-

A tweak to the deductibility of gambling losses may not bring in a lot of tax revenue, but it could certainly alter a lot of wagers next year.

December 1 -

In Notice 2025-69, the IRS and the Treasury offer clarifications and examples of how to claim the One Big Beautiful Bill Act deductions.

November 24 -

Generation Z is favoring Roth accounts like no generation before, new Fidelity research shows. Here's why younger investors are betting on post-tax retirement savings.

November 20 -

The integration eliminates the need for a third-party intermediary between the two platforms, allowing for a direct connection between financial planning and tax, estate and insurance data.

November 18 -

Quant firm Dimensional Fund Advisors has received formal approval to adopt a fund structure that for two decades has been used exclusively by Vanguard.

November 18 -

Borrowers who receive discharges of their student debt under the Income-Driven Repayment program could be facing tax bills as high as $10,000 next year.

November 13 -

The Internal Revenue Service increased the annual retirement plan contribution limits for 2026 thanks to cost-of-living adjustments for inflation.

November 13 -

The higher standard deduction since 2017 has dramatically reduced itemization. But the new law provides incentive for teachers to consider whether that's feasible.

November 12 -

Political instability and other pressures are feeding some clients' portfolio fears, advisors say in this month's Financial Advisor Confidence Outlook.

November 12 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 10 -

The Internal Revenue Service has shut down its Direct File free tax-filing program, sending an email to the 25 states that offered it this year.

November 6 -

Across more than two years of advisor surveys, industry worries have evolved dramatically. Yet certain themes continue to capture attention.

October 31 -

Voters in 20 states will be asked to weigh in on ballot referendums and measures concerning an estimated total of $3.1 billion in potential tax hikes.

October 30 -

The choice of buyer and the price get the most attention, but a possible merger of equals and the technology side of the transition could loom large in the strategy.

October 27 -

Nearly half of advisors are considering adding this service, according to the Financial Planning's October Financial Advisor Confidence Outlook.

October 27 -

The challenge bedevils many heirs' property owners. Here's why experts say it's such a threat and how financial professionals can help guide families through it.

October 23 -

How charitably inclined taxpayers can use donor-advised funds and other tax strategies to get ahead of the OBBBA's revised rules on charitable deductions.

October 23 Natixis Investment Managers Solutions

Natixis Investment Managers Solutions -

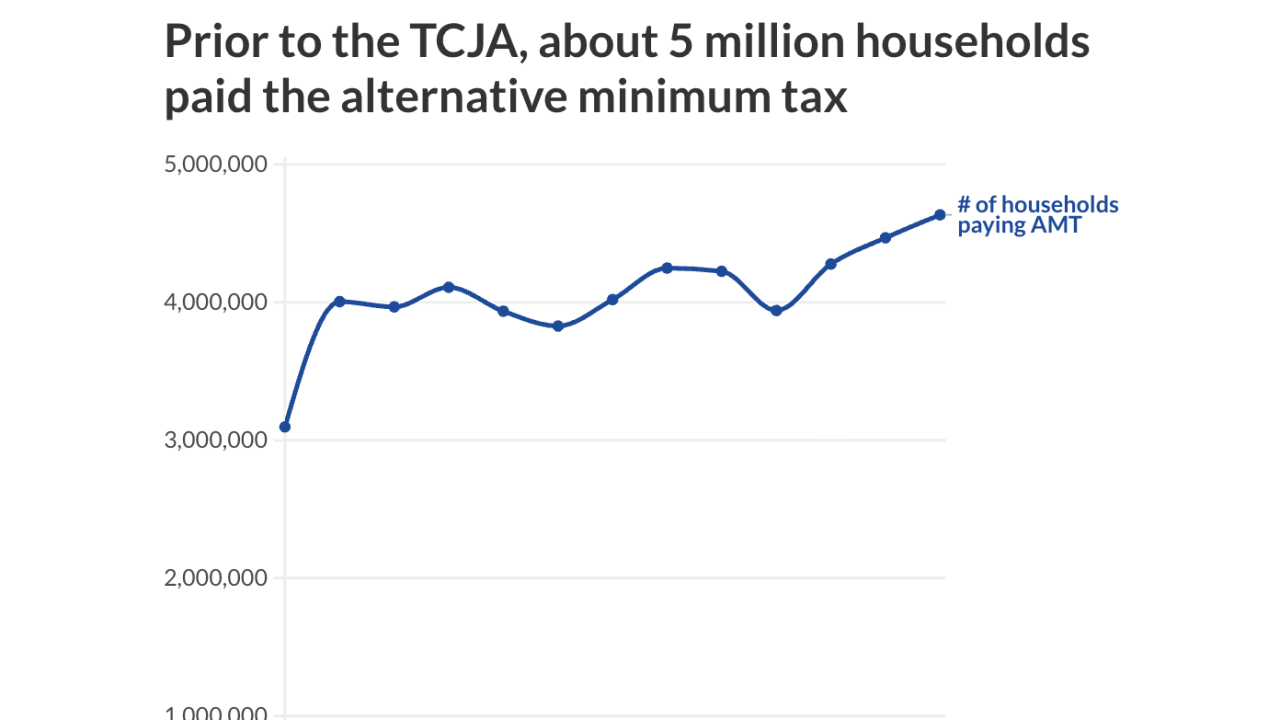

The One Big Beautiful Bill Act will boost the number of filers who must calculate their AMT. But that doesn't mean they're all going to have to pay it.

October 20 -

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

A clear division is emerging between smaller independent RIAs and their larger billion-dollar competitors, as some firms aggressively pursue a "one-stop shop" model for their clientele.

October 17