-

Stocks plummet the most in six weeks as investors shift focus from Fed to China.

March 22 -

The fund took in 100 times its average weekly amount after the latest jobs and wage data showed tepid inflation growth.

March 20 -

Anticipating volatility and its implications could make a big difference.

February 22 -

The offerings saw decent demand, given the market is facing a deluge of sales following the recent U.S. debt ceiling suspension.

February 21 -

Even core investments in developing nations reflect the firm’s conviction that Fed hikes are about to wreak havoc across markets.

February 9 -

The last time the industry’s largest ETF experienced redemptions close to this pace was before the financial crisis.

February 7 -

The major indexes are now down for the year.

February 5 -

The largest ETFs that track the two asset classes posted about $3.1 billion of withdrawals last week.

February 5 -

It’s the biggest plunge in equities since June 2016.

February 2 -

The index rose more than 300 points, reaching its highest close ever.

January 17 -

Stocks rallied around the world on signs the global economic expansion that pushed benchmarks to records in 2017 remains intact.

January 4 -

Three popular debt ETFs reported nearly $1.4 billion in combined outflows this week.

December 8 -

After the tech bubble and the 2008 financial crisis, the younger generation has little reason to trust the markets.

October 30 -

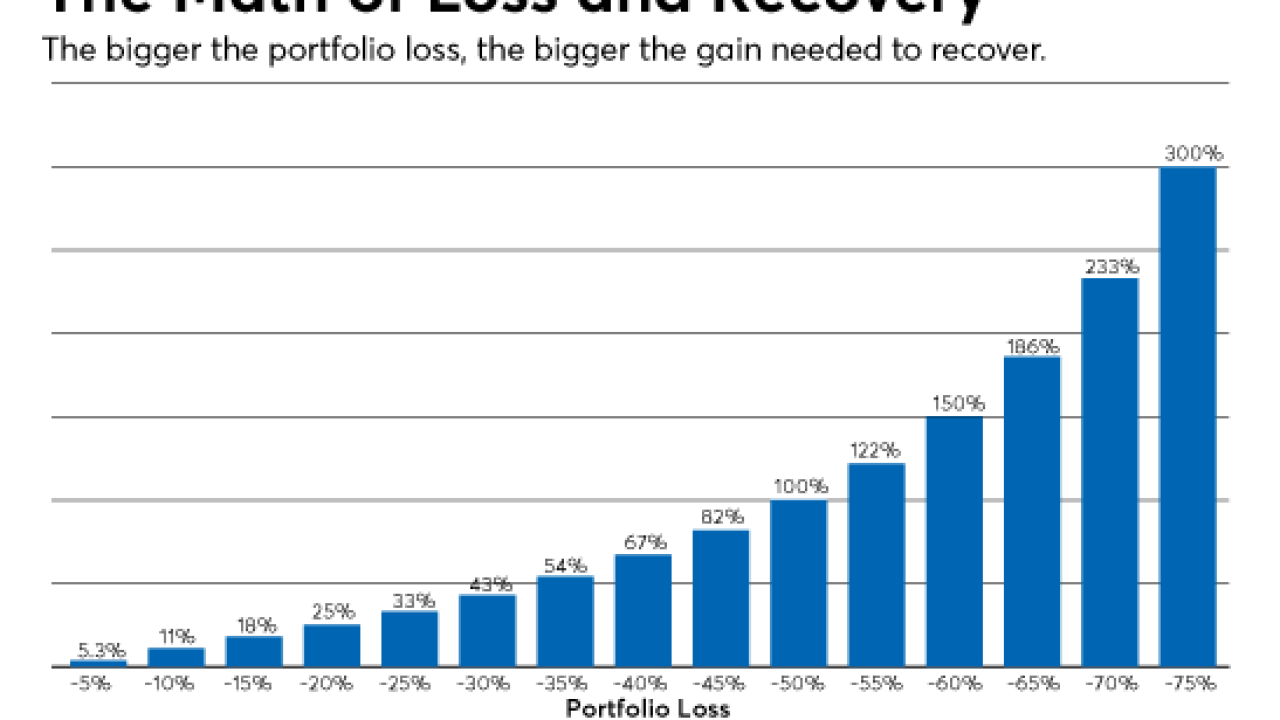

Clients — even some advisors — overreact to market losses. Are they on to something?

October 20 -

Even though they have posted positive returns, debt and equities markets have been moving in opposite directions for the better part of two decades.

June 30 -

Buying behavior may reflect underlying imbalances and mismatches between desired holdings and what’s available to purchase.

June 15 -

June, July, and August are projected to reach new highs, generating more than $100 billion of proceeds from called and maturing bonds.

May 31 -

A typical fund with an expense ratio of 0.75% will set a young investor back by nearly a half million dollars over the span of 40 years; plus, the portfolio strategy your clients need before and during retirement.

May 13