-

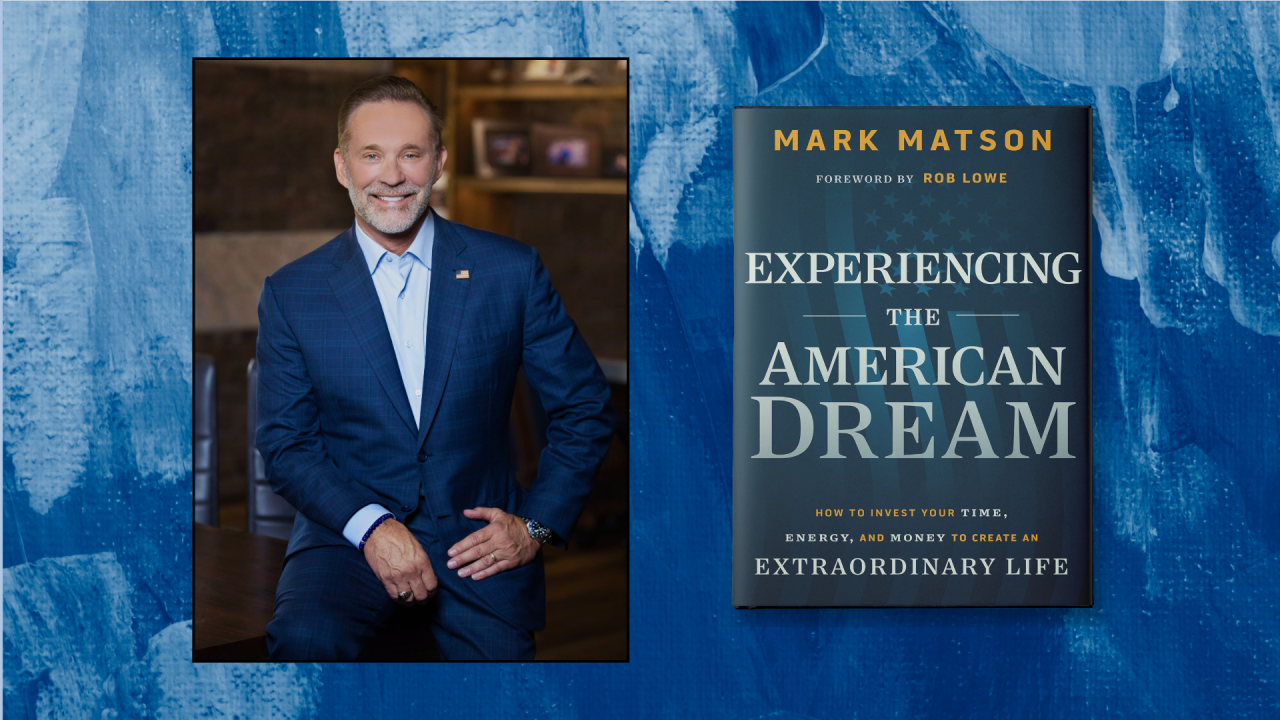

Mark Matson aims to help people define and realize their goals by making "academic investing principles accessible to everyday investors," he said.

September 19 -

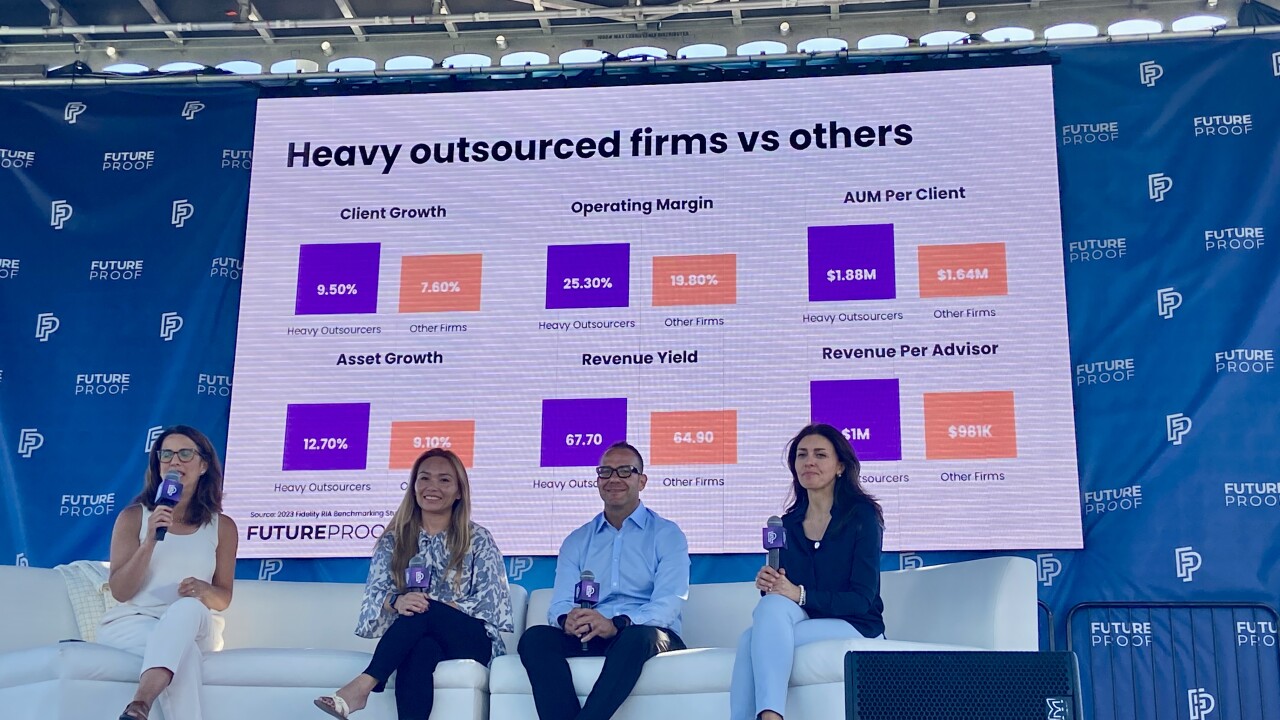

Leaders from Envestnet, J.P. Morgan Asset Management and Dimensional Fund Advisors discuss how technology has made it both easier and yet more challenging for advisors to manage portfolios on their own.

September 18 -

Clients must understand that having too much of their portfolios allocated in cash can mean lower returns over time.

September 18 -

Experts expect the rate cuts to continue, but for how long and how effective they will be in achieving a "soft landing" remain to be seen.

September 18 -

Advisors and industry experts say a historical perspective of the past and a long-ranging view of the future are key in this moment of change.

September 17 -

The firm raises its predictions after finding that fewer customers are shifting cash in pursuit of higher yields.

September 17 -

Edward Jones is also lowering its fees on certain asset ranges and seeing faster-than-expected adoption of the MoneyGuide investing systems.

September 16 -

The accounts are expected to grow by another trillion dollars over the next decade because of their tax and flexibility advantages, Daffy CEO Adam Nash said.

September 16 -

New offering would allow advisors to connect with more than 20 external asset managers.

September 16 -

The offering comes amid a slowdown in large insitutional investors' funding of private credit and equity.

September 12 -

The "father of the index fund" was famously skeptical that exchange-traded funds would encourage risky and speculative stock market bets.

September 3 -

The deal comes an ongoing boom in private loans to businesses and consumers.

August 27 -

The active side of passive indices is on display as two of the largest present plans to undercut the weighting of the largest megacap companies.

August 23 -

Small-cap funds may be an attractive element of a diversified portfolio, but you wouldn't necessarily know that looking at the data from this year.

August 20 -

The outcome of the November election is likely to have a significant effect on interest rates, tax cuts and deregulation — in turn affecting client portfolios.

August 19 -

A FINRA study found nearly 400 firms, or 65% of the broker-dealers surveyed, have some hand in crypto assets and trading, as the once-novel asset class becomes normalized. But that still doesn't make it normal for regulators.

August 15 -

A belief in the exceptional nature of U.S. markets can blind advisors to clients' true risk tolerance.

August 15 Toews Asset Management

Toews Asset Management -

Advisor consultants say it's time to do a tech gut check as new technology is bloating firms into paying for costly and often unnecessary tech stacks.

August 13 -

Advyzon has grown for more than a decade using the strategy that all technology should be built in-house, even if it takes longer.

August 12 -

Recent years have taken the shine off of fixed income, both as a portfolio diversifier and a way to boost total returns. The prospect of falling rates next month promises to reverse that.

August 12