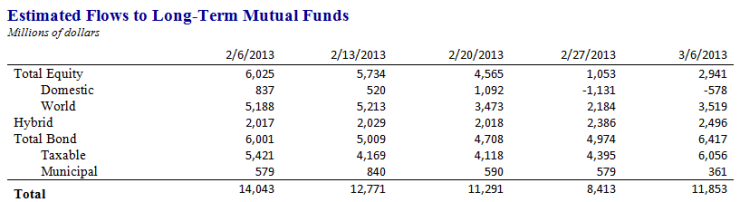

Interest in mutual funds edged up across virtually all fund categories in early March, according to the latest statistics from the Investment Company Institute. For the week ended March 6, investors steered an estimated $11.85 billion into mutual funds, up 41% from the previous week.

Bonds funds were the biggest beneficiaries, drawing $6.42 billion in estimated inflows, a 29% percent increase from $4.97 billion the week before. Of the $6.42 billion, $6.06 billion went to taxable bond funds with the remaining $361 million going to municipal bond funds.

Equity funds were also up for the week, taking in an estimated $2.94 billion, nearly triple the $1.05 billion they attracted a week earlier. Non-U.S. stock funds did especially well, drawing an estimated $3.52 billion for the week. U.S. funds, in contrast, lost an estimated $578 million, the only fund category to post an outflow.

Hybrid funds, which invest in both stocks and fixed income securities, attracted $2.50 billion in estimated inflows, up slightly from the previous week.

The weekly fund flow estimates are derived from data covering more than 95% of industry assets, according to ICI. The statistics cover long-term mutual funds, those the ICI defines as investing in long-term instruments.