Wealth management firms have stumbled in recent months, as profits and client asset levels have been buffeted by volatile markets. And with few notable exceptions, advisor headcounts have also fallen at the largest brokerage firms.

Meanwhile, wirehouse and regional broker-dealers – particularly those owned by larger banks – are trying to boost their profit margins. On an earnings call with analysts, Morgan Stanley CEO James Gorman said

To reach the company's goals, Gorman said that Morgan Stanley would follow a program of cost cuts, digital technology enhancements and pursue greater lending and banking business.

Recent earnings reports give the industry a moment to take stock and see how the firms are measuring up. Scroll below or click here to view our slideshow to see how your firm is performing compared to its peers.

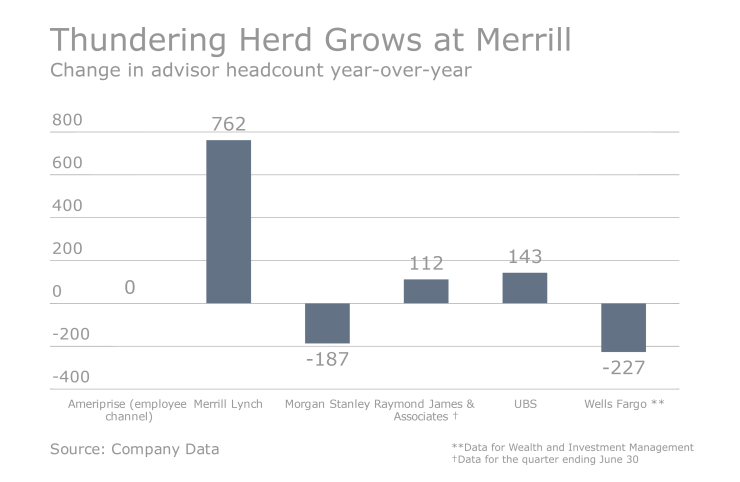

Thundering Herd Grows at Merrill

Merrill Lynch was the only wirehouse to grow its advisor force last year. The firm's thundering herd was up more than 700 advisors compared to the same period a year ago. The rise was due to recruiting as well as new trainees joining Merrill, according to the firm.

Meanwhile, rival firm Raymond James continues to grow its employee channel through aggressive recruiting. The firm had reached a record size by the end of 2015.

Assets Levels Drop at Wirehouses

Market volatility at the end of the fourth quarter buffeted asset levels at all firms, most of which reported declines.

The decline at UBS was partially offset by its aggressive recruiting during the fourth quarter, as dozens of large teams – many from Credit Suisse – transitioned their books to UBS.

Volatile Markets Dampen Profits

With declining profits at nearly all firms, executives were quick to point to the market upheaval as a decisive factor. UBS suffered the biggest drop, which was also attributable to high legal costs that the firm incurred due to client complaints related to the sale of Puerto Rico bonds and closed-end funds.

Wells Fargo was an outlier in that it reported a roughly 15% year-over-year increase in profits for its wealth management unit. However, that unit was recently reorganized, as the company moved divisions and renamed it.

Advisor Productivity Drops at Merrill, Inches Up at Morgan

Given the drop in profits at wealth management firms, it should come as little surprise that FA productivity also fell at Merrill Lynch.