Advisers who put their clients into dividend-paying foreign stocks face a major question: Should the position be hedged?

This wasn’t a palatable option years ago when currency hedging for individual stock positions was costly and cumbersome. But with today’s currency-hedged ETFs, the process is simple.

However, the ease with which one can buy a hedged ETF does not mean that the decision to do so is simple. Will the currency in question weaken or strengthen against the dollar? Will the Federal Reserve or a foreign central bank take actions that will affect the currency’s trend? Will unforeseen macroeconomic changes alter what appears to be a sure bet?

Even in the case of dividends collected by a U.S. investor, changes in exchange rates can have a major effect. Asset manager Henderson Global Investors tracks dividends paid by the world’s 1,200 largest companies through the Henderson Global Dividend Study (HGDS). Recently released HGDS data on 2016’s first quarter illustrates the effects of currency on dividend growth. In Canada, dividends paid by local stocks rose 6.3% in Canadian dollars. But U.S. investors in these stocks saw a 14.1% decline in dividend payments. While some Canadian companies fell out of the universe of the largest-cap stocks that make up the Henderson index, much of the difference was due to the slide of the loonie against the greenback.

Investors in the UK saw sluggish 0.7% dividend growth in sterling. But when translated to rising dollars, the same benchmark experienced a 5% dividend payment decline for U.S. investors.

Investors can buy currency-hedged ETFs covering both Canada and the U.K. Two of the largest examples are iShares Currency Hedged MSCI Canada (HEWC), with an expense ratio of 0.51%, and iShares Currency Hedged MSCI United Kingdom (HEWU), with an expense ratio of 0.48%. There is even a dividend-weighted, currency-hedged U.K. ETF: the WisdomTree United Kingdom Hedged Equity Fund (DXPS), which has an expense ratio of 0.48%.

But Japan leads with the greatest interest in currency-hedged portfolios from U.S. investors. Three of the four largest Japan equity ETFs in the U.S. are currency-hedged portfolios. History is part of the reason: From early 2012 through 2015, the dollar generally rose against the yen. Hedging allowed investors to zero out the negative effects of U.S. dollar strength against the yen.

But currencies don’t always fall against the dollar.

At the start of 2016, the yen rose in value, meaning profits earned and dividends paid by Japanese companies translated into more dollars for U.S. investors. First-quarter dividends reported by the HGDS reflect this. In local currency, Japanese stocks posted dividend gains of 10.5%. But that was amplified to a 21.1% rise when translated into dollars.

Owners of currency-hedged ETFs did not get the full dollar benefit of the Japanese dividend boost. They also lost out regarding total return.

Consider two similar dividend-weighted ETFs from WisdomTree:

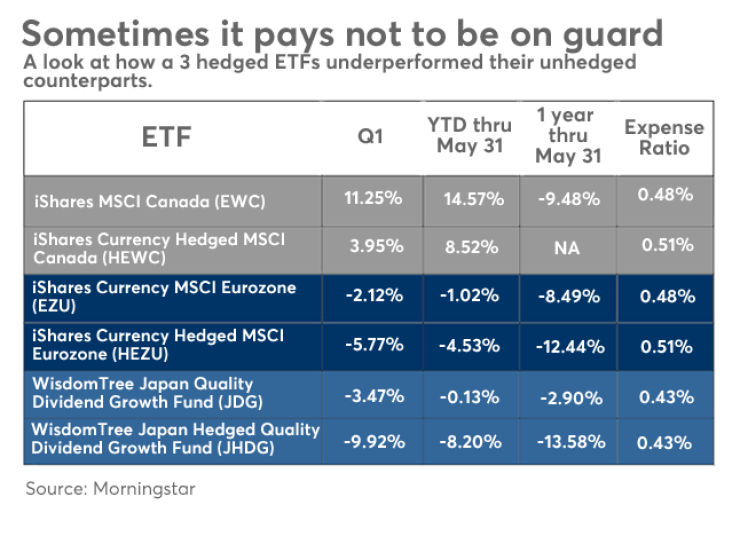

In the first quarter, the WisdomTree Japan Quality Dividend Growth Fund (JDG) a portfolio of large-cap Japanese stocks weighted by cash dividends paid with an expense ratio of 0.43%, had a total return of -3.47% based on NAV, according to Morningstar. A similar currency-hedged portfolio from the same shop, WisdomTree Japan Hedged Quality Dividend Growth Fund (JHDG), with an expense ratio of 0.43%, had a much worse total return of -9.92%.

Similar recent underperformance can be seen in hedged iShares ETFs that track MSCI Canada and Eurozone indexes.

Is it time, then, to abandon currency-hedged portfolios?

Until the release of the weak May jobs report, the dollar had been rising against the yen for about a month. The dollar fell after the employment report because it seemed to rule out a near-term rate boost. But, though the Fed may hold off on another rate increase until later in the year, there’s still a good chance that rates will be higher before the end of 2016.