the alts space.

July 26 -

The SEC has approved the first U.S. exchange-traded funds investing directly in ether, the world's second-largest cryptocurrency.

July 23 -

The latest legal action over the industry's handling of clients' uninvested cash suggests sweeps are a bigger profit generator than most firms let on.

July 19 -

The initial suite of ETF products available on the platform will all be actively managed.

July 19 -

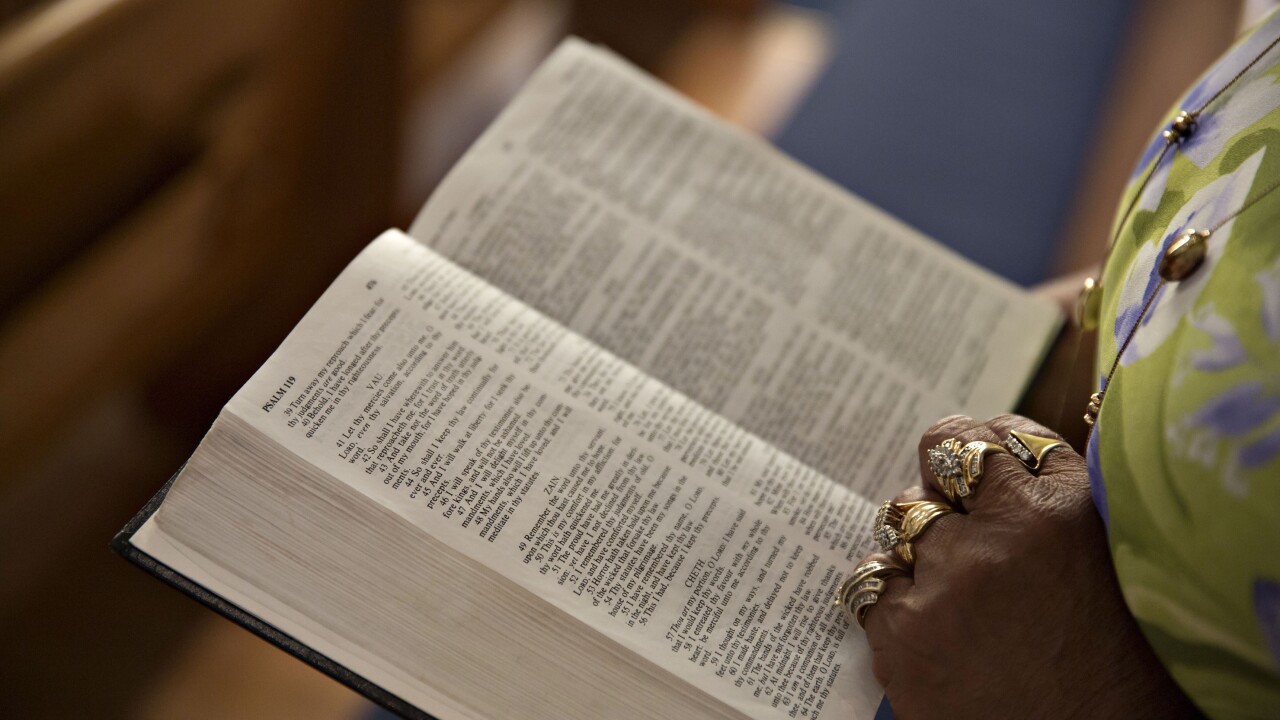

Financial advisors who cater to investors who want to put their money where their faith is say what is screened out all depends on several different factors.

July 18 -

These hybrid securities blend a bond and a derivative and are customizable to clients' savings needs.

July 16