-

Gary Quinzel, vice president of portfolio consulting at Wealth Enhancement Group, gives his views about monetary policy and offers his opinion on the FOMC statement and Fed Chair Jerome Powell's press conference.

-

Mutual funds are losing assets, while ETFs are gaining them. Here's a look at how a pioneering firm has adjusted to a difficult environment in recent years.

August 6 -

While big firms keep getting hit with lawsuits alleging unfair cash sweep policies, MaxMyInterest is generating returns from cash through the competitive marketplace.

August 6 -

These recoveries don't guarantee a bottom has been reached.

August 6 -

Financial planners have had to field plenty of questions about why they weren't more aggressively chasing returns. With the market correction, they now have a chance to show the benefits of a diversified strategy.

August 5 -

The planning strategies for large individual equity holdings pose tax, investment and behavioral questions for financial advisors and their customers.

August 5 -

The firms acknowledge on social media that they are responding to technical difficulties.

August 5 -

The soliciations can be made only to clients who have a net worth of at least $1.5 million, high risk tolerance and the intention to invest in speculative assets.

August 5 -

A recent YouGov survey said 60% of Americans consider integrity the most important factor in their selection process.

July 31 -

Firms like BlackRock and Invesco are among those signaling they want to offer access to private markets via ETFs.

July 31 -

Despite the notion that an ESG backlash is pushing clients away, private equity products aiming to solve challenging problems through investments are still on the rise.

July 30 -

Before he became a Republican vice presidential candidate, and shortly after he published "Hillbilly Elegy," JD Vance worked for five years in venture capital.

July 29 -

New alternative investment platform JKBX has attracted thousands of retail investors purchasing the streaming rights to hit songs from Beyoncé, Taylor Swift and more — here's what it might mean for the alts space.

July 26 -

The SEC has approved the first U.S. exchange-traded funds investing directly in ether, the world's second-largest cryptocurrency.

July 23 -

Instead of shying away from fraught interactions as the presidential race heats up, financial advisors say it's important to face them head-on.

July 22 -

The latest legal action over the industry's handling of clients' uninvested cash suggests sweeps are a bigger profit generator than most firms let on.

July 19 -

The initial suite of ETF products available on the platform will all be actively managed.

July 19 -

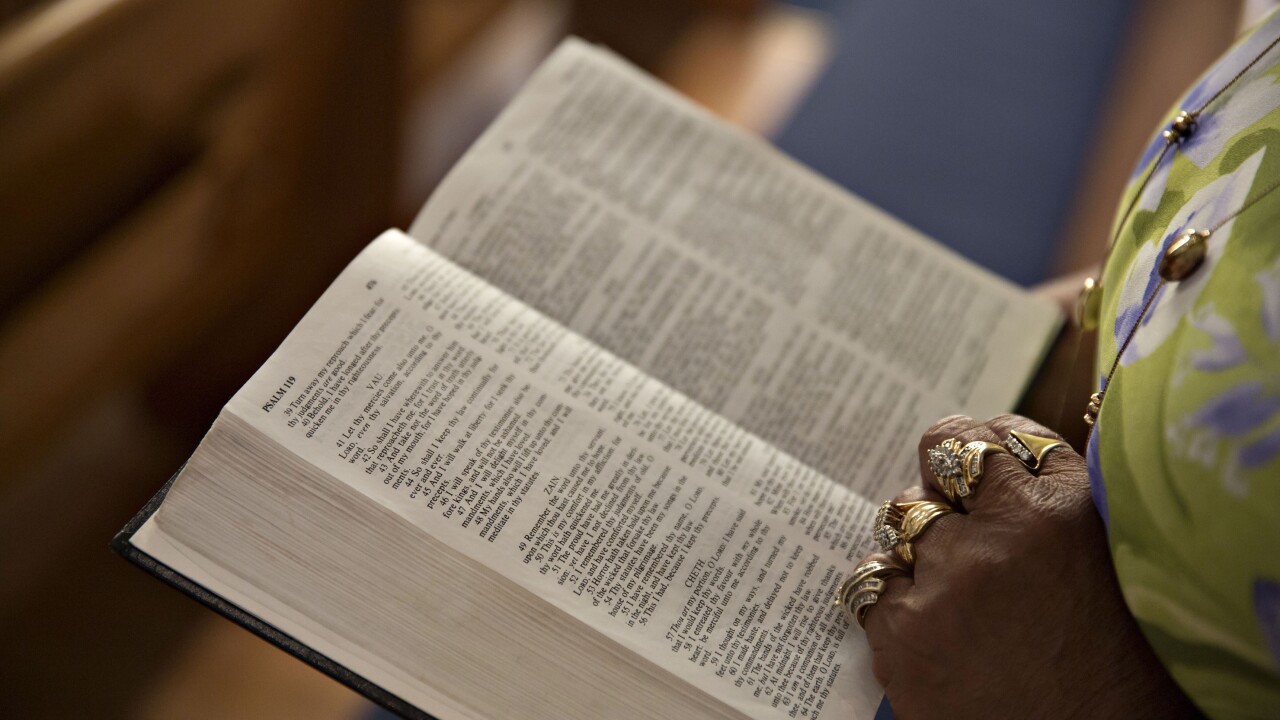

Financial advisors who cater to investors who want to put their money where their faith is say what is screened out all depends on several different factors.

July 18 -

Industry groups say RIAs are receiving SEC letters inquiring about compliance with the new T+1 settlement rule for stock and bond trades.

July 18 -

These hybrid securities blend a bond and a derivative and are customizable to clients' savings needs.

July 16