-

There are drawbacks to a new law designed to help disaster victims access their retirement funds early without penalty.

October 31 -

Taxpayers face a penalty known as an individual shared responsibility payment if they do not comply, IRS says.

October 30 -

Experts say 18-to-36-year-olds should take advantage of workplace 401(k) and Roth IRA tax benefits now and shop around for the best savings rates later.

October 30 -

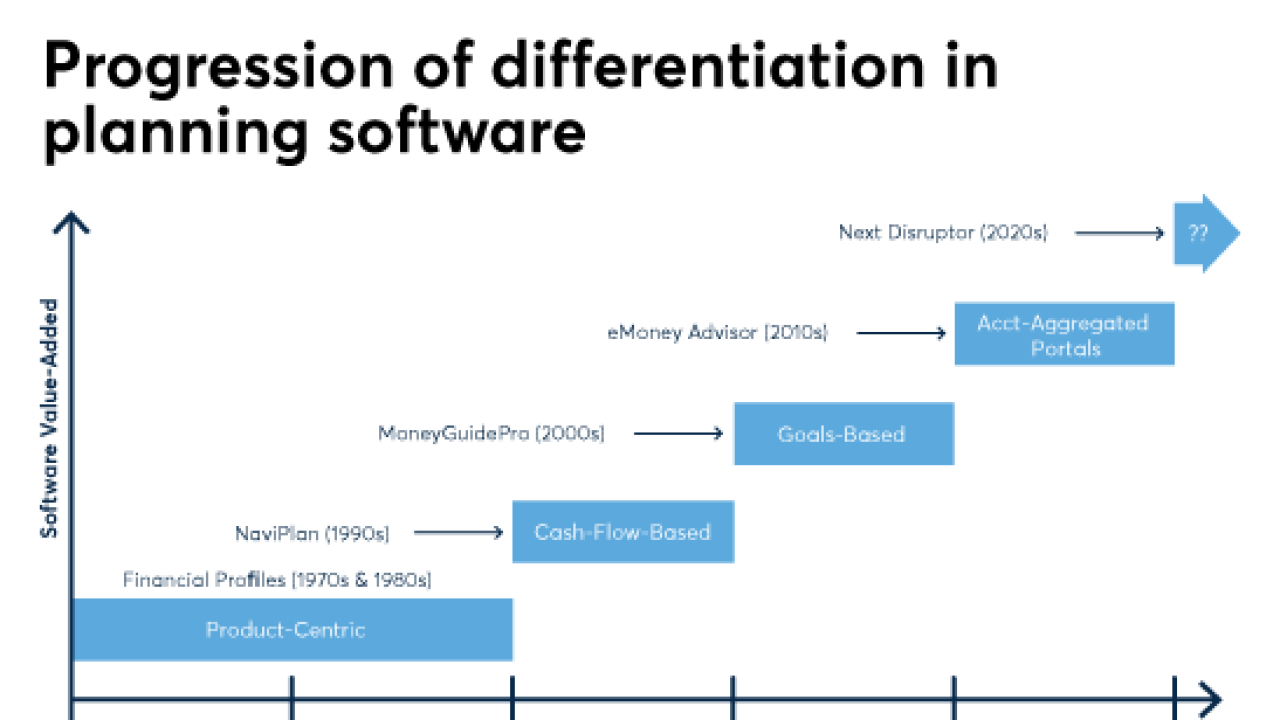

New solutions offer plenty of features but lack focus.

October 30 -

Schwab’s nonprofit arm and many firms allow advisors to serve clients while helping charities.

October 25 -

Five ways to build a successful charitable planning practice.

October 24 CEG Worldwide

CEG Worldwide -

The number of health savings accounts has increased 16% over the past year, and assets now exceed $40 billion.

October 24 -

The federal exemption does not cancel out key planning matters affecting everyone at death.

October 24 -

Clients could save significant money when they need it most.

October 23 Thomson Reuters Checkpoint

Thomson Reuters Checkpoint -

The increasingly popular tactic can save business owners hundreds of thousands of dollars in taxes.

October 20