-

Anthony Kelly, the new co-head of the SECs Enforcement Division subunit, looks to reassure CCOs.

March 10 -

The clearing houses are too important to fail, and the current rules governing their risk management are too lax.

March 10 -

Voices: Moving from a commission account to a fee-based account with an additional risk tolerance questionnaire does not equal sufficient Know-Your-Customer or suitability measures.

March 9 Totum Wealth

Totum Wealth -

The advisor was a compulsive gambler who continued to bet in an attempt to make his clients whole, says attorney.

March 8 -

The advisor also beat back Wells Fargo's $200,000 in claims for breach of promissory note.

March 8 -

BlackRock issued and sold more shares than it was authorized to in its iShares Gold Trust, which could lead to penalties by regulators.

March 8 -

The domestic planning component of advising is likely to be increasingly regulated, and firms should use this to their advantage, Glenn G. Kautt says.

March 7 -

The commission also settled related charges against First Southwest, a financial advisor, for failing to document its advisory relationship with the agency for seven months.

March 7 -

The rep was reprimanded for allegedly failing to disclose her business involvement with a kitchen-cabinet installation company in Florida.

March 3 -

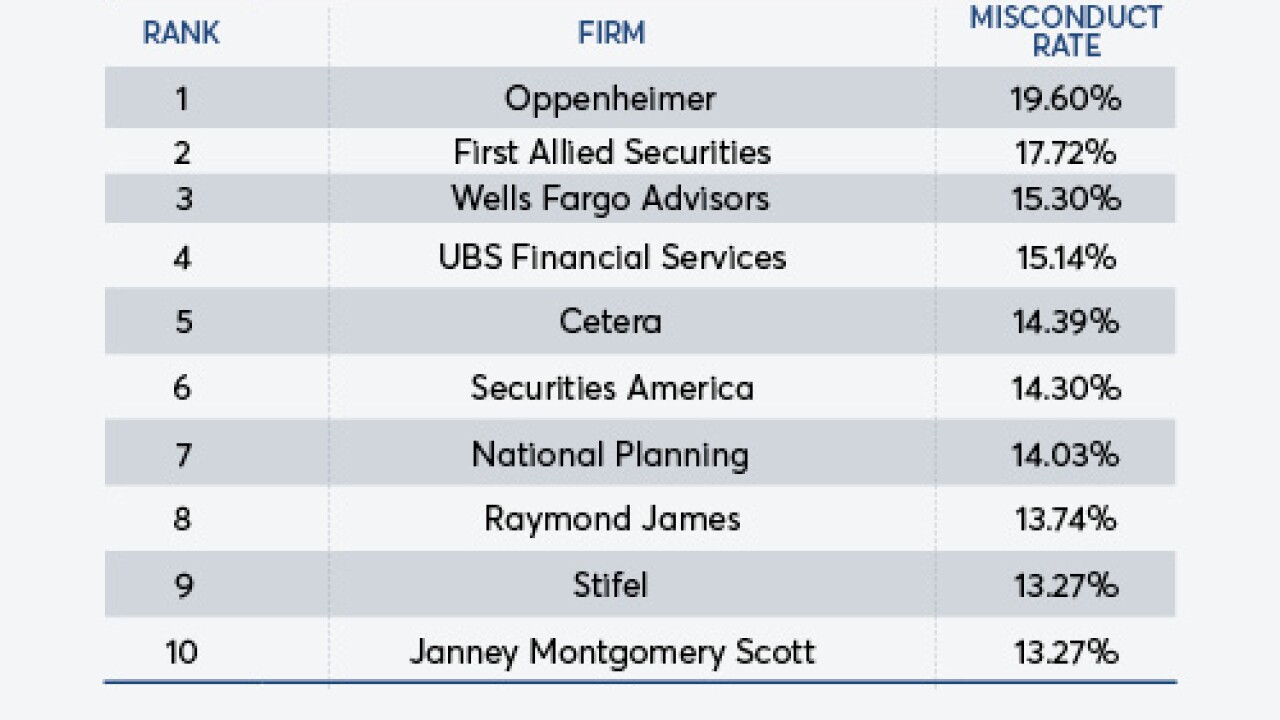

FINRA's BrokerCheck shows that 7% of advisors were disciplined for misconduct, including putting clients in unsuitable investments and trading on client accounts without permission, a new study says.

March 2