-

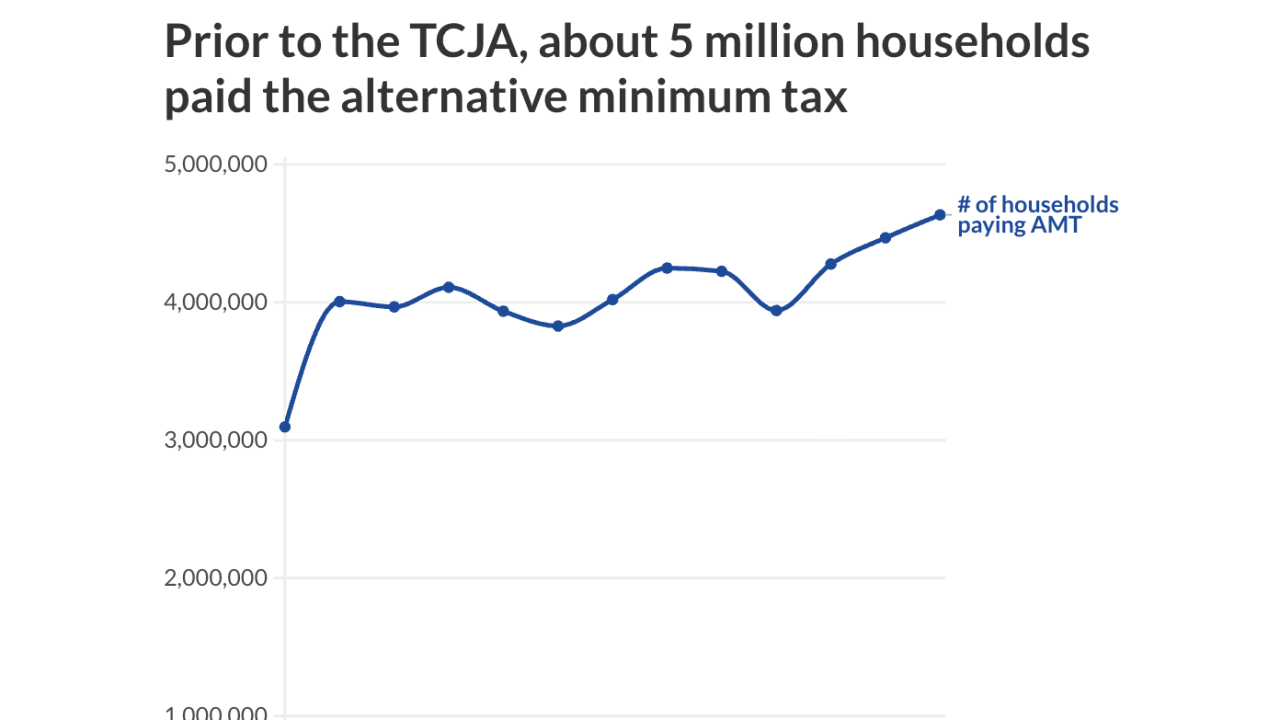

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

The massive law filled in some important answers for financial advisors and tax pros' many questions coming into the year. Here's a roundup of FP's coverage.

October 3 -

It's time to revisit the $10,000 cap considering a new $40,000 limitation under the OBBBA.

September 30 University of Colorado Boulder

University of Colorado Boulder -

The use of multiple entities as a means of shifting a high net worth client's yearly income could help rack up bigger breaks, with some caveats.

August 25 -

A new study predicts the One Big Beautiful Bill Act will reduce federal taxes on average for individual taxpayers in every state, but the impact will differ.

August 13 -

The One Big Beautiful Bill Act presents some complexities for wealthy families, alongside its extension and expansion of provisions in the Tax Cuts and Jobs Act.

July 30 -

Republicans will be planning a victory lap and Democrats will be thinking about their election strategy. But financial advisors and tax pros will be preparing their clients.

July 3 -

Areas around Jackson Hole, Aspen, Palm Beach, Miami, New York, Dallas and Austin are in the group. Other top performers may come as more of a surprise.

May 29 -

When a company considers adding new jobs or making new investments, many state and local authorities offer tax incentives to support that growth.

May 28 McGuire Sponsel

McGuire Sponsel -

The headache of filing dozens of state or international returns due to the so-called jock tax comes with opportunities to tap into savings, experts say.

April 23 -

Retirement savings can stretch further in some states than others, but retirees don't appear to care much about that fact, data shows.

March 24 -

Financial advisors and their clients will need to prepare for many possible outcomes by focusing on the key themes around these eight TCJA policy issues.

March 4 -

President Trump and his Republican allies in Congress aim to extend the expiring provisions of the Tax Cuts and Jobs Act. But they'll need to fill in a lot of details first.

March 4 -

Every state levies property taxes, but some states have high or complex property tax structures, making them less competitive.

January 7 -

The No. 1 state effectively charges 1.88% on the value of a residence, according to a realty firm's analysis of a frequent and growing concern among clients.

December 30 -

From those with no corporate tax at all, to those that tax everything they can — a guide to most and least competitive states when it comes to taxing businesses.

December 12 -

States that do not assess the major taxes are more competitive than states with complex taxes with high rates.

December 2 -

There are ways the business owners can continue to operate in the other states.

November 21 CorpNet.com

CorpNet.com -

The top state has a total tax burden of 12.02%.

July 31 -

Middle-class residents in these states pay a smaller percentage of their paychecks to taxes.

June 25