A

Commonwealth Financial Network’s RIA failed to disclose conflicts of interest related to more than $100 million in revenue sharing from mutual funds over 4 and ½ years, the regulator

The latest one involves the nation’s fourth largest independent broker-dealer

The SEC's settlements with Commonwealth and 78 other RIA affiliates of broker-dealers had prompted the firm to

Commonwealth “has not adopted a reasonably designed, and enforced, written policy for identifying material conflicts of interest,” according to the SEC’s civil complaint, which it filed in the U.S. District Court in Massachusetts.

The complaint also alleges Commonwealth hasn’t implemented policies and procedures designed to prevent violations of the Advisers Act and its own rules around “ensuring the disclosure of ‘any form of compensation,’ including the revenue sharing arrangement with NFS.”

Commonwealth has built a reputation for

“While the enforcement action proposed by the [SEC] is a pending legal matter, Commonwealth Financial Network vehemently denies the allegations and believes they are categorically without merit,” Marchand said. “We are confident we have operated both appropriately and justly and will vigorously defend our actions in this matter.”

-

With transparency about conflicts on the rise even as it varies by firm, critics question whether clients really understand complicated technical documents.

May 30 -

The rarely dinged firm joined peers grappling with two issues: mutual fund fees and supervision of advisors who've been sanctioned multiple times.

December 6 -

The RIA divisions of Raymond James and RBC are also among the companies that self-reported.

March 11

Mainstays of the sector like Commonwealth, Cambridge and Northwestern Mutual are contributing to it, but smaller firms are also driving change.

The SEC listed the Fidelity NFS unit — which has some 200 broker-dealer clients — as a relevant entity rather than as a defendant. The custodian and clearing firm declined to comment on the case.

NFS and Commonwealth share a portion of the recurring fees NFS collected from mutual funds in exchange for access to Commonwealth’s $80-billion asset Preferred Portfolio Services advisory program, according to the complaint. Such arrangements are common among BDs.

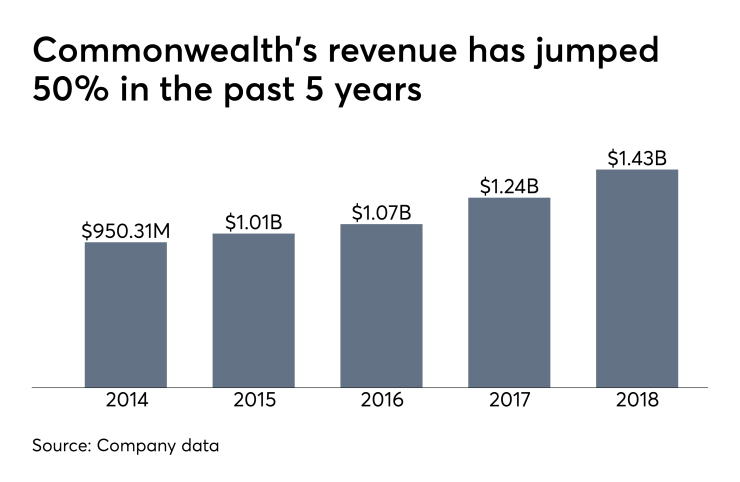

BD-affiliated advisors don’t receive any part of the revenue-sharing payments at Commonwealth or other firms. However, between July 2014 and December 2018, Commonwealth didn’t fully spell out to clients how the firm stood to benefit from their mutual fund investments, the SEC says.

The firm failed to explain its vested interest in making recommendations among the various share classes of mutual funds, according to the SEC. Even an amended Form ADV disclosure about no-transaction-fee funds in March 2017 “was still deficient and misleading,” the regulator says.

“Commonwealth described the conflict as merely ‘potential’ and acknowledged only that Commonwealth ‘may’ have incentives to select more expensive investments based on its compensation,” the complaint states. “In reality, Commonwealth had an actual conflict that did create those incentives.”

In addition, the complaint continues, the firm didn’t state it had an incentive to place clients in higher-cost share classes that came with greater revenue sharing. Among funds that did have transaction fees, Commonwealth failed to disclose any revenue sharing, according to the SEC.

The case also outlines the differences in expenses relating to some sample share classes, noting that some no-transaction-fee products came with higher internal costs that benefited Commonwealth. The firm failed to disclose this conflict, according to the complaint.

It wasn’t immediately clear whether the revenue-sharing investigation stemmed from information Commonwealth provided to the regulator under the RIA self-reporting program. Representatives for the SEC declined to comment beyond the complaint and a press release

Tolley, the Commonwealth CCO, said on a panel at

“The reality is that we need to disclose that information,” Tolley said in the panel on conflicts of interest. The firm is “going to err in the most extreme way” on the side of spelling them out, he added.