-

Assets held by exchange-traded funds in the U.S. hit $10 trillion for the first time as the investor-friendly products continue their Wall Street takeover.

September 27 -

A new ETF is attempting to carve out a slice of the $6.3 trillion in traditional money-market funds.

September 26 -

The Goldman Sachs 2024 Retirement Survey & Insights Report found that while competing priorities affected workers' ability to save, having a plan in place helped clarify goals and the grit required to meet them.

September 26 -

The latest lawsuit accuses the firm of not only failing to look out for clients' best interests but also failing to secure "reasonable returns" on money held in retirement accounts.

September 25 -

Merrill and a partner firm were accused of running a complicated yield enhancement strategy, or CYES plan, of the type that has long been in regulators' crosshairs.

September 25 -

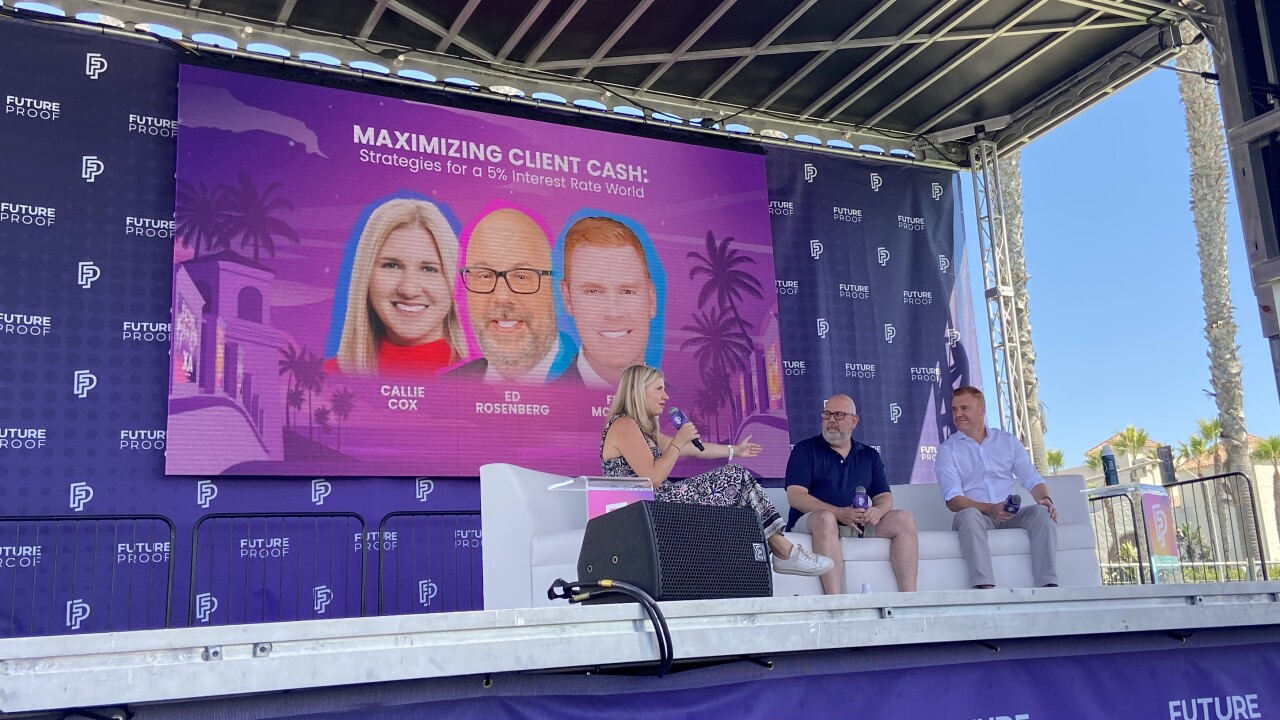

Here are some of the key takeaways from a sampling of the many substantive discussions at Huntington Beach last week.

September 24 -

Three of the biggest ETFs tracking EM bonds saw cash infusions last week.

September 24 -

After cutting rates 50 basis points in September, the Federal Open Market Committee meets after Election Day to determine monetary policy. Gary Pzegeo, head of fixed income at CIBC Private Wealth U.S., provides his take on the latest move.

-

The broader tech sector makes up around one third of the S&P 500.

September 23 -

Getting clients to focus on a longer time frame for their investments can be challenging in the age of micro attention spans and instant gratification.

September 20 -

Lower interest rates are just one of many factors weighing on the $1.7 trillion market for private debt.

September 20 -

The money managers slashed their support of ESG shareholder proposals amid a Republican-led backlash against sustainable investing.

September 20 -

Large exchanges argue some of the changes could make it more costly for them to offer rebates to brokers in return for order flow.

September 18 -

Clients must understand that having too much of their portfolios allocated in cash can mean lower returns over time.

September 18 -

Experts expect the rate cuts to continue, but for how long and how effective they will be in achieving a "soft landing" remain to be seen.

September 18 -

Fintech startup Intelligent Alpha has launched a chatbot-powered ETF that claims to harness the investment brainpower of Warren Buffett, David Tepper, and more.

September 18 -

Advisors and industry experts say a historical perspective of the past and a long-ranging view of the future are key in this moment of change.

September 17 -

Demand from retail investors for the closed-off securities has boomed, with private markets now worth more than $13 trillion.

September 17 -

Edward Jones is also lowering its fees on certain asset ranges and seeing faster-than-expected adoption of the MoneyGuide investing systems.

September 16 -

The accounts are expected to grow by another trillion dollars over the next decade because of their tax and flexibility advantages, Daffy CEO Adam Nash said.

September 16