-

A new Cerulli report suggests that one of banks' best opportunities to grow in the coming years is right under their nose, with a client segment they often ignore.

December 15 -

A new study by Financial Planning parent company Arizent shows that firms are missing a big opportunity to get ahead on winning in the wealth transfer race.

July 6 -

Citizens made waves with its hires of around 50 private banking staff from First Republic. The head of wealth management at Citizens shared what's next.

July 3 -

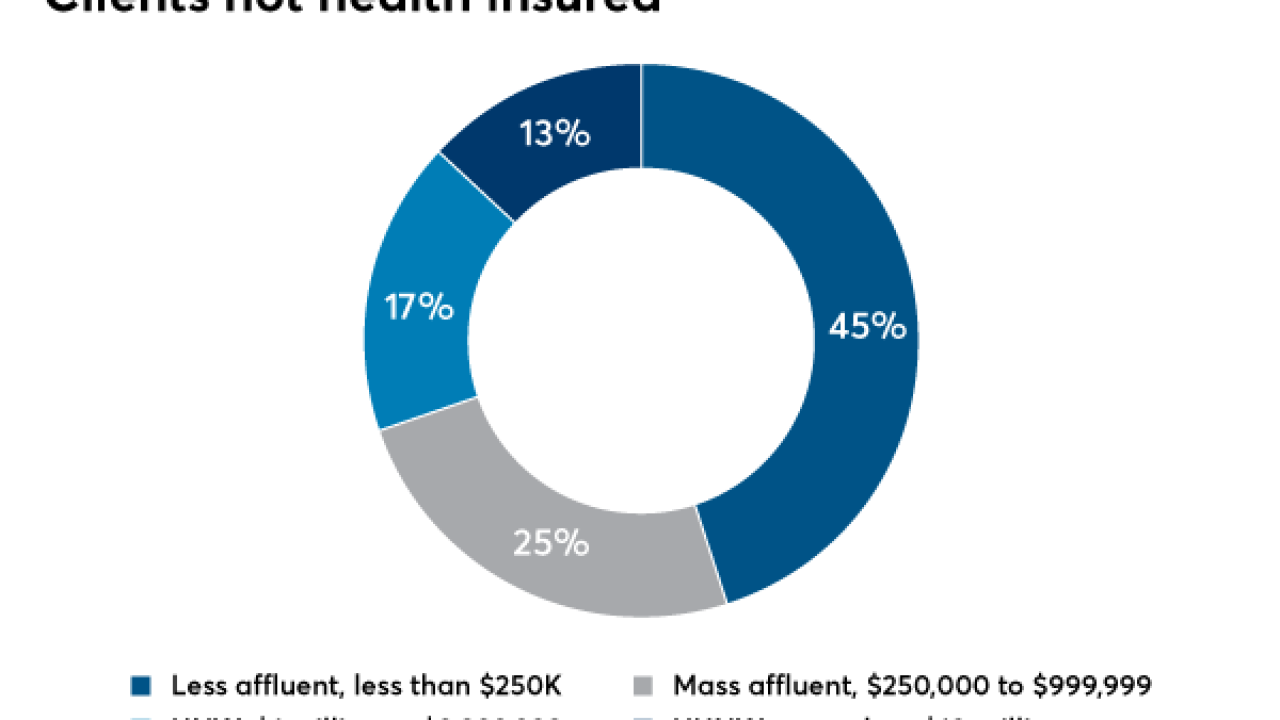

Investors with between $250,000 and $1 million outnumber the ultrawealthy by 2.5 to 1. For financial advisors, that could be a huge opportunity.

June 1 -

Wealthy individuals, not institutional investors, will drive money into alternative assets, data provider Preqin says in a new study.

March 28 -

The Finra report suggests that advisors looking to tap into these clients will find savers with improved financial capabilities.

February 21 -

Gifting embedded loss assets can avoid a step-down in basis and preserve capital losses. Here's how to go about it, under several scenarios.

August 24 -

The Wall Street giant has built an automated advice platform and is considering how to release it to the mass affluent market.

November 6 -

They have begun eyeing clients with $1 million and less.

June 21 -

The firm hopes to broaden wealth management offerings beyond ultrahigh-net-worth clients.

June 3 -

-

Joe Duran outlines the company’s strategy for its mass-affluent advisory push.

May 20 -

-

The value advisors provide has not been historically aligned with the price clients pay. That’s changing, says the Facet Wealth CEO.

May 8 -

The investment platform, which is in the early stages of development, will be part of Marcus, the firm's consumer bank.

April 17 -

The market can't go up indefinitely, says Facet Wealth CEO Anders Jones, who predicts RIAs looking to fund growth-by-acquisition might find themselves cut off.

November 7 -

For potential landlords, owning rental property can sometimes be managed from a laptop or even a phone.

October 5 -

Copying big banks, smaller institutions are pairing with robos to meet changing mass-affluent preferences in long-term investment products.

September 28 -

Bank of America has plans to expand the self-directed platform’s reach even further.

September 12 -

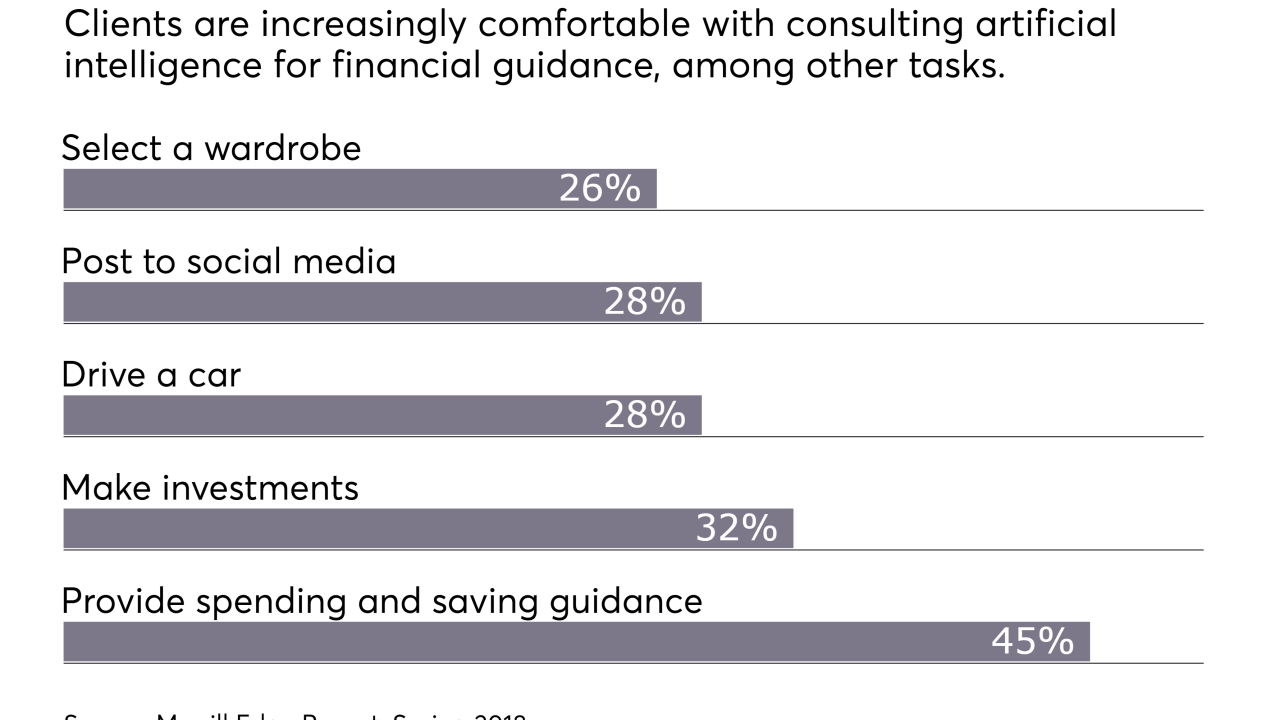

Banks are opting for a hybrid approach, augmenting in-person advice with digital guidance.

June 11