WASHINGTON – Thirteen months after creating a helpline for senior investors, FINRA says the service is yielding more than the occasional refund to the elderly client.

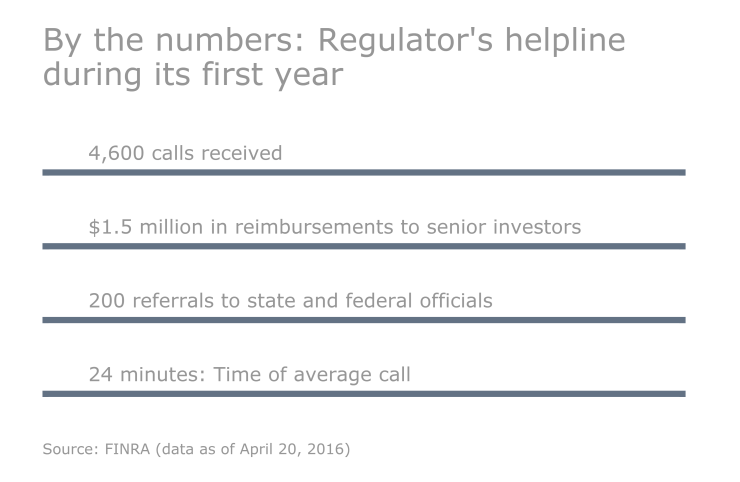

The helpline – which has received more than 4,600 calls since going live – is enabling the regulator to better understand senior investors' needs and concerns, says Susan Axelrod, executive vice president of regulatory operations at FINRA.

"We're tracking the information based on when we get the call, who is calling, what state they are calling from – we're getting a better sense of the issues impacting the population," Axelrod tells On Wall Street.

Advisers, Axlerod says, should feel "absolutely comfortable" giving their clients the regulator's helpline number.

Some of the information gleaned from the calls – which ranges from technology issues to poorly understood account statements to scams – is being shared with firms so that they too better understand problems that older clients are facing, Axelrod says.

The helpline has also helped the regulator identify mistakes and instances of abuse; calls have resulted in firms voluntarily making more than $1.5 million in reimbursements to senior investors.

Sometimes calls to the helpline are leading to regulatory action; FINRA has referred more than 200 matters to state and federal regulators. And the calls have also led FINRA to identify emerging scams and to issue investor alerts earlier than it might have otherwise.

Given the nation's growing number of senior investors, the scope of the problems they face is likely to increase as well.

"There is an aging population, their money has to last longer and we're in a low interest rate environment. So that has created more people with more concerns," Axelrod says. "I would say it's always been important but in the current environment it's incredibly important."

SUCCESS STORIES

Between 2000 and 2010 the number of Americans 65 years and over increased 15.1% compared to 9.1% for the total U.S. population, according to data from the U.S. Census Bureau.

Axelrod says that the helpline – (844) 574-3577 – is growing in popularity with that increasingly large population.

"The call volume now in a day is what we used to get in a week," she says.

To help raise the profile of the service as well as BrokerCheck, FINRA has done outreach to the consumer press and offered free workshops in malls around the country in a bid to meet seniors where they are. Axelrod says that FINRA is looking at additional ways to connect with older clients.

Advisers won't be surprised to learn that FINRA's call center is based in Boca Raton, Fla. Nearly 20% of Florida's population was 65 years and older in 2014, according to census data. Nationally, the figure was about 14%.

Axelrod said Florida's large senior population was one of the reasons they chose to site the call center there (the other being that it was the only FINRA office to have investors actually visit it).

While investors call about a wide variety of things, robo advisers haven't come up much. "I think overall that seniors like to talk to someone," she says.

The average call lasts 24 minutes. Luckily, FINRA's staffers at the call center like to listen, Axelrod says, adding that they treat every call as important, even if it's not necessarily related to fraud or criminal activity.

Axelrod – who has been at FINRA since 2007, and held her current role since 2010 – says that the regulator received a call from a 99-year-old woman who had received a letter from her adviser saying he couldn't serve anymore. A quick call to the firm cleared up the confusion, and put the woman at ease, Axelrod says.

"Success stories don't necessarily mean getting money back to customers; it can mean just getting customers the right information that addresses their concern," she says.