-

Up to 85% of retirement benefits might be taxed if their combined income exceeds a certain threshold.

August 14 -

Divorced women are more financially prepared for retirement than their single, never-married counterparts because they are more likely to secure their marital home after the separation.

August 13 -

-

Congress is considering seven bills, which if passed, would help Americans improve their retirement prospects.

August 8 -

82% of surviving spouses could have collected a higher benefit if they did things differently with their filing, according to a new report.

August 7 -

States with unfunded public employee retirement obligations will have to rely on real estate property as their ultimate collateral to deal with the risk.

August 6 -

Not all vehicles are created equal — and for high earners in particular, the conventional wisdom may not apply.

August 6 -

Divorce is expected to be different for couples who are in their advance years than when they were younger.

August 3 -

Many seniors who succeeded in retirement set their sights on becoming millionaires while they were young.

August 2 -

Clients will be better off using the income allocation strategy than the asset allocation approach when building a retirement portfolio, an advisor says.

August 1 -

Retirees may have gotten out of the workforce too early if they are not yet eligible to claim health coverage through Medicare.

July 30 -

The typical tax-deffered savings account can easily hit $1 million — mathematically speaking.

July 24 -

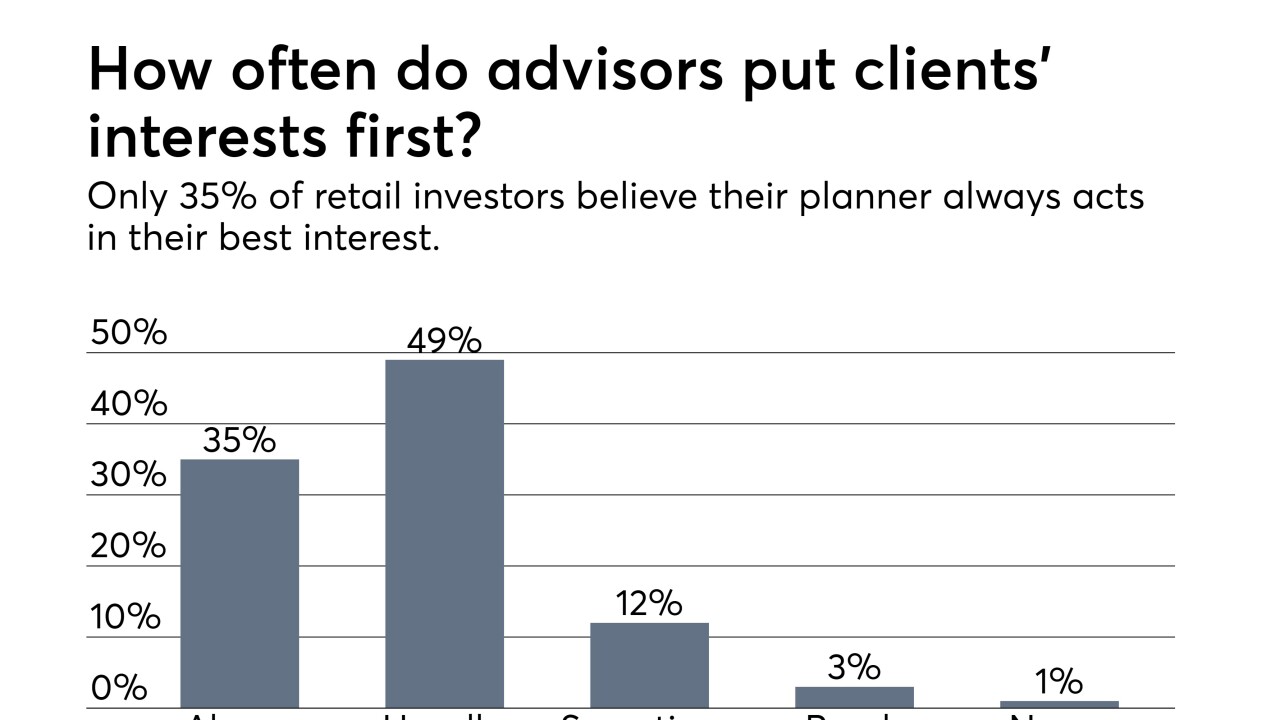

Whether measuring performance against the market or a client’s own goals, the industry needs accountability.

July 20 -

In some cases, amassing a large IRA can have unforeseen negative consequences, including higher Medicare costs. Here’s how Roth conversions and other strategies can help.

July 20 -

More small companies would be encouraged to offer retirement savings plans to their employees under a proposed bill.

July 18 -

Many retirement investors are including target-date funds in their 401(k) plans, but this strategy may not be a smart move.

July 17 -

Seniors should have socked away at least 10 times their salary in their retirement accounts by the time they retire to secure their golden years.

July 16 -

We give advice based on the intel we have, but not all clients are as up front as we are.

July 13 -

-

The worry that many clients feel about the possible reduction in their future retirement benefits as a result of Social Security's dwindling trust fund is misplaced, says expert.

July 11