Measured across a number of market indicators, the story for ETFs last year was one of growth, says Ben Johnson, director of global ETF research at Morningstar.

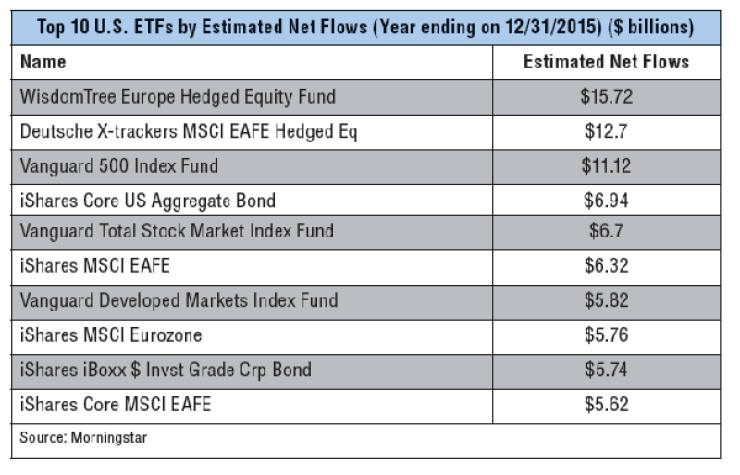

For instance, investors flocked to international stock ETFs, amassing a total of $105 billion in net new assets, he says.

Launches of currency-hedged versions of various types of international equity exposure as ETFs or repackaging existing un-hedged versions of international equity ETFs sought to capitalize on the trend.

"I don't know how much steam that trend has left in it," he cautions. "Expect the investors' interest in currency-hedged ETFs will ultimately follow the direction of the dollar."

But competition will continue to broaden among ETF providers, he adds.

"A number of non-traditional players entered the ETF arena for the first time in 2015 and in fact we saw a record number of entrants into the ETF space."

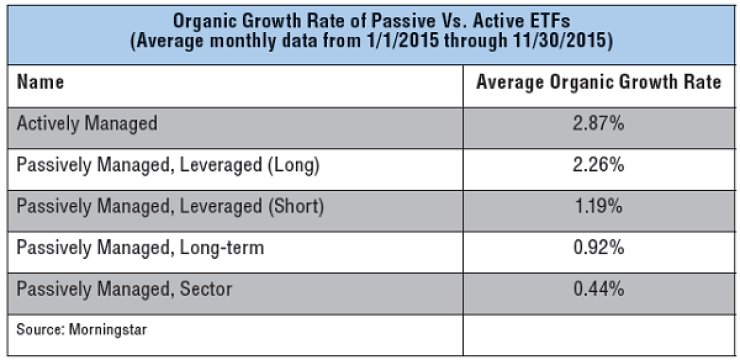

Fund flows over the course of a number of years now have been pointing decidedly in favor of passive strategies, he says, be they index, mutual funds or ETFs.

In 40 years, "the passive strategy share of the U.S. funds market has gone from zero to now nearly a third, so I would expect that trend will ultimately continue for the foreseeable future."

Read more:

-

Bumpy Road: Best Performing International Funds -

U.S. Stocks Plunge, Oil and China Worry Investors -

Wealth Profits Up 15% at Wells, Despite Falling Headcount, Assets