-

There are still several moves that clients can make to reduce their 2018 tax bill.

April 1 -

Errors are regrettably common. They are also easily avoidable.

April 1 -

New innovations increase participation by making it easier to save and invest for retirement, an expert says.

March 28 -

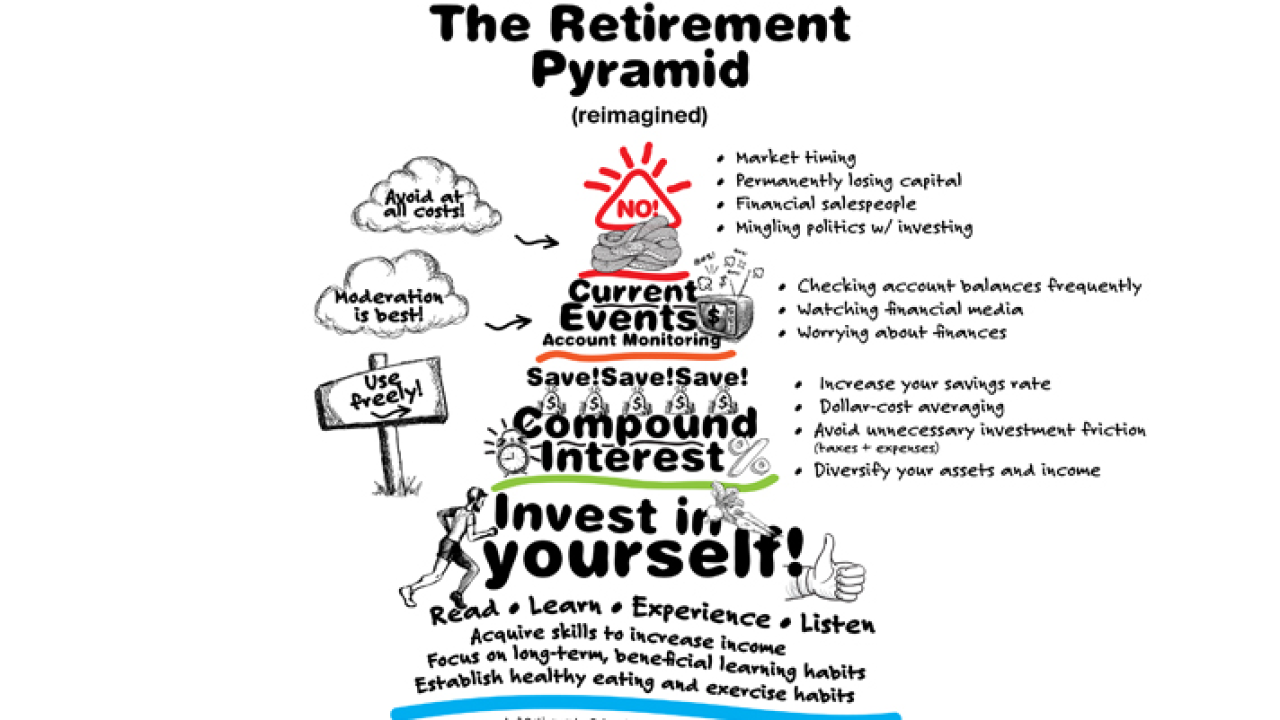

This interactive tool challenges conventional wisdom about planning for retirement and offers a smart and streamlined way to plan for your future.

-

The Treasury and IRS are lowering the withholding underpayment threshold to 80%.

March 26 -

More than 130 survivors of a devastating California wildfire have received pro bono planning services that helped them begin to reassemble their lives.

March 20 -

Should advisor retention go as planned, Blucora's agreement to purchase the firm would boost its IBD headcount to 4,500 reps.

March 19 -

The regulator is looking into whether brokers made appropriate share class recommendations for the plans as a result of the new law.

March 19 -

The tax law has made deducting philanthropic contributions more difficult, but there are ways to help clients reap benefits from their generosity.

March 19 -

The U.S. is one of the few countries that doesn’t have paid family leave, and it can cause families hardship around the time of a birth, says an expert.

March 14