-

With the exact timeline and eventual destination unclear, the private equity-backed firm was revealed as one of two major OSJs departing from LPL.

July 30 -

The author learned fast that running an OSJ has little overlap with operating a fully independent, multicustodial firm.

July 31 Concurrent

Concurrent -

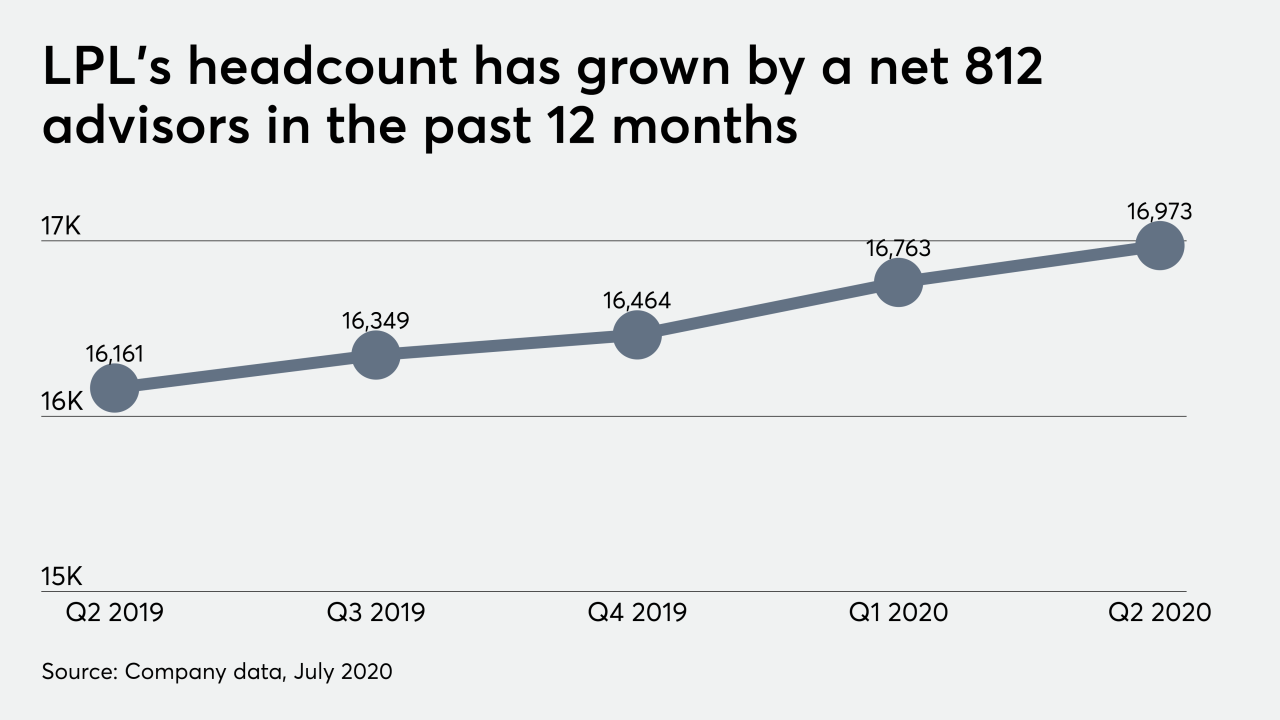

The No. 1 IBD added to its record headcount with the third billion-dollar move it unveiled in a two-week span.

June 24 -

The 10-person practice, rebranded as Puzzle Wealth Solutions, is led by CEO John Klaas and COO David Millington.

June 21 -

Its parent seeks to support more holistic planning by combining it with two other subsidiaries.

June 18 -

Good Life Companies fosters competition among wealth managers for its own health and runs food stores and a gym.

June 17 -

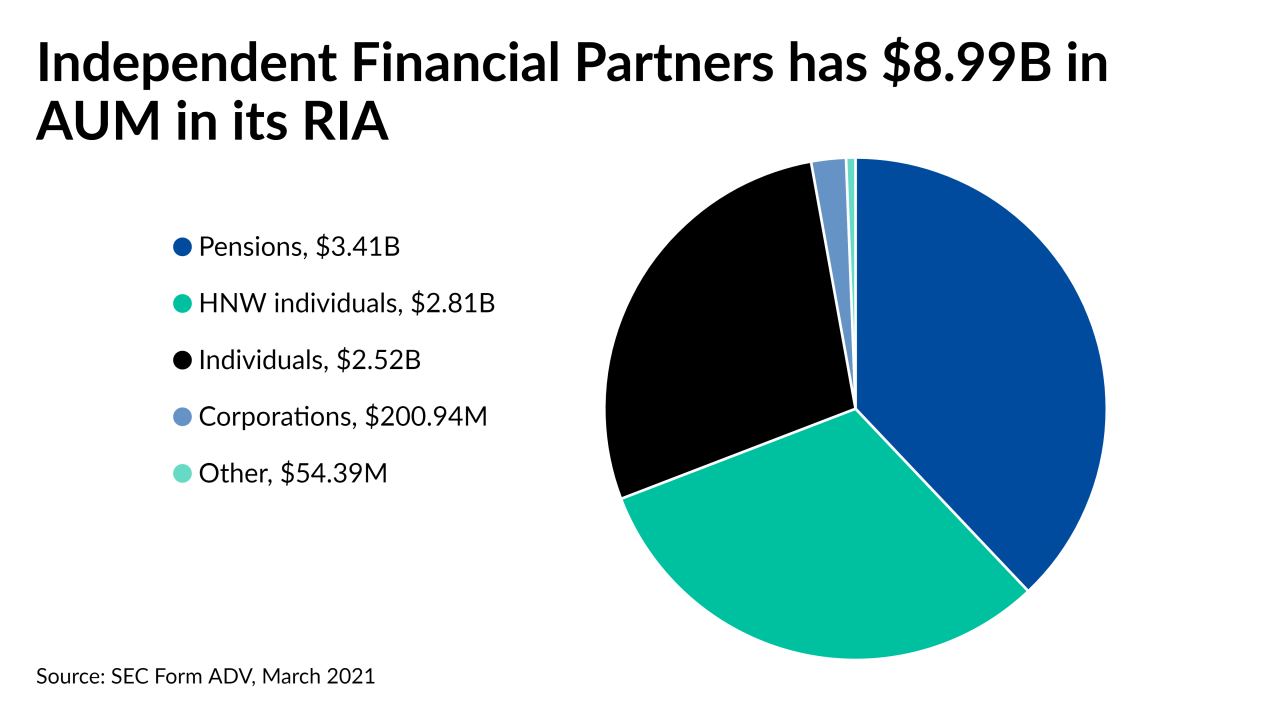

Bill and Chris Hamm admit it’s been something of a rocky start, but they say IFP is saving advisors and clients money compared to a typical wealth manager.

June 15 -

The Dallas-based hybrid RIA has more than 100 reps, and, if they follow the chief’s exit, it would be the the No. 1 IBD’s largest loss since 2019.

June 11 -

Concurrent is catering to breakaway teams assessing their options after back-office frustrations during the coronavirus, co-founder Mike Hlavek says.

June 3 -

The enterprise could reach more than 50 registered representatives in the next couple of months, depending on how many of them leave MassMutual.

May 6 -

Financial advisor Christian D’Urso spends his mornings hiking, kayaking or biking, and his afternoons running a $110 million advisory business on the water.

March 25 -

The agreement will expand the companies’ recruiting efforts in the bank and wirehouse channels.

February 17 -

The founding partners of the 300-advisor OSJ will remain in their current roles for three years under the same structure as before the deal.

January 13 -

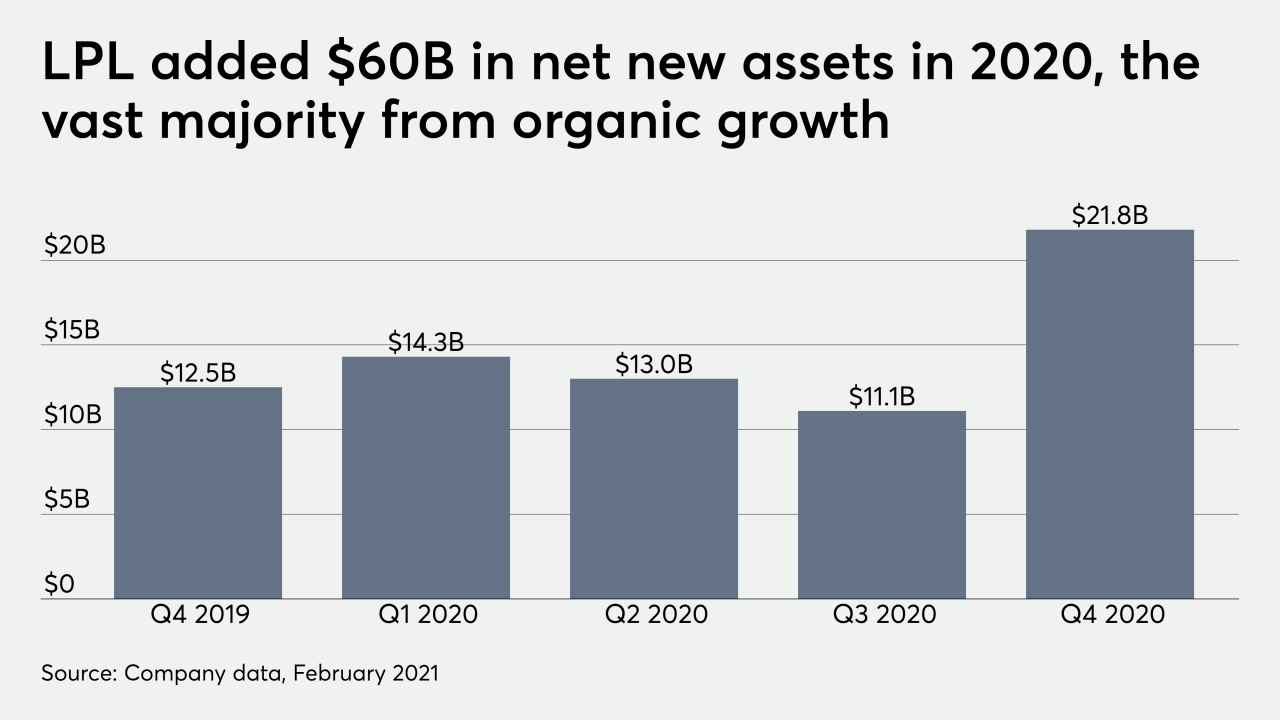

LPL Financial and indie rivals like Raymond James, Wells Fargo FiNet and Kestra Financial completed at least 17 recruiting grabs of $800 million or more this year.

December 18 -

The OSJ scooped up teams from Edward Jones, Wells Fargo Advisors and Wedbush Securities.

December 11 -

The No. 1 IBD is responsible for nearly half of the dozen mega-moves in its sector this year.

November 24 -

In a surprise announcement, Private Advisor Group tapped Moore as CEO nearly two years after he left Cetera for undisclosed medical reasons.

November 18 -

It’s one of the largest recruiting moves of the year in the independent broker-dealer sector.

November 16 -

The 40-advisor OSJ brings more than double the assets of any other new group unveiled across the IBD network in 2020.

November 11 -

The No. 1 IBD is keeping up the recruiting momentum that’s sustaining record headcounts and billion-dollar moves.

October 23