-

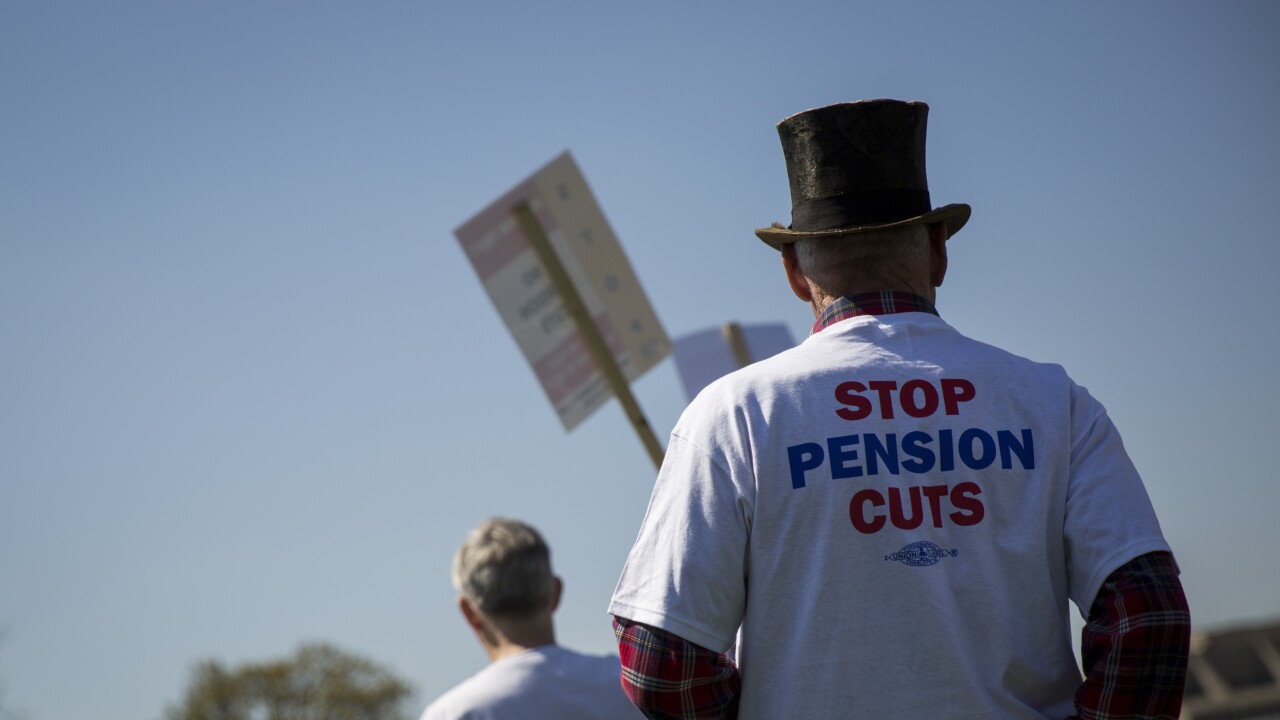

Lawmakers agreed to form a congressional committee that would look into multiemployer plans and develop a measure to fix these plans' insolvency woes.

February 20 -

With many private and public pensions in the red, clients are advised to look for options that will improve their prospects, such as Roth IRAs.

January 23 -

The funded ratio for defined benefit plans at Fortune 1,000 firms rose to 83% at the end of 2017, a new report says.

January 3 -

Investors are advised to do a Roth conversion before year-end to make the most of the federal tax deduction for state and local income taxes, which could disappear next year.

December 15 -

The strategy could provide lifelong cash flow by trimming longevity risk.

November 28 -

Many carriers offering long-term care coverage are experiencing financial woes and may no longer guarantee payments when clients need them.

June 15 -

Workers who withdraw from their 401(k) plan lose about 25% in compounded growth.

April 4 -

Proponents of defined-contribution plans envisioned them as supplements to defined benefit plans; they didn't anticipate that 401(k)s would largely replace pensions.

January 4 -

Some of the most significant financial planning changes advisers should consider when working with same-sex couples.

November 23 -

Some of the most significant financial planning changes advisers should consider when working with same-sex couples.

November 23 -

Clients who borrow from their company retirement plans can often get a good rate with no hassle. But if they miss payments, they might face nasty tax charges.

October 26 -

Open enrollment offers seniors the opportunity to change their plans and save hundreds of dollars.

October 6 -

Retirees over 65 will no longer be able to contribute to health savings accounts once they file for benefits.

August 12 -

Long-term investors have nothing to fear when it comes to short-term market volatility.

June 2 -

Investors often think their time and savings are running out and micromanage their investments despite having hired a financial adviser.

May 5