After a series of dramatic changes, the largest tax-focused independent broker-dealer’s parent firm surprised the sector with a much more unexpected move.

HD Vest Financial Services' parent Blucora agreed to purchase 1st Global for $180 million, the firms

Both parties agreed to a stock purchase, which Blucora intends to finance with cash and an add-on of $125 million to its credit facility. They expect the deal to close next quarter, pending FINRA approval. 1st Global advisors would move the new Blucora wealth management entity in nine to 12 months.

Dallas-based 1st Global and Irving, Texas-based HD Vest both have headquarters located in the DFW Metroplex and emphasize tax-focused wealth management. However, the seller works primarily with large, multi-partner accounting firms while HD Vest typically converts individual CPAs and enrolled agents into full-scale advisors.

“We had both a shared culture and an aligned vision and were pulling in the same direction, and we had very complementary business models,” HD Vest interim CEO Todd Mackay says. The multi-partner firm focus at 1st Global will allow Blucora “to really be the leader and dominant player in tax-focused financial planning,” he adds.

1st Global didn’t immediately respond to requests for comment on the deal. The firm sees Blucora as the “ideal acquirer for us” because of the similarities between the firms, its strong business model and execution on its strategy, CEO Tony Batman said in a statement.

“We know that Blucora shares our vision and that together we are better and stronger with the shared talent and expertise of the two businesses,” Batman said. “This will provide our advisors and their clients with even greater service, support and solutions for years to come.”

-

The tax-focused IBD is betting on a switch to Fidelity and Envestnet while undergoing a cultural shift.

September 13 -

The executive must attend to a close family member who has recently learned of significant health challenges, a spokeswoman says.

October 31 -

The tax-focused IBD’s custodial and platform transition is taking longer than the company or its advisors expected.

February 14

Firms’ head counts show how they’re responding to a challenging time in which experts predict the number of advisors to fall in coming years.

Mackay declines to comment on whether the acquirer will offer 1st Global advisors retention bonuses, and he says the firm is still working through the details on whether the deal will require repapering of client assets. The firms also both use Fidelity’s National Financial Services as a custodian and Envestnet as their main trading platform.

Hours after the announcement and publication of Financial Planning's story, representatives for HD Vest said the new combined firm would have a new name after the 1st Global advisors have transitioned. Blucora, which also owns the tax preparation software firm TaxAct, hasn't yet picked a name for the IBD under its wealth management unit.

Some 850 advisors from 1st Global will bring $18 billion in client assets, half of which are fee-based advisory accounts, according to Blucora. The transaction would also add between $23 million and $24 million in run-rate adjusted EBIDTA by the end of the year, Blucora says.

The deal comes about six months after HD Vest CEO Bob Oros

The No. 19 IBD had carried out an array of shifts being undertaken by several firms near its size. In the

HD Vest trimmed its headcount by 20% — or 879 advisors — in the last two years to 3,593 advisors as it

The acquisition would boost HD Vest’s thinned headcount to 4,500 advisors with about $60 billion in total client assets. In a call with analysts, Blucora CEO John Clendening called the multiple of roughly 7.5x 1st Global’s estimated EBITDA for 2019 an attractive price.

“We believe that the fact that this is a consolidating, scale-building acquisition with geographic and vendor overlap, lowers the relative risk of the transaction and should make integration, cost savings and synergies easier to achieve,” Clendening said in prepared remarks.

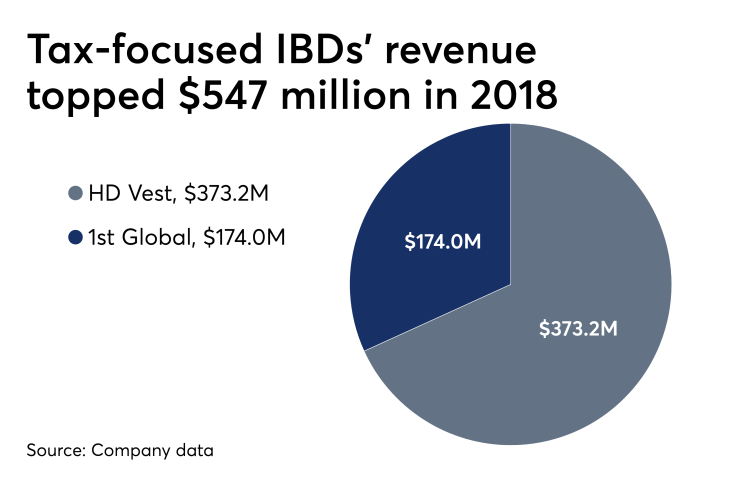

He also noted that HD Vest’s client assets were only 30% advisory at the end of the year, compared to half at 1st Global. The selling firm also generated 65% of its revenue from fee-based accounts in 2018, CFO Davinder Athwal noted.

Acknowledging that he is the interim CEO after replacing Oros late last year, Mackay declines further comment beyond prior public statements regarding the search. HD Vest expects any disruption to advisors’ practices at the two firms to be “extremely limited or muted” under the deal because of their Fidelity and Envestnet relationships, he says.

“We feel that both groups have tremendously strong advisors … that have customer care in mind at the utmost and believe in delivering value to their end clients,” Mackay says. “We're looking to help accelerate that promise.”