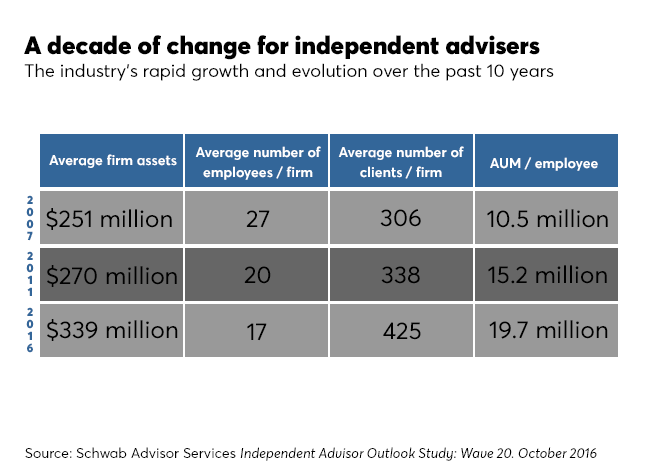

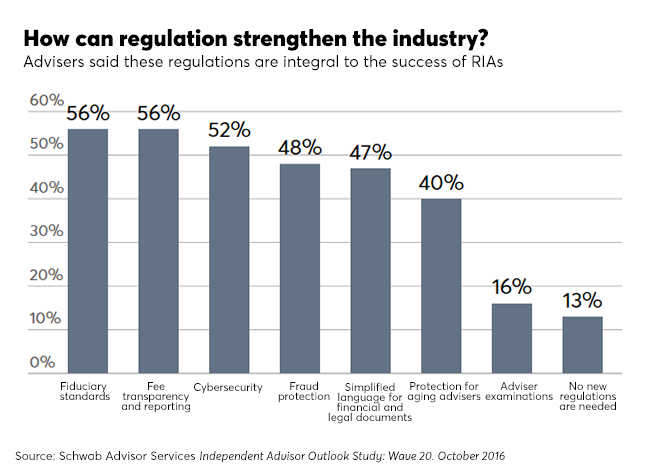

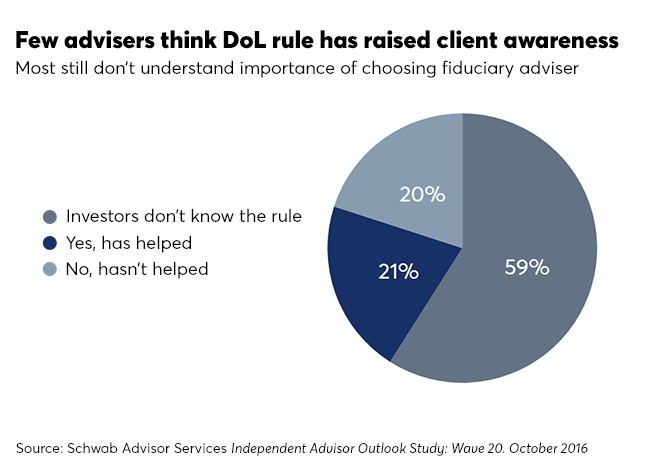

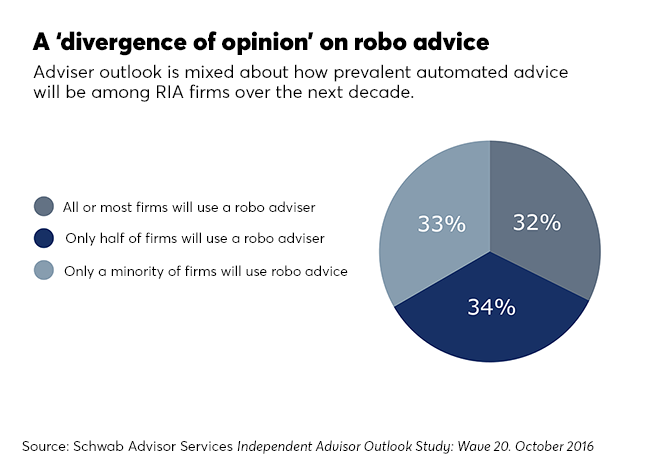

Advisers are gearing up for even more advancements (and challenges), according to the most-recent Schwab Advisor Services' Independent Advisor Outlook Study. Respondents weighed in on the future of the business — from how they run their practices, to robo advisers and meeting tougher compliance requirements. Click through to see the findings.