In its first case against a firm that didn’t participate in

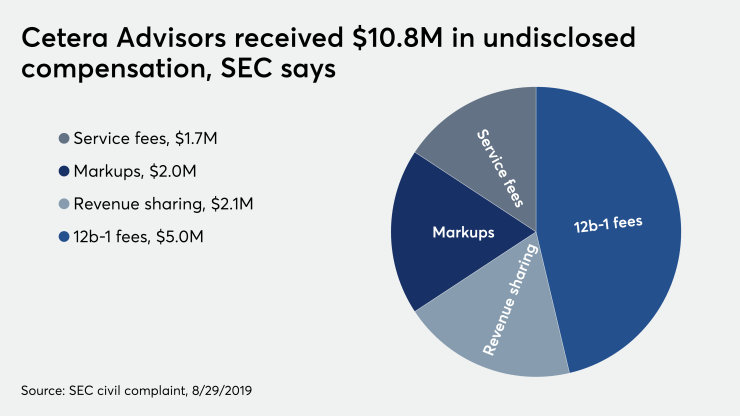

Cetera Financial Group’s second largest independent broker-dealer failed to disclose conflicts of interest relating to $10.8 million in compensation from mutual funds and its clearing broker, Pershing, over five and ½ years, the SEC

The regulator filed a civil case in the U.S. District Court for Colorado, alleging that Denver-based Cetera IBD acted negligently in failing to disclose 12b-1 fees, revenue sharing, service fees and markups. The case seeks disgorgement of ill-gotten gains plus interest, as well as civil penalties.

Nearly 80 firms

Over multiple time spans between 2012 and 2018, Cetera Advisors failed to adequately disclose that it invested and held client assets in higher-priced mutual fund share classes, hit them with markups of up to 300% and received $1.7 million in service fees, the SEC says.

“Cetera owes its advisory clients a fiduciary duty to act in its clients’ best interests and to fully disclose all material facts about the advisory relationship, including disclosing any conflicts of interest that might cause Cetera to put its own interests before those of its clients,”

Representatives for the five-firm Cetera IBD network — which generated $1.88 billion in revenue in 2018, including $367.4 million by Cetera Advisors — said the firm doesn’t comment on legal matters. Representatives for Pershing also declined to comment.

Just as in the revenue sharing disclosure case the SEC filed earlier this month against

For example, Cetera Advisors clients paid markups of $70 and $100 above Pershing’s outgoing transfer fee of $25 during respective five- and eight-month spans under Schedule A of the firms’ clearing agreement, according to the complaint.

Through one of two September 2014 administrative service agreements with Pershing, the IBD took in 25% of the service fees the clearing firm received from certain mutual funds — plus $4 per “eligible position” each year — for performing tasks like “handling client inquiries, maintaining client accounts, and trade correction processing,” the complaint states.

The firm and its roughly 1,000 advisors also amassed $5 million in 12b-1 fees of 15 to 25 basis points for distribution and shareholder service expenses between September 2012 and December 2016, according to the SEC.

“In investing and holding client assets in higher [priced] share classes, Cetera was, at least, negligent,” the complaint says, adding that the company was “failing to exercise the care that a reasonable investment adviser would use in making a client investment.”

Cetera Advisors then misled clients about these 12b-1 fees in its required Form ADV brochure, according to the regulator. For nearly three years, the firm pledged to mitigate the conflict by monitoring advisors “to ensure that the products and services they offer to you are appropriate for your specific situation,” the complaint states.

In fact, the firm violated its fiduciary duty to clients because its reviews of mutual fund sales covered only their “general suitability,” the complaint says. The monitoring didn’t include any judgment of whether advisors recommended the most favorable share class, the SEC says.

To be sure, FINRA and the SEC frequently ding firms over mutual fund fees, to the tune of

Enforcement appears to be entering a new phase in which firms fight the SEC’s lawsuits in court ahead of

“The Form ADV and associated firm brochures,” according to the Cetera Advisors complaint, “are designed to provide adequate disclosure to advisory clients so that they can understand the firm they are hiring to manage their investments and what economic incentives in the firm’s business model might influence the firm’s decision-making on the client’s behalf.”