-

Advisors must be attuned to the emotional factors at play, since no two clients have the same relationship with money.

March 8 Arrowroot Family Office

Arrowroot Family Office -

President Joe Biden proposed tax increases on the wealthy and large corporations, along with some new tax credits, in his State of the Union address on Thursday night.

March 8 -

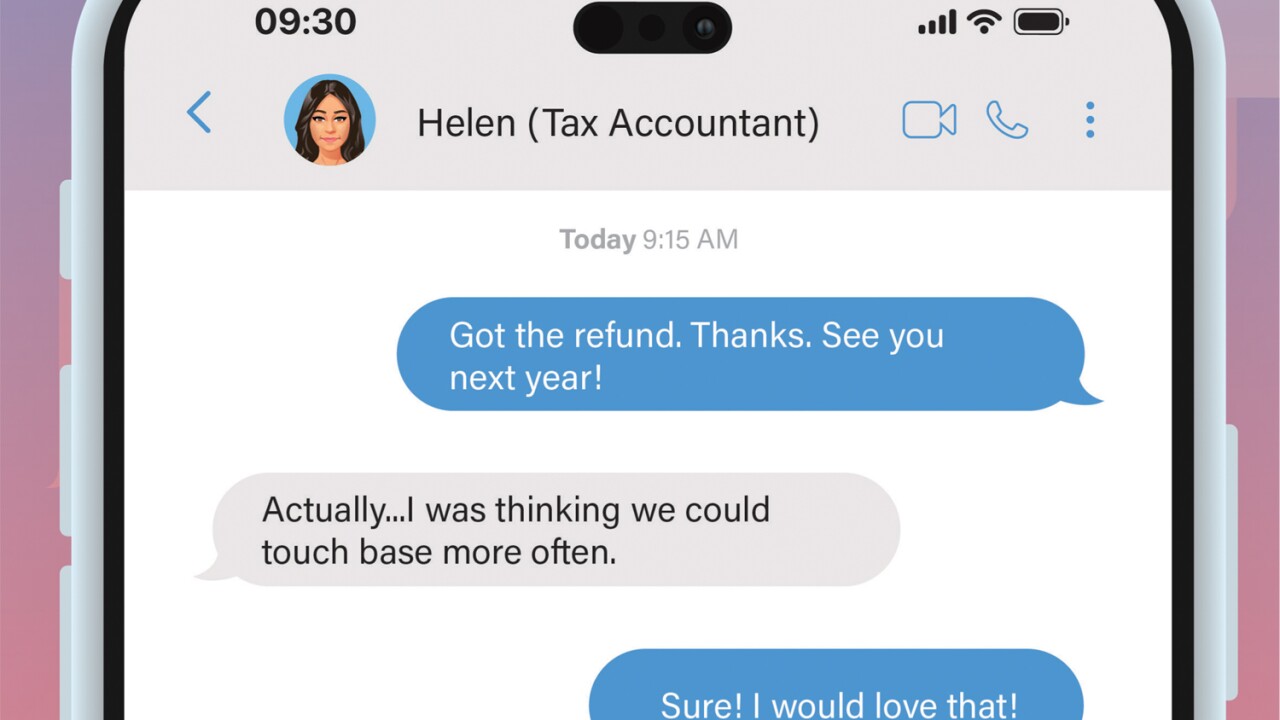

With wealth and accounting firms increasingly working together, a seasoned expert from both fields describes the key issues ahead of Tax Day.

-

Here's how some financial advisors have offered the two services for decades and why the rest of the industry may finally be catching on to the opportunity.

March 5 -

There's a growing sense of unease among asset managers that companies with conspicuously small tax bills pose a financial liability too big to ignore.

March 4 -

The 20% deduction for the qualified income of pass-through entities has strong supporters and critics. Here's how tax experts say it could play out if made permanent.

February 23 -

The report casts a skeptical eye on the PPLI industry, claiming it functions as a tax shelter for a few thousand millionaires and billionaires.

February 21 -

Parents can leverage their wealth to access the dream of homeownership for their kids — as long as income tax and gift tax consequences are factored in.

February 7 American College of Financial Services

American College of Financial Services -

The measure now heads to the Senate where lackluster Republican support threatens to sink it.

February 1 -

From knowing your demographics to understanding RMDs, these are some of the best opportunities for tax planners to demonstrate their value to clients this year.

January 30 -

Financial advisors and tax professionals with clients who bet online or at casinos must guide them through the choice of classifying as amateur or professional.

January 29 -

The revamped Estate Snapshot tool promises to create estate planning documents in minutes rather than days through artificial intelligence.

January 24 -

The 2024 T3/Inside Information survey on the tools and tech advisors use has landed. Here's what you need to know.

January 24 -

Many financial planners have yet to incorporate crucial documents like wills and trusts into their service offerings — a potentially costly mistake, writes the CEO of a wealthtech platform.

January 23 Wealth.com

Wealth.com -

As tax-friendly as the rules are for HSA funds during an individual's lifetime, they can become much more punitive for funds left over after the original account owner dies.

January 18 -

The Internal Revenue Service provided initial guidance to aid employers in establishing pension-linked emergency savings accounts, an outgrowth of the wide-ranging SECURE 2.0 Act of 2022.

January 15 -

From estate, gift and trust work to Social Security maximization and charitable planning, there are a host of offerings firms can work on once the tax return is finished.

January 9 -

Asking the right questions early on can help a planner identify gaps in an emerging estate plan and uncover opportunities for clients down the road.

January 9 LJW Wealth Management of Raymond James

LJW Wealth Management of Raymond James -

Practitioners have always shared advice as part of tax prep, but the future of the field is in proactive, intentional tax advisory services.

January 8 -

Financial advisors, tax professionals and their customers can recoup 30% of the cost through credits for qualified upgrades to their residences.

January 8