5 Best- and Worst-Performing ETFs

Here are the five best- and worst-performing ETFs so far this year.

The ETFs ranked here are among funds with at least $10 million in assets that have existed for at least a year. The list excludes leveraged ETFs.

All information and graphs are provided by Morningstar through February 24, 2014.

5 Best- and Worst-Performing ETFs

Name: iPath DJ-UBS Coffee TR Sub-Idx ETN

Ticker: JO

Net Assets: $198,689,740

Total Ret YTD (Daily): 61.462%

Total Ret 1 Yr (Daily): 11.142%

5 Best- and Worst-Performing ETFs

Name: Market Vectors Junior Gold Miners ETF

Ticker: GDXJ

Net Assets: $2,122,074,991

Total Ret YTD (Daily): 40.906%

Total Ret 1 Yr (Daily): -32.809%

5 Best- and Worst-Performing ETFs

Name: Global X Gold Explorers ETF

Ticker: GLDX

Net Assets: $39,504,684

Total Ret YTD (Daily): 39.732%

Total Ret 1 Yr (Daily): -27.277%

5 Best- and Worst-Performing ETFs

Name: Global X Silver Miners ETF

Ticker: SIL

Net Assets: $270,355,127

Total Ret YTD (Daily): 31.395%

Total Ret 1 Yr (Daily): -20.664%

5 Best- and Worst-Performing ETFs

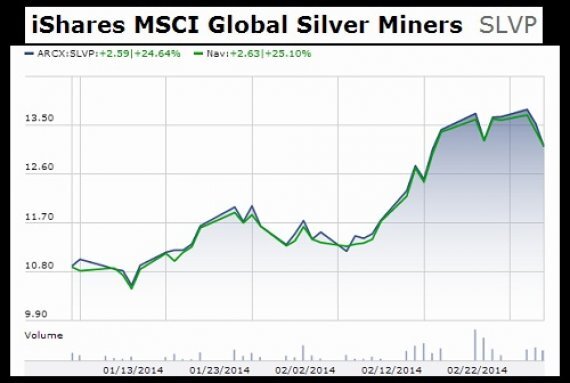

Name: iShares MSCI Global Silver Miners

Ticker: SLVP

Net Assets: $10,944,805

Total Ret YTD (Daily): 30.534%

Total Ret 1 Yr (Daily): -23.250%

5 Best- and Worst-Performing ETFs

Here are the five worst-performing ETFs in the first 7 weeks of 2014.

5 Best- and Worst-Performing ETFs

Name: Market Vectors Russia Small-Cap ETF

Ticker: RSXJ

Net Assets: $17,801,419

Total Ret YTD (Daily): -12.808%

Total Ret 1 Yr (Daily): -19.674%

5 Best- and Worst-Performing ETFs

Name: EGShares Brazil Infrastructure

Ticker: BRXX

Net Assets: $34,695,120

Total Ret YTD (Daily): -11.450%

Total Ret 1 Yr (Daily): -26.352%

5 Best- and Worst-Performing ETFs

Name: PowerShares DB Gold Short ETN

Ticker: DGZ

Net Assets: $23,740,625

Total Ret YTD (Daily): -10.832%

Total Ret 1 Yr (Daily): 12.026%

5 Best- and Worst-Performing ETFs

Name: Market Vectors Russia ETF

Ticker: RSX

Net Assets: $837,646,437

Total Ret YTD (Daily): -10.561%

Total Ret 1 Yr (Daily):-10.587%

5 Best- and Worst-Performing ETFs

Name: Global X China Financials ETF

Ticker: CHIX

Net Assets: $30,811,790

Total Ret YTD (Daily): -10.431%

Total Ret 1 Yr (Daily): -10.594%