-

Blue Owl's decision to halt withdrawals from one of its private credit funds raises further questions about the already obscure world of private credit.

February 23 -

The 6-3 Supreme Court ruling against one of President Donald Trump's signature economic policies was consequential, but experts say volatility is unlikely to be over.

February 20 -

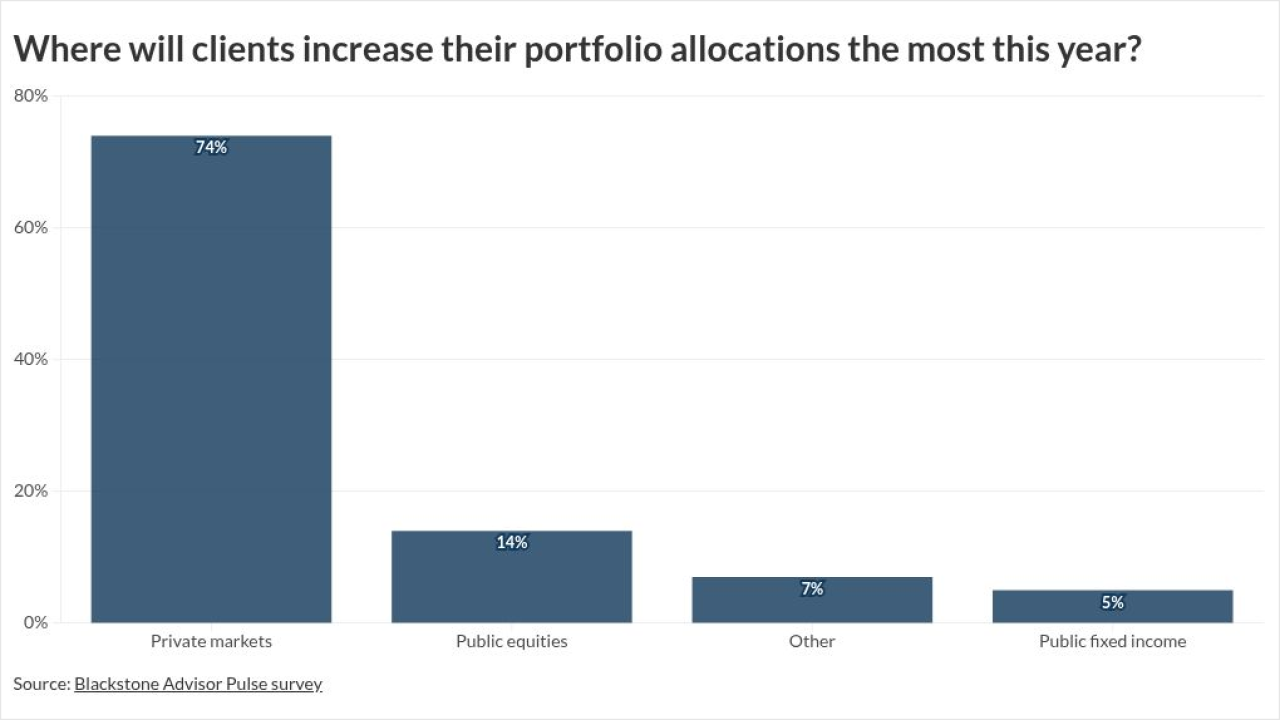

Retail investors increased their allocations to private equity, private credit by a whopping 36% last year as advisors look for diversification and strong returns.

February 19 -

SyntheticFi co-founder Joseph Wang says his firm's investment and trading technology makes an options strategy long embraced by hedge funds more accessible to advisors and their clients.

February 17 -

The "sticker shock" of tax rates and IRS reporting rules may place the recent record highs and falls in a different context for investors, one expert says.

February 11 -

None of the findings in a new working academic paper will likely surprise financial advisors. But they could provide some helpful data for conversations with investors.

February 4 -

With more than $12 trillion in assets, the company led by CEO Salim Ramji is pressing its advantages of scale in a rapidly consolidating, commodified industry.

February 2 -

The accounts give wealthy investors more opportunities to place alternative vehicles in a tax-advantaged retirement nest egg. But mistakes can be costly.

January 28 -

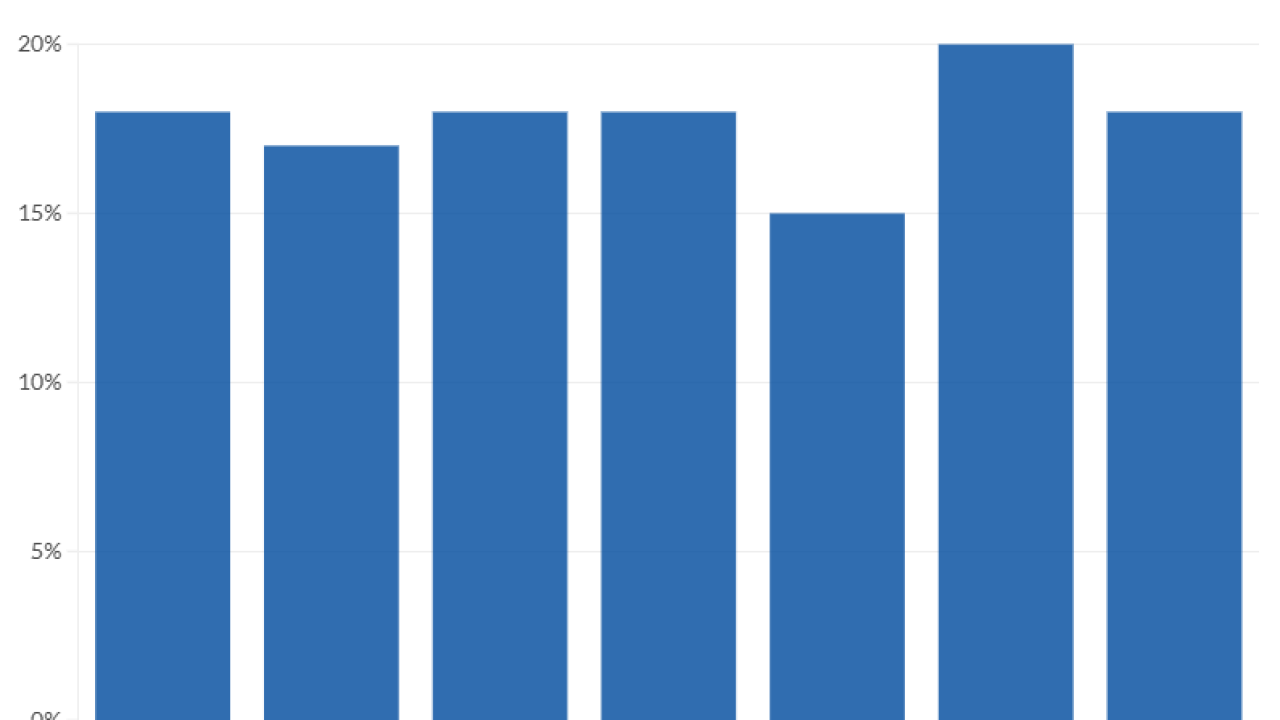

The results of Morningstar's latest study tracking fees and performance finds accelerating consolidation and commodification that makes advice more valuable.

January 22 -

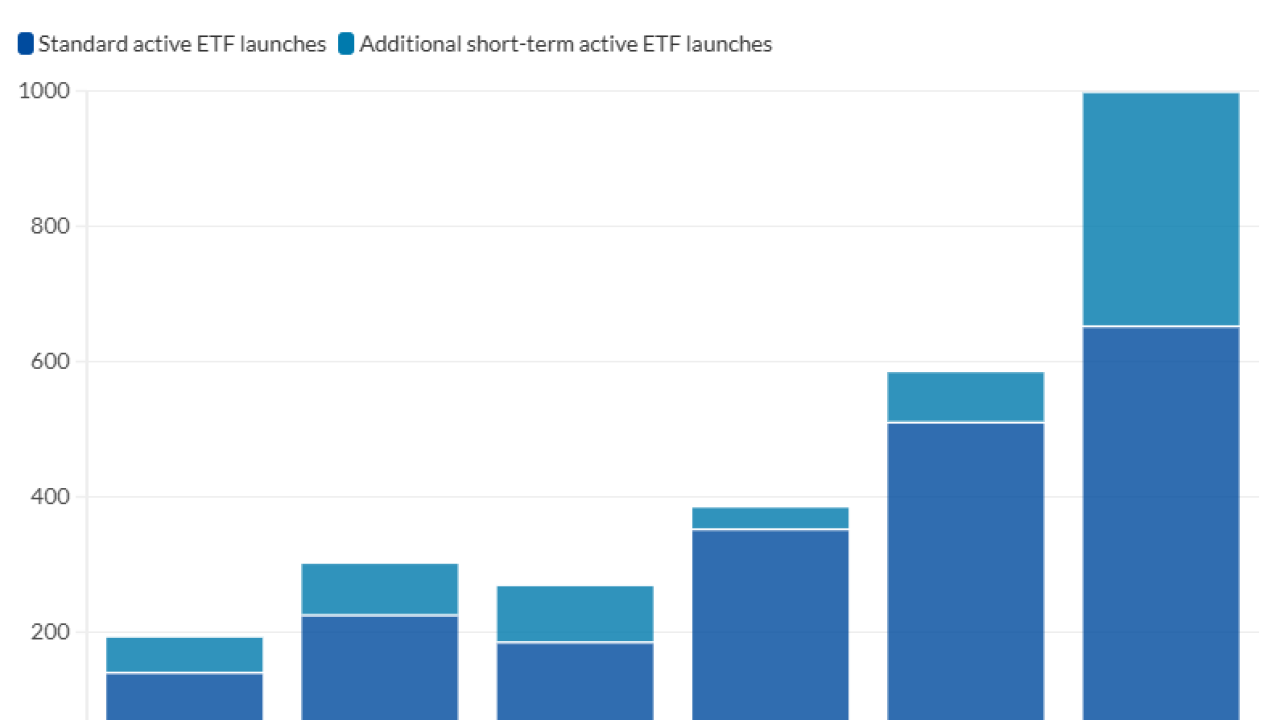

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

Once rare, the same kind of permissive terms that are widespread on leveraged loans are becoming increasingly common in the $1.7 trillion private credit market.

January 15 -

Fixed-income represented a surprising bright spot in 2025, despite the warnings of "bond vigilantes" and inflation pressure. Here's the outlook for 2026.

December 30 -

Financial advisors and their clients have a range of options to consider for traditional IRA holdings — but also a finite deadline.

December 29 -

Independent research firm Morningstar's latest study of the value of financial advice examines tax-efficient IRA asset location during the decumulation phase.

December 18 -

FINRA identifies new ways firms and investors are using technology like AI to spot changes in market sentiment and asks the industry to chime in on how finfluencers and others are using social media.

December 17 -

From crypto to private markets to AI and beyond, here are the investing trends and themes to watch in the new year.

December 16 -

An increasingly popular form of lending enables financial advisors and their clients to offset capital gains and find other tax savings.

December 15 -

Rethink bonds and hedged funds while prepping clients for a market correction — or worse — in the coming year, counsels the CEO of Toews Asset Management.

December 10 Toews Asset Management

Toews Asset Management -

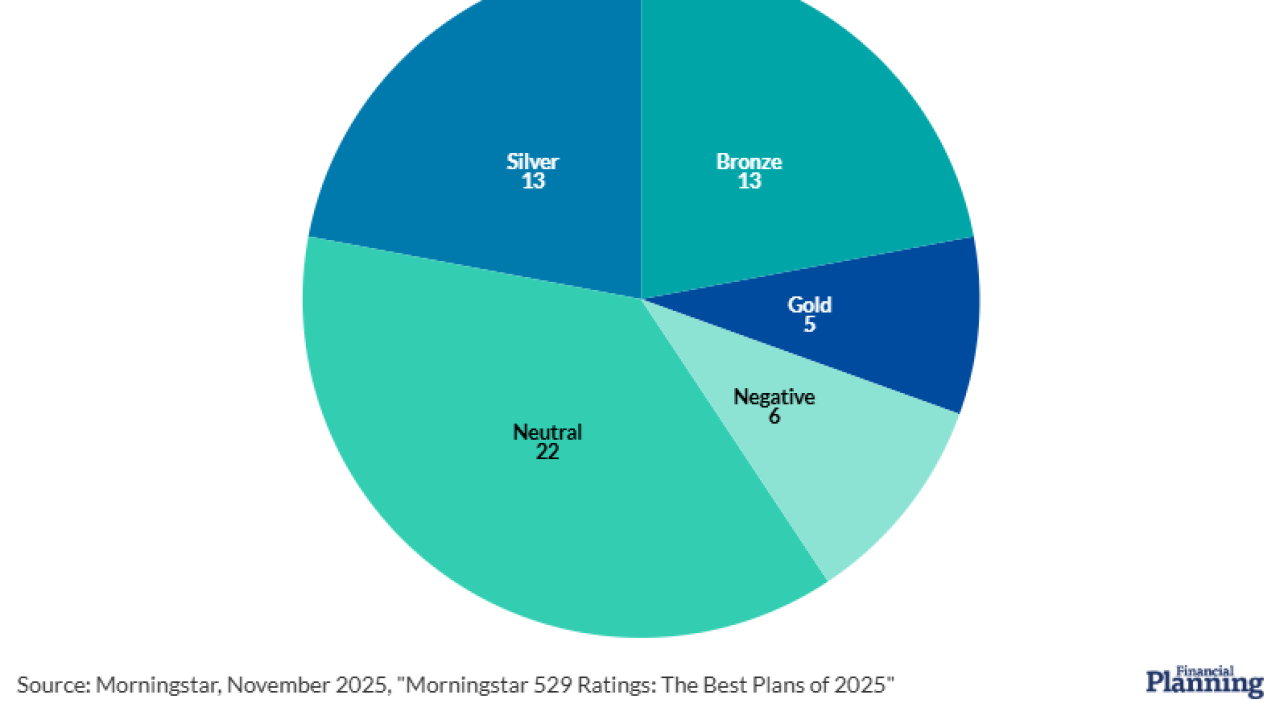

Morningstar's study of this growing area of asset management suggests that 529 plan quality is rising, despite the research firm's lackluster grades for it.

December 8 -

Prediction markets like Kalshi and Polymarket, growing in popularity, allow users to essentially bet on nearly everything. If your clients have questions, here's what experts say you should tell them.

December 5