Vanare is getting $20 million and a new name.

WisdomTree is providing the adviser technology provider with an injection of funds in a bid to better position itself for industrywide changes wrought by new technologies and stiffer regulations, according to CEO Jonathan Steinberg.

"The adviser in the 21st century we think needs to do two things," Steinberg says. "They need to digitize their book of business, and they need to differentiate themselves.

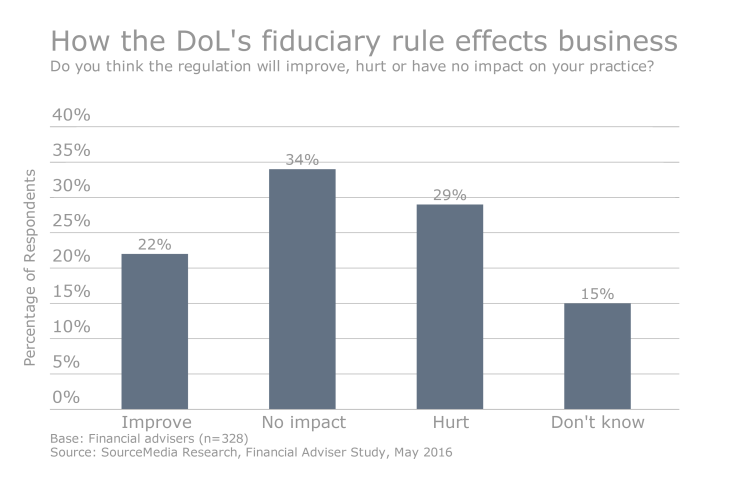

He adds: "The need to use technology to build and support a practice has always been there. The DoL [fiduciary] rule has just been an accelerant. It's a gun to the head to figure things out."

For Vanare, the cash infusion (a Series A round of funding based on a valuation of $55 million) also brings a rebranding. The firm will now be known as AdvisorEngine, says founder and CEO Rich Cancro.

"Changing our name is about aligning who we started as and who we are today," Cancro says. "Our purpose to help advisers is clear. People were sometimes confused by what we did, and were shocked at how much we offer."

Among its solutions is a wealth management platform called NestEgg. Cancro notes his firm's platform has over $1.5 billion assets and 30,000 accounts.

Cancro says the new partnership doesn't interfere with AdvisorEngine's relationship with Pershing. The custodian brought his firm, in addition to SigFig and Jemstep Advisor Pro, onto its platform in May.

He adds that with an open architecture approach, the AdvisorEngine platform avoids having a digital advice platform consisting only of proprietary products, something that the Labor Department has called a potential problem.

Steinberg says that there's a danger in relying on the same funds too much. "Advisers cannot just sell an all-Vanguard portfolio and hope to afford their fee on top. They need differentiation."

'INCREDIBLY COMFORTABLE'

The platform will capture more of the independent space, Cancro claims, because it was built as an enterprise solution from the start, rather than a retail offering rejiggered to serve advisers.

Steinberg says that was one of the appealing aspects for a partnership, adding that his firm surveyed 30 different firms before deciding to invest in AdvisorEngine.

Despite reporting tough third quarter earnings — WisdomTree said total revenue drop 36% to $51.8 million — Steinberg was upbeat about the deal.

"We're incredibly comfortable," Steinberg says. "We're making investments to thrive over the long term. We couldn't be more bullish on where asset management is going and how it lines up with WisdomTree."

WisdomTree is the latest asset manager to invest in adviser technology providers, with the goal of adding a new digital distribution route for its funds.

BlackRock acquired San Francisco-based FutureAdvisor, and has since spun that into agreements to provide its technology to U.S. Bank, BBVA Compass, RBC Wealth Management and LPL. Invesco acquired Jemstep, and Eaton Vance is among the investor consortium backing SigFig.

-

The latest deal with heavyweights including Eaton Vance challenges industry predictions that robos would die off.

May 24 -

"Asking more questions or a specific number of questions isn’t necessarily going to make the suitable and fiduciary responsibilities any better," says FutureAdvisor's co-founder Jon Xu.

April 28 -

We're a long way from building strong, interpersonal relationships with computers (the movie "Her" notwithstanding), which gives banks an advantage.

June 29

Steinberg says asset management firms that have not made a move into ETFs or digital are in for "a very hard transition," noting how in the last decade, ETFs have taken in trillions while mutual funds have bled billions in assets.

"Most haven't made the transition fast enough," he says. "A handful bought their way in, such as BlackRock and Invesco, but many are behind the curve. There's a belief now that if you haven't built a scaled business in ETFs it's already too late."