-

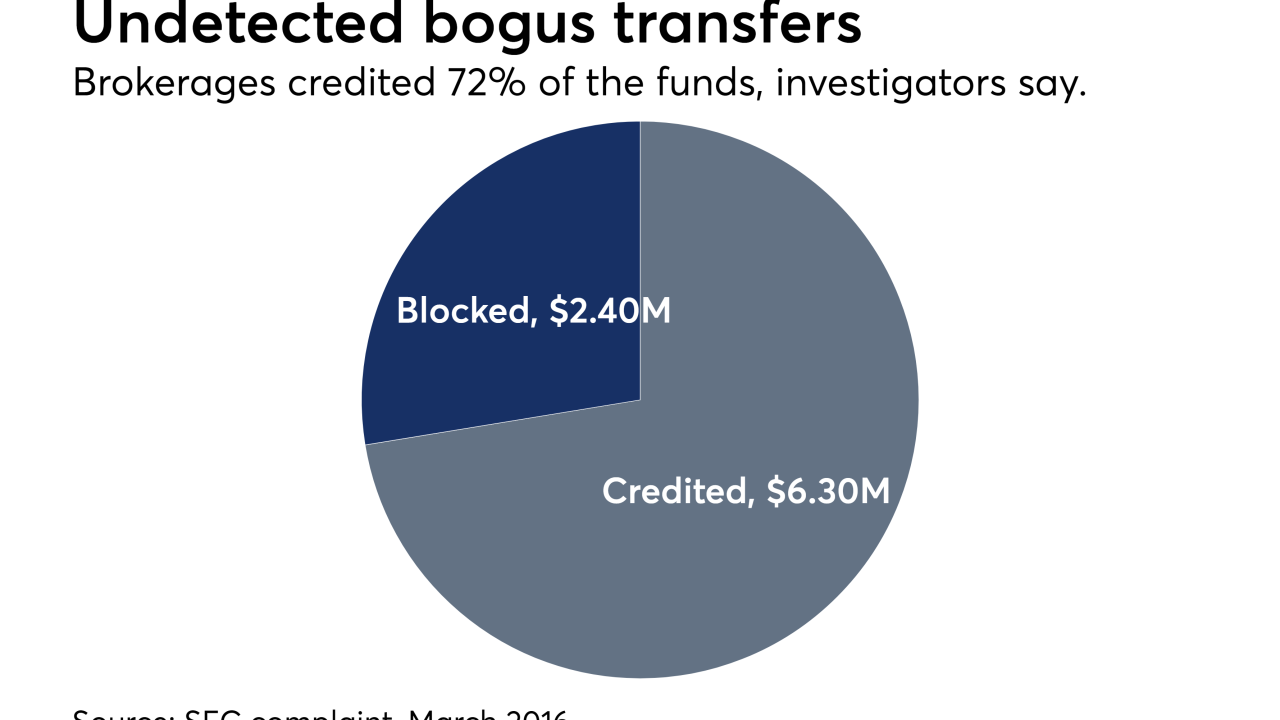

Two hundred fraudulent wire transfers were made over more than a decade, says the regulator.

October 23 -

The advisor used the money on cars and gambling in the latest Ponzi-like scheme, investigators say.

September 7 -

Chairman Jay Clayton and OCIE's director provided advisors with hints on the regulator’s methods.

September 6 -

The firm allegedly profited $14 million by fabricating performance records.

September 1 -

The case marks the firm’s second in a month, but its special investigations unit helped crack it.

August 25 -

The RIA rep fabricated account statements and used forged letterheads as part of the deception, investigators say.

August 23 -

Louis Blazer III used client funds to finance 'Mafia the Movie,' according to the complaint.

August 14 -

The advisors collected $1.7 million by fraudulently pushing variable annuities, investigators say.

August 3 -

Some advisers are actually embracing changes by making the rules work for them.

July 13 -

OCIE plans to conduct 1,850 probes of RIAs, a 28% jump over its 2016 total, while sharply cutting those aimed at broker-dealers.

June 30 -

Jay Clayton acknowledged in testimony on Capitol Hill that it's a “very complicated issue.”

June 27 -

Regulators now use deeper dives into specific areas rather than broad probes, experts say.

June 21 -

RIAs using digital platforms will face scrutiny about disclosure and client communications.

June 14 -

The investor received 15 months in prison after pleading guilty to wire fraud.

June 1 -

In 2016, the SEC brought a record 868 cases, including 173 against broker-dealers and advisers and 159 against investment companies.

May 16 -

The SEC could continue cracking down on brokers and advisers, but some see Clayton’s leadership taking a more business-friendly tack.

May 5 -

The SEC is investigating the bank for selling clients mutual funds that charge marketing fees when other, cheaper funds were available. SunTrust expects an enforcement action.

February 27 -

Advisers have been warned: SEC's exam guidance to focus on cyber threats and issues involving seniors, leaving little excuse for noncompliance.

January 13 -

The advisor paid $50,000 to a widow's lawyer to refer her $100 million account to him – a fact he failed to disclose to the client, the agency claims.

January 10 -

The allegations come a year after the firm paid over $300 million to resolve regulators' claims that it failed to tell wealthy clients it was steering them into its own funds.

December 16