-

Since this March, almost 100 firms have settled with the regulator for approximately $173 million. Other cases are still pending.

October 8 -

Although FINRA cannot investigate potential wrongdoing by these former employees, state regulators are expected to do so.

October 3 -

The IBD’s corporate RIA didn’t require about 350 banks to provide clients the terms of its arrangement.

September 30 -

The employee and independent BD collected excess UIT commissions and failed to properly review inactive accounts, the regulator says.

September 18 -

The agency's goal of trying to recover client losses allows advisors accused of fraud to decide who'll manage their clients’ remaining assets.

September 5 -

The IBD trade group launched a public campaign after more than 80 cases this year alleging inadequate disclosure of mutual fund fees and compensation.

September 5 -

The SEC published more than 1,300 pages of regulatory information. Here's what advisors need to know.

September 3 -

The IBD failed to adequately disclose conflicts of interest to clients related to receiving $10.8 million from mutual funds and its clearing broker, the SEC says.

August 30 -

IFS has notified regulators about the alleged illegal trades, which sources say cost the firm more than $10 million.

August 15 -

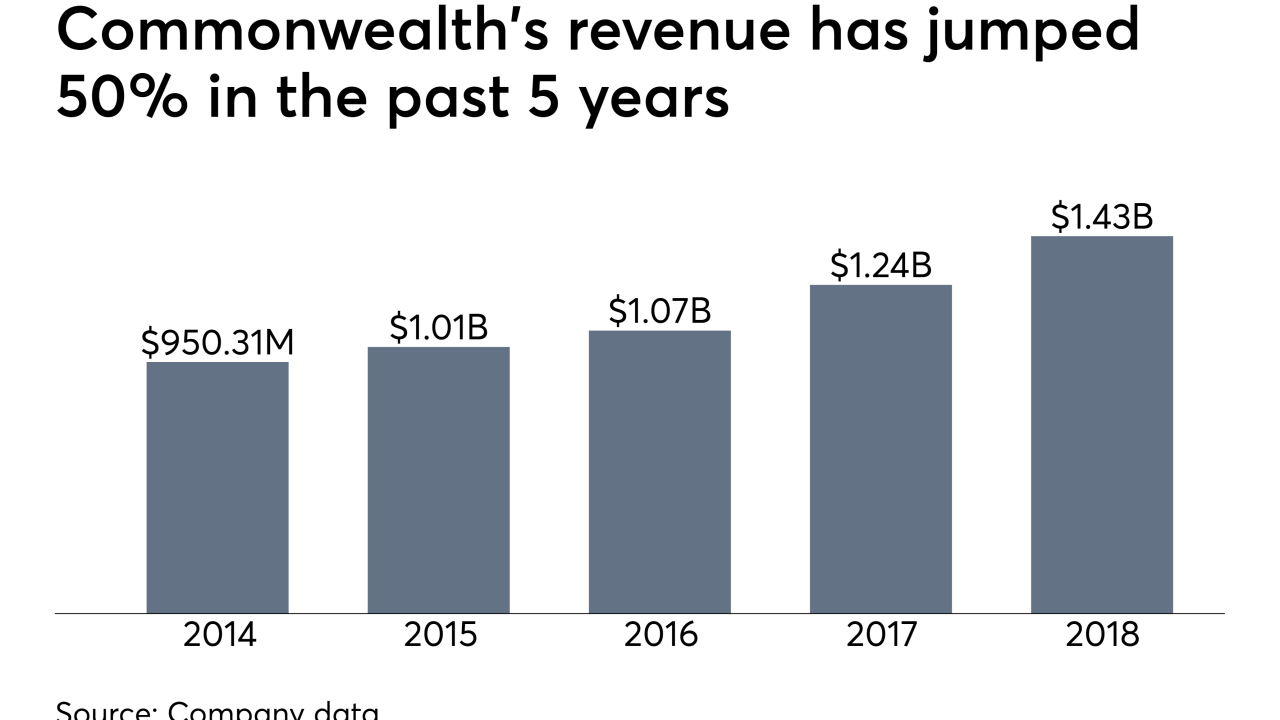

Critics reject the notion that disclosure alone is sufficient for reigning in conflicts — but the charges against Commonwealth have put BDs on notice.

August 12 -

The firm didn't disclose its conflicts of interest in receiving over $100 million in revenue sharing from mutual funds over nearly five years, the SEC says.

August 1 -

A barred broker told clients the lifestyle media company was about to be acquired, so “they needed to act quickly,” according to the regulator.

July 9 -

Clients seeking to recoup some $14 million in damages have received only 12% of their total claims, according to an SEC-appointed receiver.

July 3 -

With transparency about conflicts on the rise even as it varies by firm, critics question whether clients really understand complicated technical documents.

May 30 -

The SEC is giving serious side-eye to firms with part-time or underqualified compliance officers.

April 30 Cipperman Compliance Services

Cipperman Compliance Services -

The allegation was laid out in an SEC order, which hit a U.S. unit of the firm with a $500,000 penalty.

April 26 -

Audit volume is up but compliance issues are down — with cybersecurity as the wild card.

April 9 RIA in a Box

RIA in a Box -

The justices said bankers can be held liable for sending clients deceptive information written by others.

March 28 -

The firm’s founder “knowingly engaged in a multi-year scheme to mask the poor performance of one of the funds’ largest investments,” the SEC alleged.

March 26 -

The independent broker-dealer accidentally published a list of credits of its most lucrative advisors.

March 22