-

Advisers might want to steer their practices away from doctors and toward millennials.

February 23 -

Changes can substantially reduce the value of delaying widow(er) benefits for surviving spouses.

February 21 -

Retirees who earned at least 40 work credits are entitled to Medicare Part A and can pay for Part B through their Social Security checks.

February 17 -

From a tax perspective, donating required minimum distributions from a traditional IRA to a qualified charity is a smart move for retirees.

February 10 -

Small businesses would not be allowed to enroll their employees automatically in state-run plans under legislation introduced in Congress.

February 9 -

Investors need to increase their allocation to stocks and other riskier investments to get the portfolio return that they need to secure their retirement.

February 7 -

Clients can fully deduct their IRA contributions if they have no access to a workplace retirement plan.

February 6 -

People are saving more money for retirement and setting up more retirement accounts, with fewer savers borrowing from their funds, according to author Dan Kadlec.

February 3 -

There are some situations where delaying is neither feasible nor prudent. Here’s how to weigh them.

February 2 -

Retirees on Social Security can expect the government to garnish a portion of their benefits if they fail to make student loan payments.

January 31 -

First-time home buyers can withdraw as much as $10,000 from a Roth account without paying taxes and penalties if the account is at least five years old.

January 26 -

The move to reintroduce legislation that seeks to adjust the cap on Social Security wages and to raise the payroll tax is a step in the right direction in fixing the program's solvency woes, says expert.

January 25 -

More retirees are expected to join the gig economy and go on trips that offer unique experiences.

January 24 -

Clients can end up with $1 million in retirement by saving $298 every month and maintain an investment portfolio consisting of stocks, corporate bonds and municipal bonds.

January 23 -

For years, it seemed that a decline in monthly benefits was a long way off. Now it may be sooner than expected. Here’s what advisers need to know.

January 23 -

Your late clients' surviving spouses or children are entitled to a $255 lump-sum death benefit, as long as they meet these requirements.

January 18 -

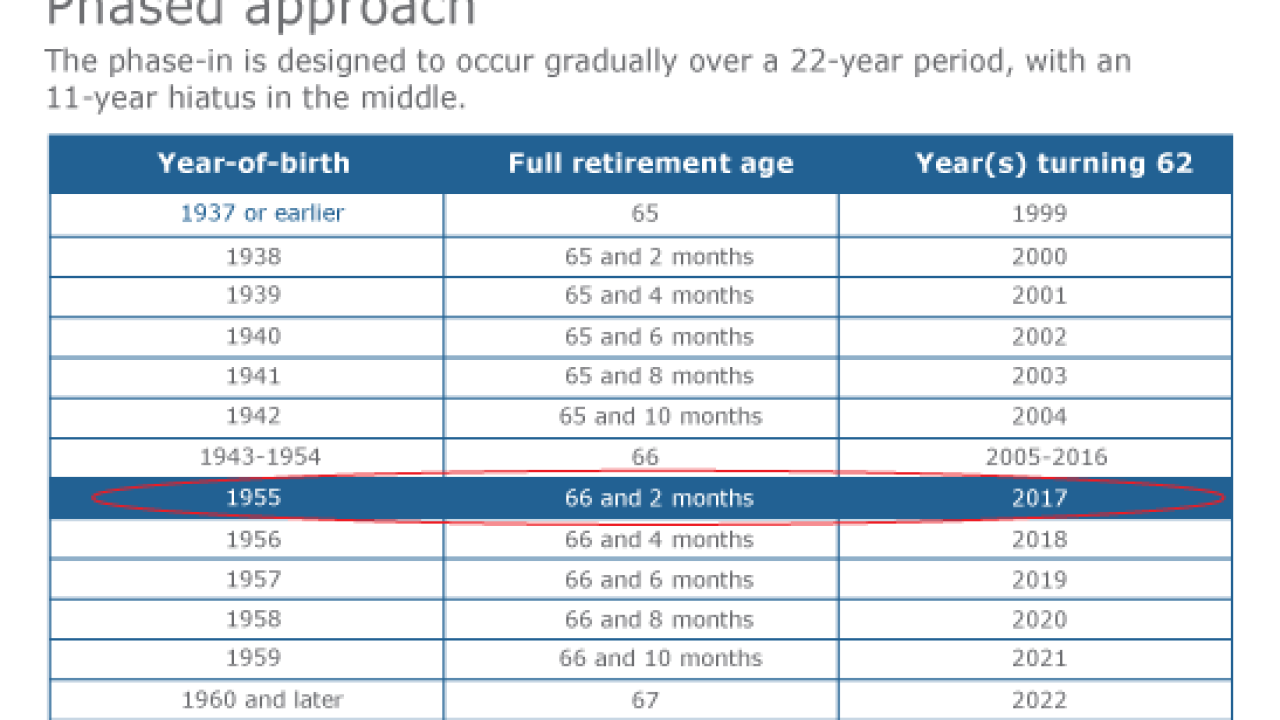

79% of people supported raising the full retirement age to 68 from 67, according to a survey from the University of Maryland, which could reduce benefits even for those who wait until 70 to retire.

January 17 -

Clients are likely to overlook the possibility of portfolio failure, unexpected financial responsibility and health issues.

January 13 -

While some experts recommend annuitizing at least 25% of savings to generate guaranteed income in retirement, clients should weigh other options before making a decision.

January 12 -

With the full retirement age increased, the advantages of waiting until age 70 have been somewhat diminished.

January 6