Toby is a veteran journalist with more than a dozen years of experience in the field who joined Financial Planning in 2017 after prior tenures with the New York Daily News, Commercial Observer and City Limits. He earned an undergraduate degree in the humanities from the University of Texas at Austin and a master's degree in journalism from the Craig Newmark Graduate School of Journalism at the City University of New York. He has won a dozen business journalism awards during his time with Financial Planning, including those received for the 2020 podcast series "

-

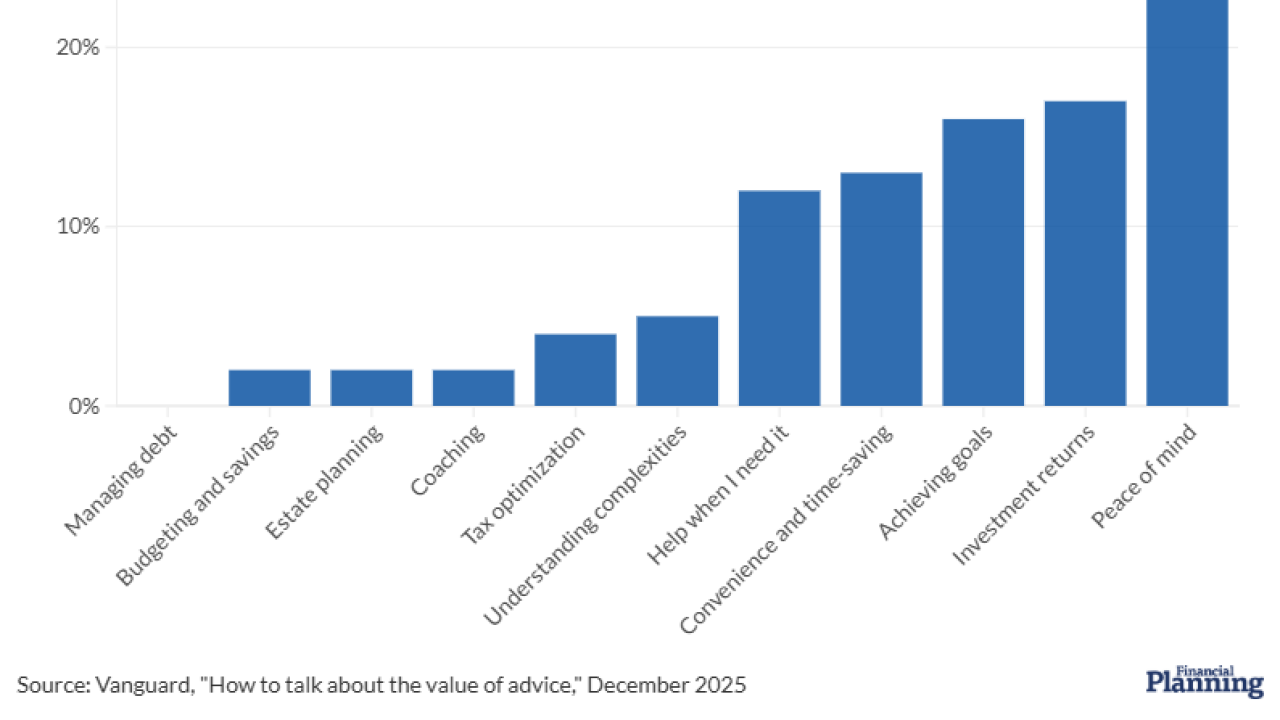

Vanguard's latest poll and analysis offers a multifaceted explanation into how financial advisors should talk about their value to clients and prospective customers.

January 8 -

Fewer U.S. adults have non-retirement investment accounts than three years earlier, and many retail investors struggle with understanding fees and fraud risk.

January 7 -

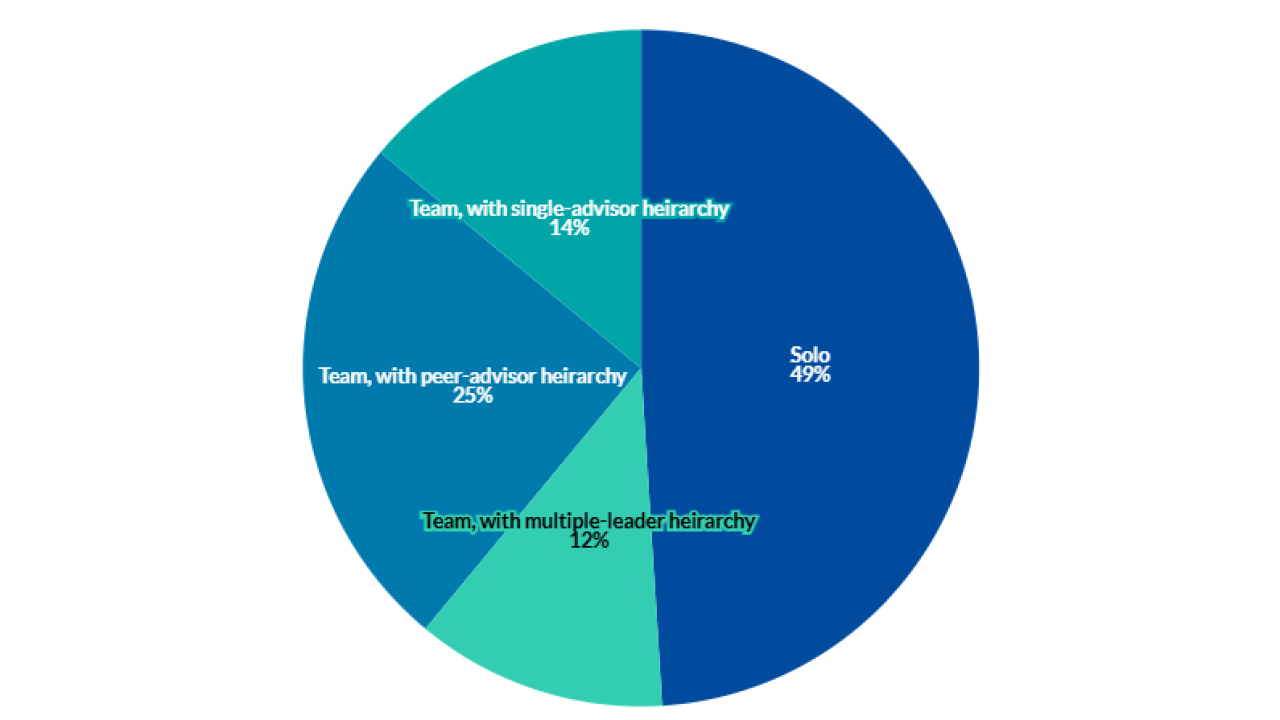

Logic (and compelling Cerulli Associates data) explain why advisor teams are gaining momentum. But teaming is not the only option for growth.

January 6 -

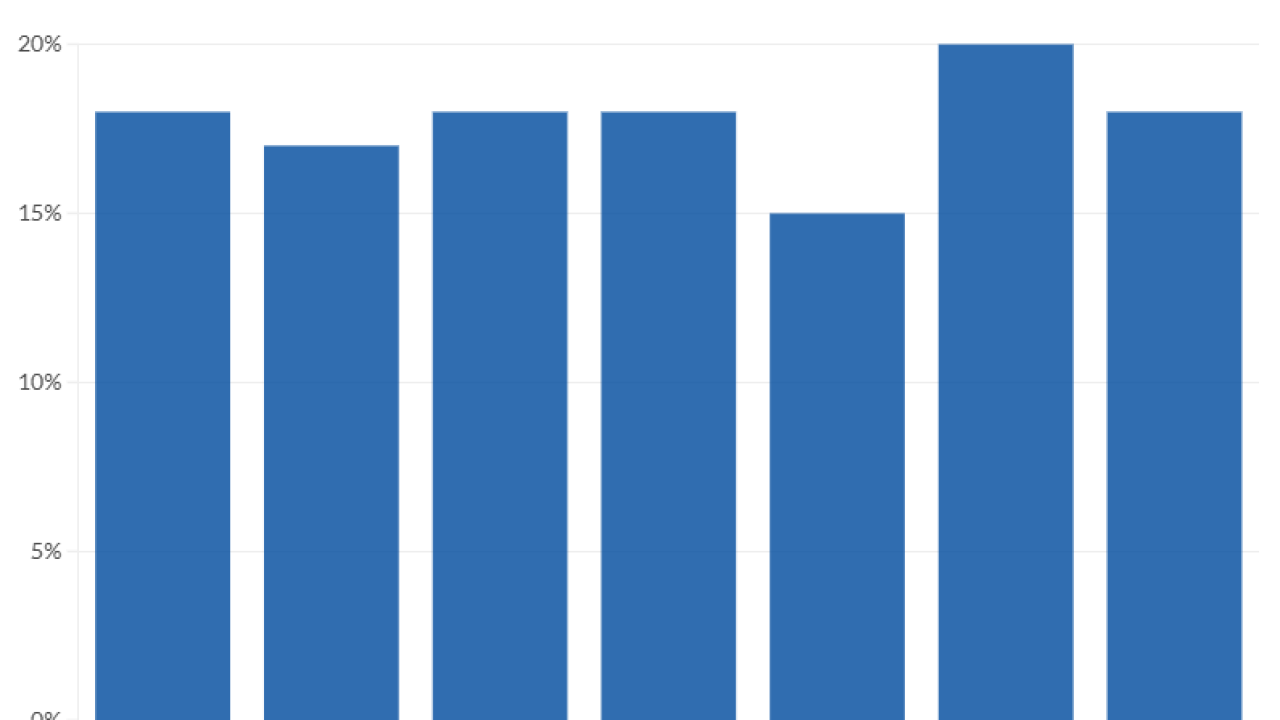

Getting away from the office to create or revise a firm's concrete goals and teammates' roles can help RIAs tap into organic growth, experts say.

January 5 -

Fixed-income represented a surprising bright spot in 2025, despite the warnings of "bond vigilantes" and inflation pressure. Here's the outlook for 2026.

December 30 -

Mary Kate Gulick's case was dismissed with prejudice, a year after the case's allegations against a major RIA drew significant attention across the industry.

December 29 -

Financial advisors and their clients have a range of options to consider for traditional IRA holdings — but also a finite deadline.

December 29 -

Independent research firm Morningstar's latest study of the value of financial advice examines tax-efficient IRA asset location during the decumulation phase.

December 18 -

President Trump's signature tax law drew the most headlines, but FP covered the "T" intersection with wealth management from many angles.

December 17 -

Founders Elissa Buie and Dave Yeske are leaving a legacy in the profession and at the firm under three successors taking over in 2026.

December 16 -

An increasingly popular form of lending enables financial advisors and their clients to offset capital gains and find other tax savings.

December 15 -

Steve Lockshin and Michael Kitces tied what they view as some mistaken assumptions around fees to the competitive need for more estate planning services.

December 11 -

Consolidation has been ongoing for more than a decade in wealth management, but it accelerated to unprecedented levels this year.

December 10 -

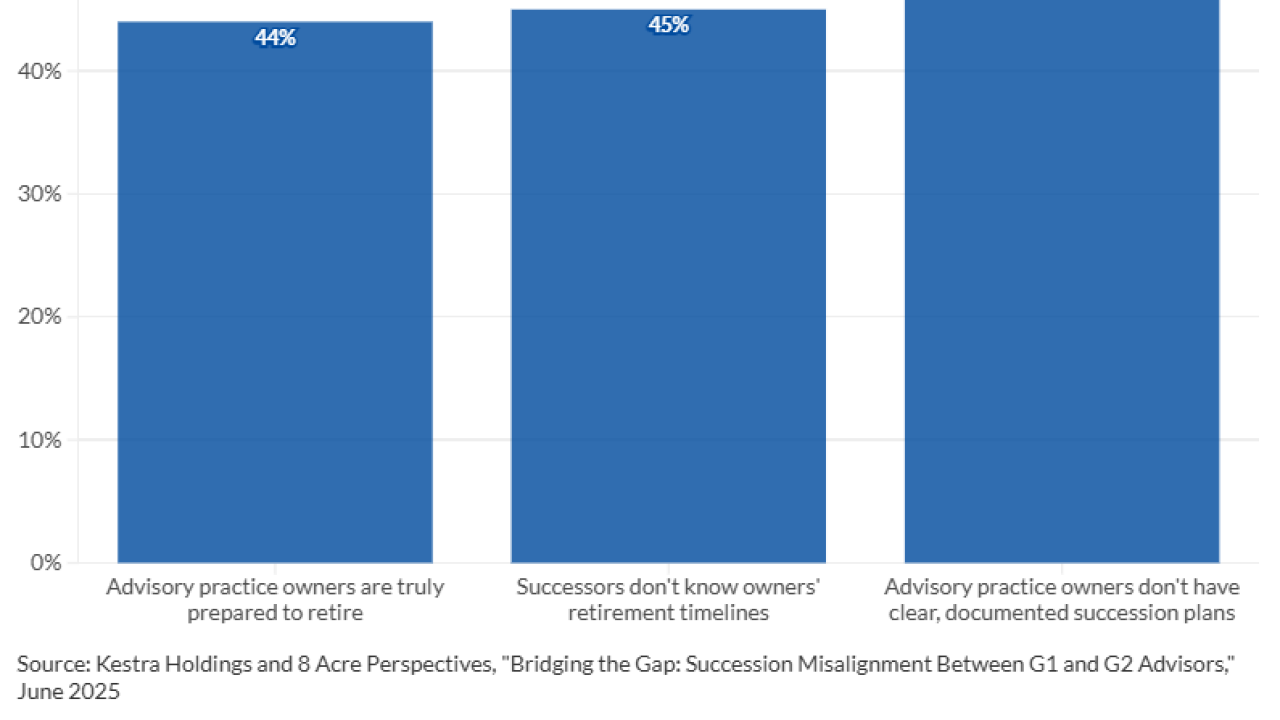

Separate from any transactions involved with succession, financial advisors who want to retire face challenges that make exiting the business difficult.

December 9 -

Morningstar's study of this growing area of asset management suggests that 529 plan quality is rising, despite the research firm's lackluster grades for it.

December 8 -

Nearly all the brokers who dropped their FINRA registration in the wake of tougher rules kept their insurance licenses, according to newly published research.

December 4 -

When a client's insurance needs change, the opportunity to sell their life policies to outside buyers should not be overlooked.

December 3 -

Preparation is everything: If clients are aware of the transition well in advance, experts say the risk is pretty low they'll leave the firm.

December 2 -

A tweak to the deductibility of gambling losses may not bring in a lot of tax revenue, but it could certainly alter a lot of wagers next year.

December 1 -

One of the most consequential M&A deals in years leads this roundup of the many ways big independent firms grew in 2025 and how they plan to continue growing in 2026.

November 28